The price of Litecoin (LTC) has jumped over 12% within the past 24 hours due to Nasdaq’s application for listing Canary Capital’s Litecoin ETF. This upward trend is driven by optimistic technical signs, such as a golden cross formation and increased buying demand, which is evident in key momentum indicators.

The Relative Strength Index (RSI) of Litecoin (LTC) has moved into an area suggesting it’s overbought, and its Chaikin Money Flow (CMF) is at its peak since December 2024, indicating significant buying activity by investors. With this momentum growing, Litecoin might challenge crucial resistance points, possibly reaching prices not seen in more than a month if the upward trend persists.

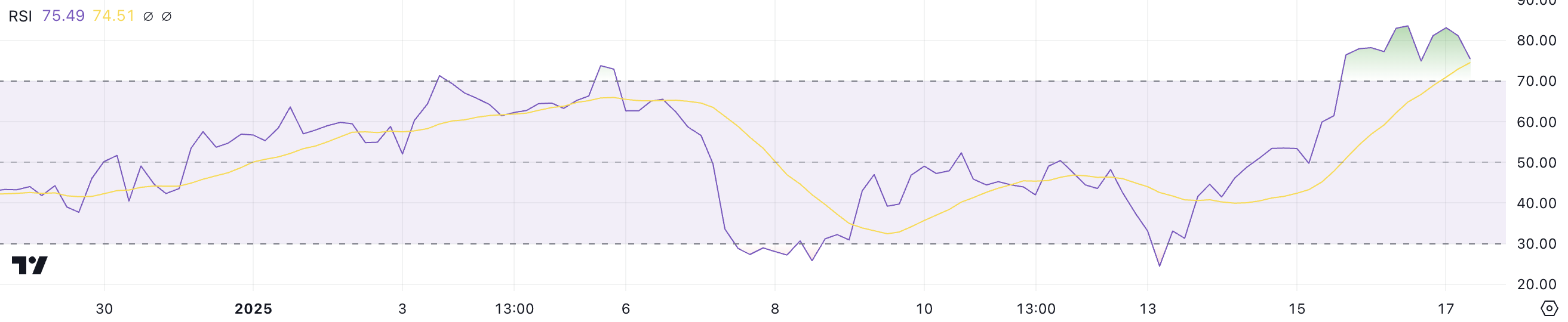

Litecoin RSI Indicates Overbought Conditions

In just four days, Litecoin’s Relative Strength Index (RSI) has surged significantly, now standing at 75.4. Compared to its value of 24.4 only four days ago, this is a substantial increase. Yesterday, the RSI reached a high of 83.5, marking its first entry into overbought territory since December 3. The RSI is a tool that gauges the rate and direction of price fluctuations on a scale ranging from 0 to 100.

As a crypto investor, I always keep an eye on the Relative Strength Index (RSI) to gauge the market’s momentum. When the RSI exceeds 70, it usually suggests that the asset could be overvalued and might be due for a correction. Conversely, if the RSI dips below 30, it might signal possible undervaluation, hinting at potential buying opportunities.

Right now, the Relative Strength Index (RSI) of Litecoin stands at 75.4, indicating it’s in an overbought state. This could potentially mean a brief pause or a minor correction if the momentum weakens. But, when the market shows robust bullish trends, the RSI can remain high for a long time, hinting at potential further growth.

If the demand for LTC continues to grow, its price might increase more before a major drop happens. However, traders need to keep an eye out for signals indicating a decline in strength to prepare for possible corrections.

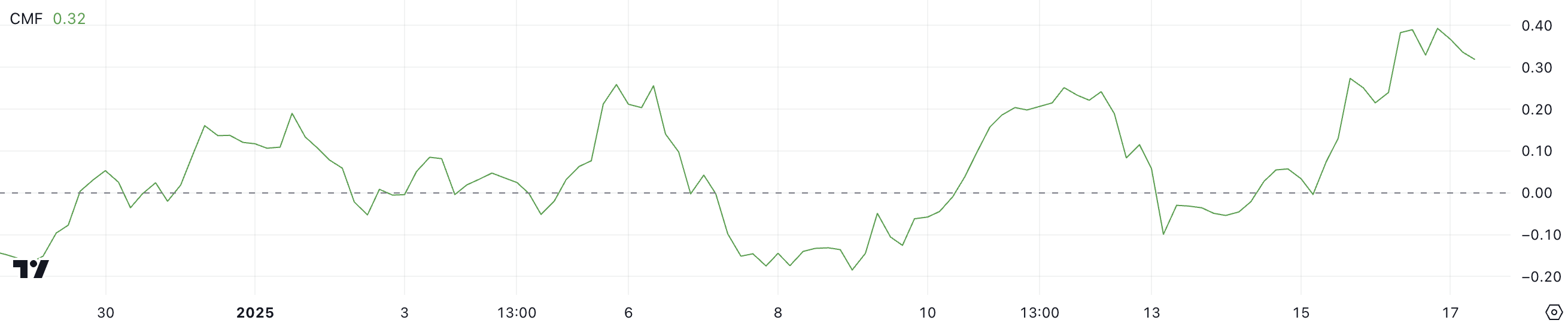

LTC CMF Points at Buying Pressure

The Chaikin Money Flow (CMF) for Litecoin (LTC) is presently at 0.32, having risen from -0.1 four days ago, following a brief increase to 0.39 just a few hours prior. The CMF gauge monitors the inflow and outflow of funds into an asset within a specified timeframe by taking both price and trading volume into account.

In simpler terms, when the value exceeds zero, it means there’s more buying than selling, suggesting a positive or ‘bullish’ trend. On the other hand, when the value falls below zero, it implies more selling than buying, indicating a negative or ‘bearish’ trend. A larger CMF value generally suggests significant accumulation, which can be a good sign for future price movement.

0.32 marks a record high for Litecoin’s Crypto Momentum Factor (CMF) since December 1, 2024, demonstrating substantial buying activity. This heightened level implies investor optimism, potentially leading to more price rises in the immediate future.

If the rate of Change Minus Fees (CMF) starts decreasing, this could suggest a reduction in the pace of accrual, possibly hinting at a slowdown or cooling-off phase in the upward trend of LTC’s price movement.

LTC Price Prediction: Will Litecoin Reclaim December’s Highs?

Yesterday, Litecoin’s price experienced a ‘golden crossover,’ which has sparked its recent surge and increased optimism among investors. This golden crossover happens when a short-term average line moves above a long-term average line, typically indicating the beginning of a robust upward trend in the asset’s price.

If the current trend persists, Litecoin (LTC) might encounter a new resistance at approximately $139. Overcoming this barrier could potentially drive the price up to $147, representing a significant high point since early December 2024. Factors such as upcoming news and market movements related to its ETF may also impact Litecoin’s price.

If the upward momentum weakens and the $131 level is challenged but doesn’t provide adequate support, the LTC price might fall to $125. In a more significant downtrend, prices could slide down to $114 or even dip below $100, potentially encountering support at $96.8. This would signify a 28.3% correction in value.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

2025-01-18 03:15