As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find myself intrigued by Litecoin’s recent surge. With my finger on the pulse of the crypto world since its inception, I’ve seen bull runs come and go, and I must admit, this one feels different.

Over the last seven days, Litecoin‘s (LTC) market value has increased by approximately 15%, resulting in an additional $1 billion, with the coin’s price peaking at a two-year high of $119.64.

Long-term investors are offloading their Litecoins due to the recent surge, aiming to bank their earnings. Yet, the upward trend in LTC’s price indicates it may persist.

Litecoin Long-Term Holders Book Gains

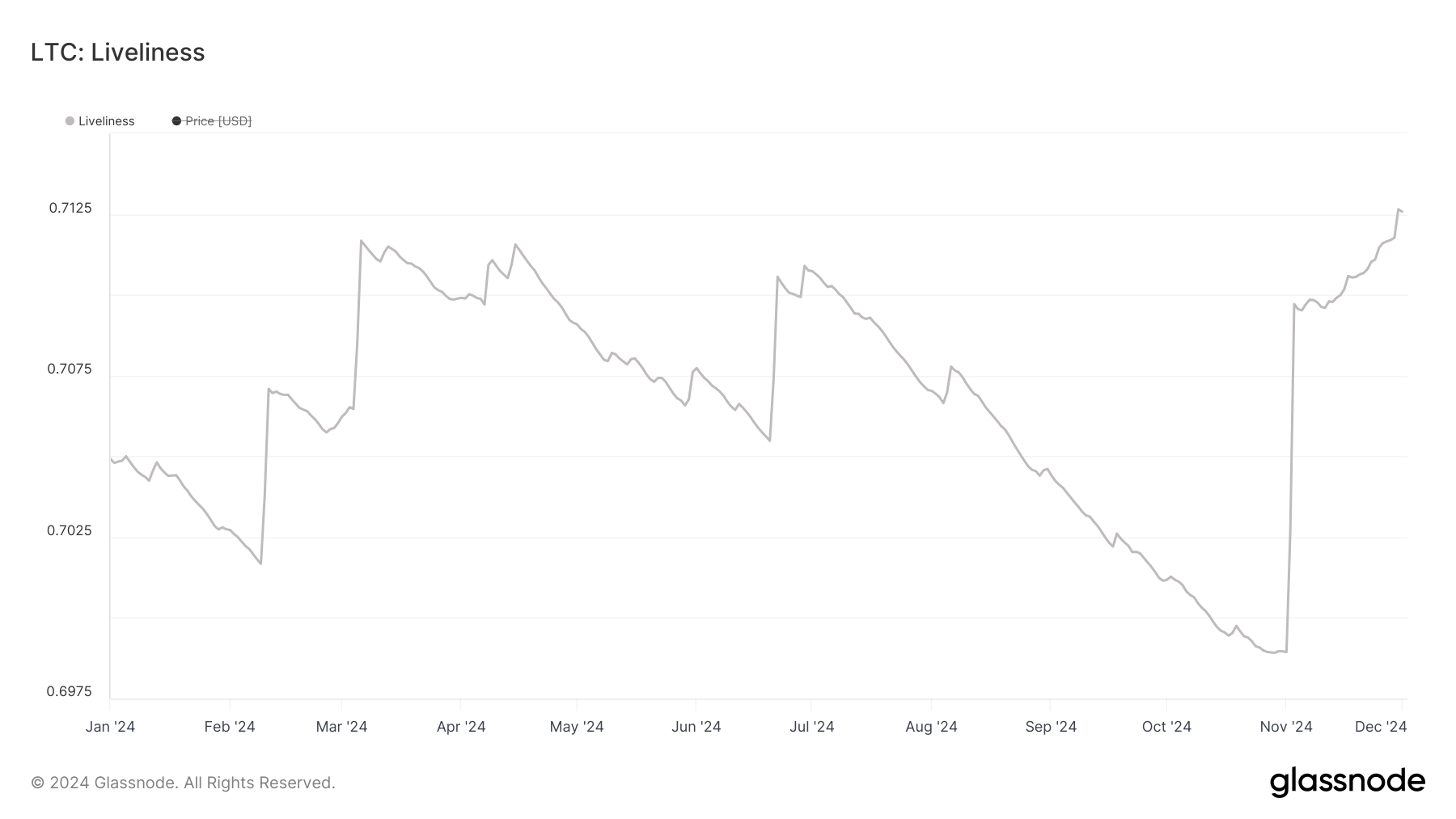

According to BeInCrypto’s analysis of the Liveliness metric for Litecoin (LTC), there has been a significant increase in coins that have recently been moved or spent. As reported by Glassnode, this current level stands at a year-to-date peak of 0.71. It’s important to note that as of November 1st, the Liveliness for Litecoin had dropped to its lowest point of the year, reaching 0.69.

The vitality of an asset offers insights into the spending patterns of its Long-Term Holders (LTHs). This metric quantifies the percentage of coins that have recently changed hands or been used in transactions. When it experiences a surge, it suggests that numerous long-term investors are selling off their holdings.

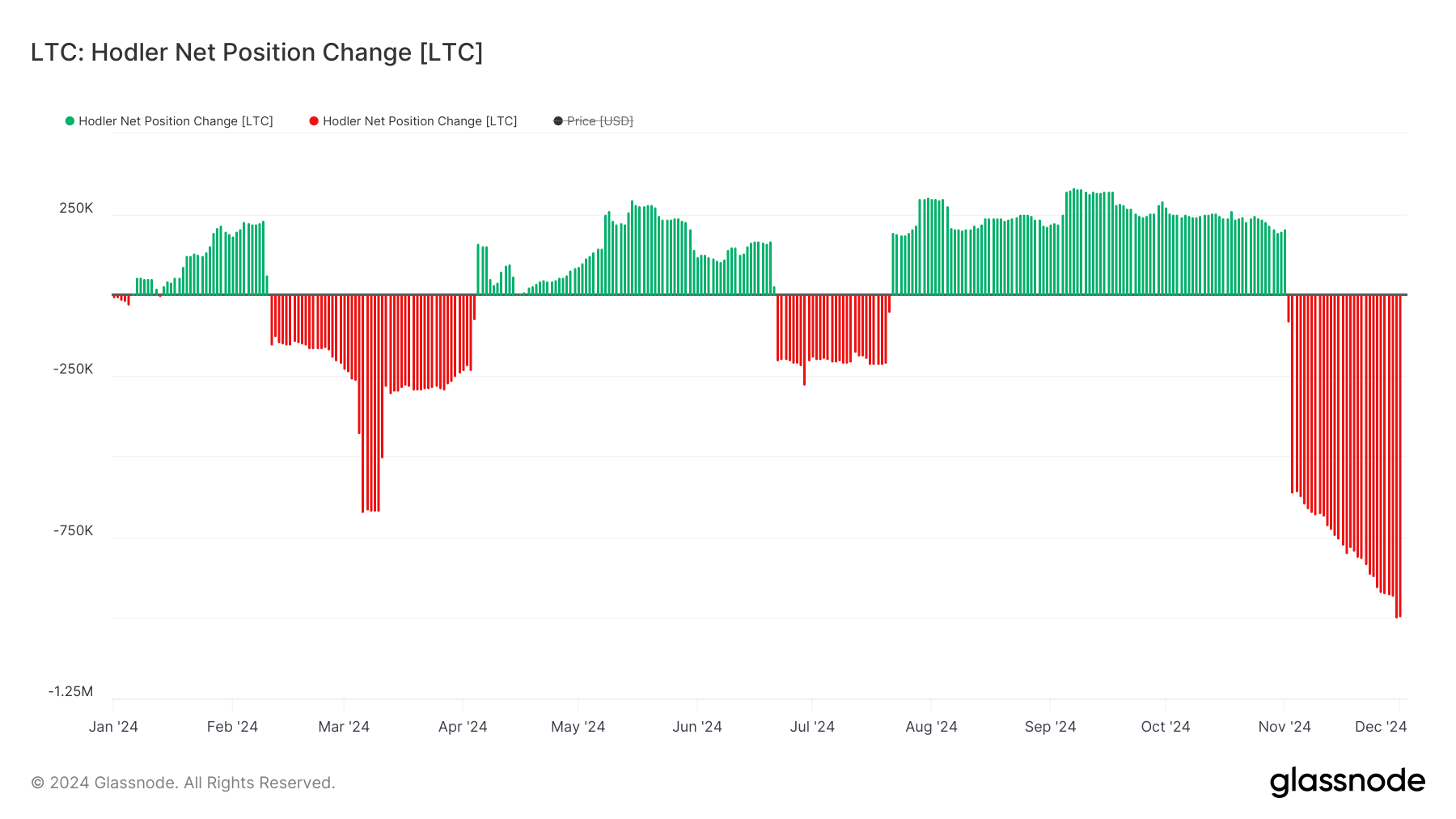

Significantly, the readings from LTC’s Hodler Net Position Change indicate that the distribution trend among its Long-Term Holders (LTHs) is indeed downward. This particular metric, which monitors the actions of LTHs, has shown only negative numbers since November 2. In fact, on December 1, it closed at a record low for the year so far, amounting to -993,199.

If the Hodler Net Position Change shows a decrease, it means that long-term holders (HODLers) are offloading more of their assets than they’re buying, suggesting they’re taking profits from their investments.

LTC Price Prediction: The Bulls Remain in Control

Regardless of small-scale sell-offs from large holders of the coin, there’s a strong optimistic outlook on Litecoin (LTC). Right now, LTC is valued higher than its Ichimoku Cloud indicator, suggesting a robust upward trend in the market.

This tool monitors the directional shifts in an asset’s market movement and pinpoints possible areas where support or resistance might occur. If an asset’s cost remains above the Ichimoku Cloud, it signifies a bullish trend, suggesting that the asset is experiencing a positive momentum with the possibility of additional increases.

If this holds true, the LTC price rally may continue toward $143.41, a level it last traded at in January 2022. Conversely, LTC’s price may drop to $107.58 if this bullish momentum wanes.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

2024-12-02 17:49