Ah, the crypto world—a place where fortunes are made, lost, and then made again, often before lunch. Chainlink (LINK), that plucky little token, finds itself at a crossroads, staring down the barrel of a rather pesky resistance level: $23.78. Break through, and it’s champagne and caviar. Fail, and it’s back to instant noodles and existential dread.

Enter Ali Martinez, the crypto analyst with a knack for spotting these things. He’s pegged $23.78 as the make-or-break point for LINK. If the token can’t muscle past it, well, let’s just say the bears will be throwing a party. But if it does? Cue the bull run, confetti cannons, and possibly a parade.

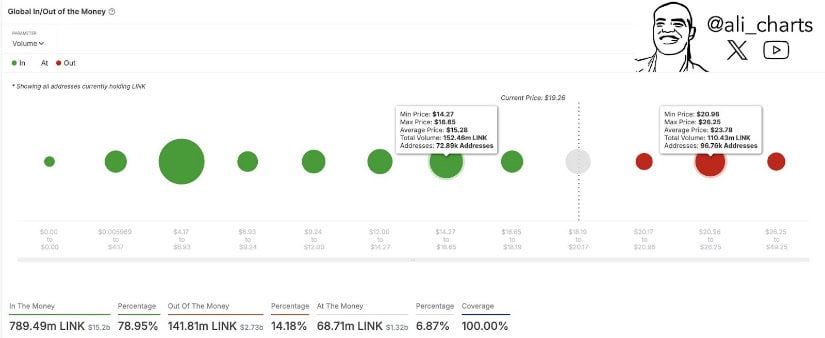

According to Ali’s crystal ball (or perhaps his spreadsheet), nearly 79% of LINK holders are sitting pretty, having bought in at an average of $15.28. Meanwhile, 14% of the poor souls bought at $23.78 and are currently nursing their wounds. That resistance level is no joke—investors who bought between $20.96 and $26.25 might just hit the sell button to break even, and who can blame them?

Whales, Sell-Offs, and the Art of Crypto Drama

If LINK does make a run for $23.78, brace yourself for a potential sell-off frenzy. Those looking to recoup their losses might just flood the market, creating enough selling pressure to make a black hole jealous. But if LINK can clear that hurdle? Investor sentiment could flip faster than a pancake at a diner, paving the way for a rally toward $25, $30, and beyond.

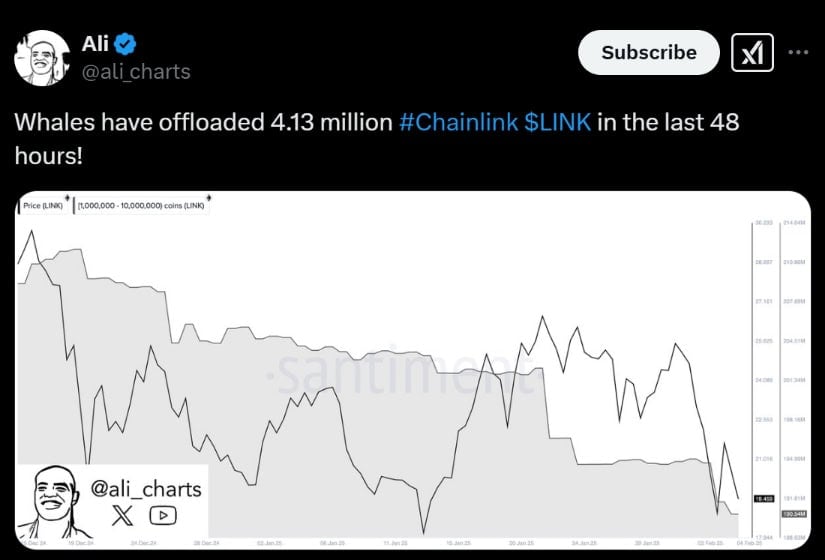

And then there are the whales. Oh, the whales. A few days ago, these majestic creatures dumped a whopping 4 million LINK tokens into the market. Such a move is often seen as a vote of no confidence, and it’s no wonder LINK has been feeling a bit under the weather lately.

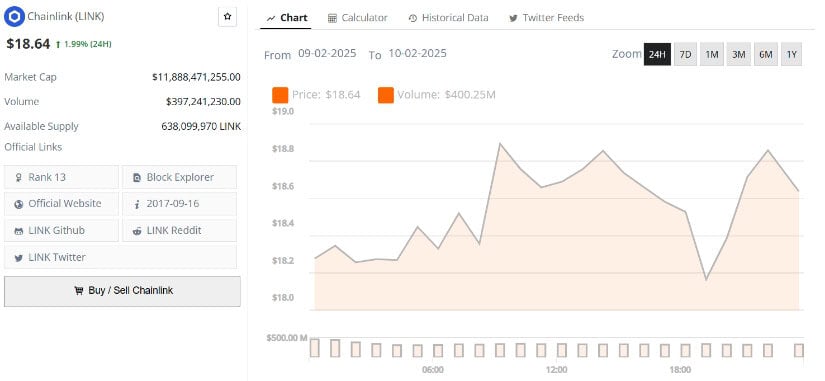

At the time of writing, LINK is trading at $18.64, according to BNC’s LINK Price Index. Trading volume has dipped by 18%, settling at $397.13 million, as investor interest seems to be taking a nap. But if buying pressure picks up, LINK might just muster the strength to challenge that pesky resistance level.

The LINK price chart via Brave New Coin

Can LINK Reclaim Its Glory Days? 🏆

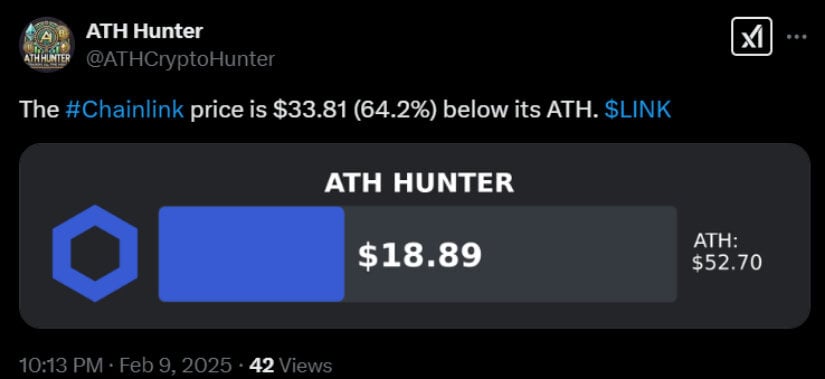

Back in the heady days of 2021, LINK soared to an all-time high of $52.70. Since then, it’s been a bit of a rollercoaster, with the token currently sitting 64.2% below its peak. But hope springs eternal, and Chainlink has been making waves with increased adoption and growing demand.

One of the more eyebrow-raising developments is the high-profile purchase by Trump’s project, World Liberty Financial. This mass acquisition of Chainlink tokens has added some serious heft to its long-term bullish case. Add in chatter about a potential Chainlink ETF and its innovative Cross-Chain Interoperability Protocol, and you’ve got a recipe for rising demand.

With the right market conditions and a strong Bitcoin rally, some analysts believe LINK could revisit the $50 mark. But let’s not get ahead of ourselves—this is crypto, after all.

LINK’s Next Big Move: What to Watch For

Many analysts are keeping their eyes peeled for a symmetrical triangle pattern, which often signals a major breakout. If LINK can breach that key resistance level, the next targets could be $28.50, $36.50, and even $50.

Historically, LINK has been known to pull off some impressive feats, like its 1,400% surge from early 2020 to mid-2021. Recent price action suggests that LINK is finally emerging from its prolonged accumulation phase, with strong support at $9.20 and $4.80. If bullish sentiment prevails, some analysts believe LINK could not only reclaim its previous all-time high of $53 but even venture into triple-digit territory. Now, wouldn’t that be something?

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- Does Oblivion Remastered have mod support?

- DODO PREDICTION. DODO cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2025-02-11 04:11