After the notable approvals of Bitcoin and Ethereum Exchange-Traded Funds (ETFs), there’s been a surge of interest among investors and experts regarding Litecoin.

SEC Engagement Sparks Optimism

At present, the U.S. Securities and Exchange Commission (SEC) is examining an application for a Litecoin Exchange Traded Fund (ETF). This significant move was brought to light by Eric Balchunas and James Seyffart, ETF analysts at Bloomberg Intelligence. They pointed out that the filing, which was submitted by Canary Capital Group, has seen more interaction from regulators. James Seyffart remarked about this, “Canary Funds have revised their S-1 form for their Litecoin ETF application. While there are no guarantees—this could potentially suggest increased engagement by the SEC on the filing.

Canyay Capital Group, an investment company specializing in digital assets, submitted revised documents to both the SEC and Nasdaq, setting a deadline for the regulator’s decision. This proposed ETF, if approved, would be physically held and its custodians could potentially include Coinbase Custody Trust Company and BitGo Trust Company.

Eric Balchunas stated: “The Litecoin ETF now meets all requirements. There’s a strong possibility that it could become the first exchange-traded fund based on an alternative cryptocurrency in 2025.

Market Reactions and Investor Activity

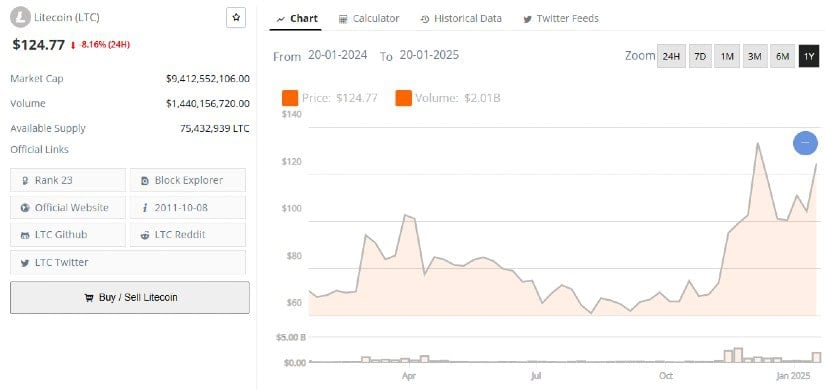

The potential approval of an ETF has propelled Litecoin higher, causing it to rise by 18% within the last 24 hours and reach $136 per coin. Trading volume for LTC spiked more than 250%, amounting to approximately $1.83 billion, as suggested by data from CoinMarketCap. Fresh predictions on Litecoin’s price forecast a significant jump in value for the cryptocurrency, with analysts expecting it to surpass its previous performance starting from 2025, following three years of relatively flat trading.

The surge in the rally can be attributed to the increasing curiosity among institutional and individual investors alike. As per the data from Santiment, the larger whale and shark investors (those holding over 10,000 LTC) have been actively buying up Litecoin since January 9, accumulating approximately 250,000 coins in the process.

Projected Inflows of Up to $580 Million

Experts within the industry believe that a Litecoin Exchange-Traded Fund (ETF) could potentially draw substantial investment. According to JPMorgan’s analysis, if adoption mirrors that of Bitcoin ETFs, Litecoin might see between $290 million and $580 million invested in its inaugural year. Steven McClurg, a co-founder of Canary Capital, suggests that since Litecoin employs the same proof-of-work consensus mechanism as Bitcoin, it is likely to be the one to receive approval.

The speaker highlighted that while the futures market for Litecoin isn’t as robust as it is for Bitcoin and Ethereum, its similarities in technology and structure to these leading cryptocurrencies could become beneficial under the new SEC leadership. In other words, he suggested that Litecoin, often referred to as “silver” compared to Bitcoin’s “gold,” may offer advantages in the future.

Competition from XRP and Solana ETFs

Despite Litecoin leading the charge in the altcoin Exchange Traded Fund (ETF) competition, other robust competitors such as XRP and Solana are also making progress. Some analysts predict that XRP ETFs could attract investments worth up to $8 billion, while those focusing on Solana might see inflows between $3 billion and $6 billion. However, the success of these funds depends largely on regulatory approval and market demand.

Edouard Hindi, the Chief Investment Officer at Tyr Capital, pointed out that the threshold for approving new cryptocurrency Exchange Traded Funds (ETFs) may decrease in 2025. He mentioned that while Litecoin is currently leading the pack, ETFs based on XRP and Solana are also strong possibilities.

A Milestone Year for Crypto ETFs

If Litecoin manages to get approval, it will be a significant step forward for the cryptocurrency market, broadening the range of exchange-traded funds (ETFs) beyond Bitcoin and Ethereum. However, as Kenneth Worthington from JPMorgan points out, “The demand from investors for more products is not yet certain. Tokens like Litecoin, Ethereum, or Solana might grab attention briefly.

2025 is shaping up to be a groundbreaking year for the market of cryptocurrency ETFs, with Litecoin leading the charge in this shift. Whether the SEC’s decision opens doors for new possibilities or brings attention to existing hurdles, the excitement reflects the increasing significance of regulated crypto investment options within the broader financial landscape.

Read More

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Everything We Know About DOCTOR WHO Season 2

- Honkai: Star Rail – Hyacine build and ascension guide

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 50 Most Powerful Anime Characters of All Time (Ranked)

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

2025-01-19 14:36