Ah, dear reader! Permit me the indulgence to regale you with a tale of folly and tempation-a narrative where fortunes are coveted yet rarely gained. The cry of “You must be in it to win it!” echoes through the air as the humble ticket to serendipity is merely a couple of dollars away. But alas! What mischief dwells in such a promise, where your solitary coin might transform into a trove, or it might simply vanish into the coffers of the lottery company, leaving you as empty as a jest without a punchline.

The Lavish Spent of Aspirations

Picture, if you will, a realm in the year of 2023, wherein approximately $103 billion was cast into the lottery abyss across the grand expanse of the United States. A staggering sum! But lo! The glittering prize of that vast ocean was only $69 billion in winnings, thus revealing a stark tableau of $30 billion siphoned away as revenue for the realm of chance.

One must ponder where that fortune does lead-a fraction, of course, is devoted to the sustenance of this beast known as the lottery, while a mere morsel may find its way to noble endeavors, such as sprucing up the scholarly halls of education. Yet, by all accounts, those revenues barely scratch the surface, contributing a mere 2.3% of state income in lands where such lotteries reign.

Alas, not all who enter the fray shall don the victor’s laurel! The odds, dear interlocutor, are a treacherous beast that shift with the number of hopefuls. Indeed, when the grandiose lotteries dazzle the masses with their stratospheric jackpots, they simultaneously cloak the players in a cloak of despair-with slim chances of success. If 292 million souls seek to win, prithee, what are the odds-a paltry 1 in 292 million?

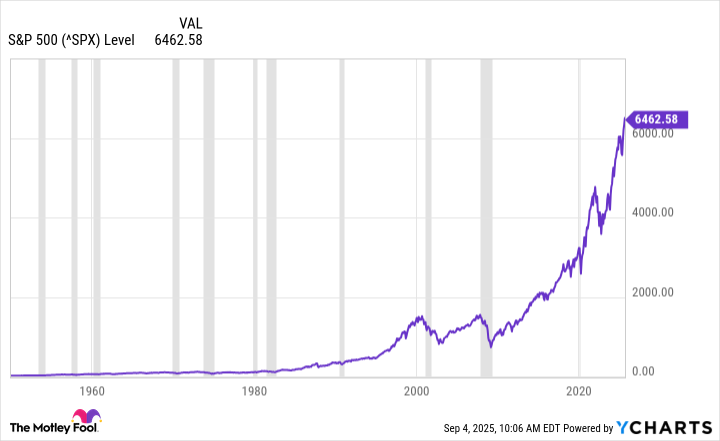

Surely, pursuing such dismal chances, one might find themselves better off turning their attention to a more disciplined venture-say, placing one’s doubloons in the illustrious S&P 500 index fund, that renowned vessel of financial prosperity.

The Fortune in Equity’s Embrace

In the dance of time, the S&P 500 has shown a commendable tendency to ascend, rising as surely as the sun greets the dawning day. One might muse, it yields an average return of approximately 10% per annum, like sweet nectar dripping from the vine of investment wisdom.

Yet, take heed! This annualized figure does not account for the wild revelry that is the market’s year-to-year returns-volatile as a tavern brawl on a Saturday night. Indeed, many may find investing feels akin to gambling, though, I assure you, the stakes are quite different. Allow your investments to rest in patience, and regardless of whether you grace the market in its exuberance or its discontent, history suggests that fortune favors the long-term holder. Just gaze upon the ledger of time, where even the most dreadful recessions appear as mere trifles against the steady march of progress in the S&P 500.

Fortuitously, it appears most of the populace concurs, for over 60% of U.S. adults possess a stake in the fabric of the stock market, whether directly or through mutual funds or those delightful exchange-traded funds (ETFs). Yet, one cannot overlook the dire disparity that accompanies this wealth distribution, as the bulk of market riches congregates in the hands of a select few.

Therefore, dear soul, let us not be deceived-the history of wealth accumulation through stocks paints a far more reliable path than that folly of chance known as the lottery. Perhaps, therein lies an admonition: the wealthy, it seems, know well the wisdom of the market.

A Pastime in Jest, Wealth Through Wisdom

If the thrill of the lottery brings you merriment, by all means, indulge! Yet, do temper your expectations with a dash of realism. The act of playing the lottery is scarcely a gateway to riches; rather, it often leads to a draught of financial disappointment.

If your ambition is to cultivate genuine wealth, allow your coins to take flight in the nurturing arms of stocks. Simple yet profound, one may purchase shares of the illustrious S&P 500 and hold them tightly for the long term-more likely will you find yourself in the company of the fortunate than standing idly by, clutching a ticket of despair.

💸

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-09-08 12:28