Link’s price has fallen by 10% over the past 24 hours, reflecting a wider decline in the cryptocurrency market. This price decrease is subsequent to Ripple‘s adoption of the Chainlink Standard to facilitate the introduction of its new RLUSD stablecoin on the blockchain.

As we speak, a single unit of LINK is being transacted for approximately $20.77. The current technical and on-chain configuration suggests the potential for additional drops in price, as outlined in the following breakdown.

Chainlink Faces Double-Digit Drop as Bearish Sentiment Intensifies

On Tuesday, it was confirmed that Ripple, a digital payment service provider, has partnered with Chainlink. This alliance is intended to deliver reliable and precise pricing information for RLUSD transactions on both the Ethereum network and the XRP Ledger, ensuring security and accuracy.

Despite the announced integration, LINK’s price hasn’t shown a positive response; instead, it decreased by 10% over the last 24 hours.

Additionally, LINK’s price drop by double digits has coincided with an increase in its trading activity, creating a negative pattern. In the last 24 hours alone, the token’s trading volume has reached $1.06 billion, marking a significant jump of 28%.

When the trading volume of an asset significantly increases while its price is falling, this suggests increased market activity due to many investors selling, potentially because of fear or trying to cash in on profits. This could mean a strong negative outlook on the market and implies that the downward trend may continue.

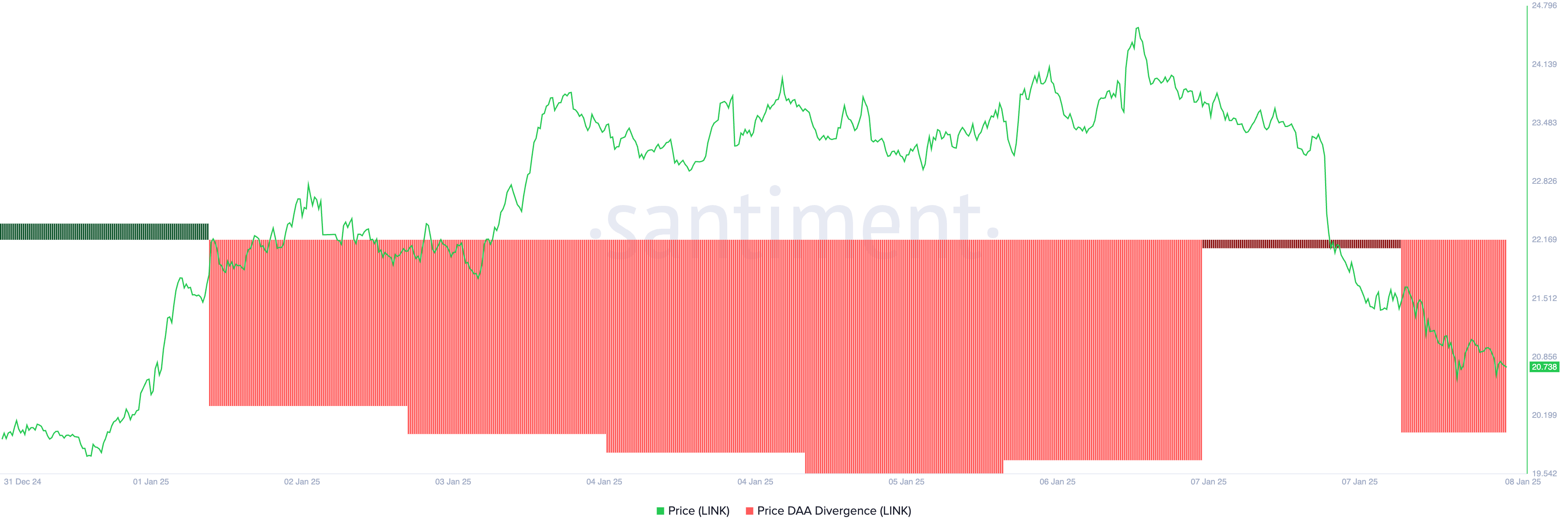

Furthermore, the discrepancy between LINK’s price and its Daily Active Addresses (DAA) suggests a decrease in interest or demand for the cryptocurrency, with a current drop of 56.61% at the moment.

This measurement tracks an asset’s price fluctuations based on the variation in the number of daily active addresses using it. When this value is negative during a price drop, it implies decreased on-chain activity coinciding with bearish market action. This reduction in activity could signal waning user interest or utility, further supporting the prevailing downward trend.

LINK Price Prediction: A Decline Below $20 or a Rally Above $30?

On the daily chart, LINK is slightly above the support established at approximately $18.53. If its current decline continues, this support may be challenged. Should it break, the price of LINK might fall lower towards $15.81.

If the overall market outlook becomes more positive and people start buying LINK again, there’s a chance its price might rise beyond $22.54 and move towards the $30 price range.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-01-09 00:11