Shocking Crypto Caper: Mark Twain Exposes the LIBRA Frenzy! 🚀🤠

Well now, stranger, as sure as the mighty Mississippi rolls on, there’s a whisper ‘round these parts that the LIBRA token might just pull a rabbit out of its hat—reaching a measly 50 cents by 2025. But don’t hold your breath any longer than you’d wait for a steamboat’s whistle! 🤠

When Congress Went Fishing for Trouble

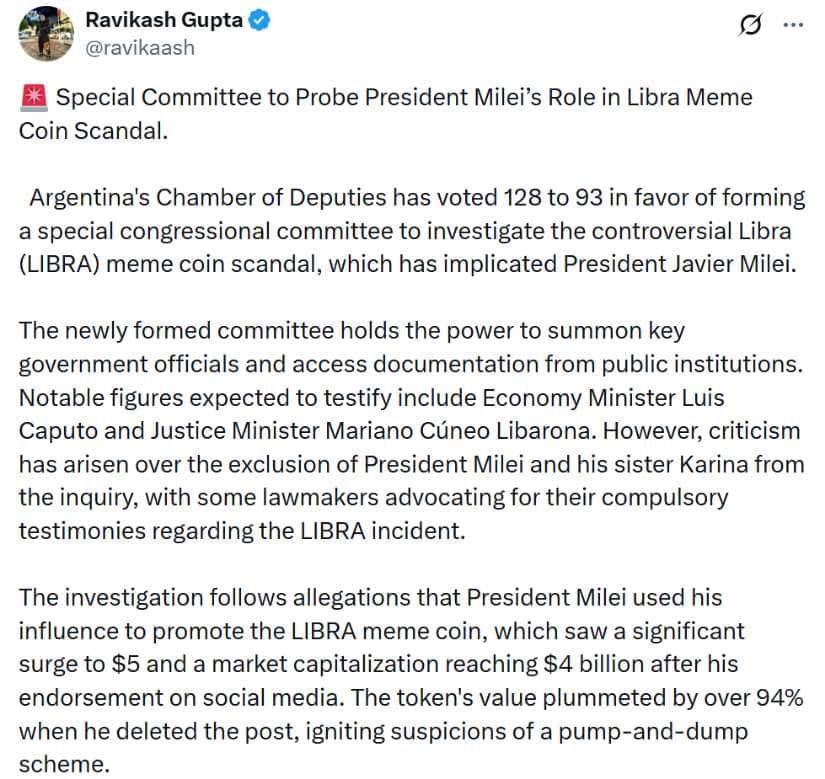

In a display of good ol’ Argentine gumption (or perhaps just hankerin’ for a spectacle), the Chamber of Deputies gathered on April 9 to set up a committee to unravel the mystery behind the LIBRA hullabaloo. It all started when President Javier Milei, in a fit of highfalutin enthusiasm on February 14, hollered about the coin, sending its value higher than a cat on a hot tin roof—only to have it tumble faster than a raft over a waterfall! 😏

Now, this token did the old vanishing act: soaring over 3,000% at one moment—reaching peaks above five dollars—and then plummeting over 90%, settling to a pitiful 31 cents with a market cap that’d make a miser blush at around $81.5 million.

Lawmakers, like weary riverboat captains, have summoned the high-flyers of the government—Ministers Luis Caputo and Mariano Cúneo Libarona, Chief of Staff Guillermo Francos, and National Securities Commission head Roberto Silva—to testify if they may have played fast and loose with the public’s coin.

“It ain’t just a memecoin, y’all,” quipped lawmaker Gabriela Estevez with a twinkle in her eye. “We’ve got to know who tampered with the gears of this farce.”

Milei’s Misadventures Under the Magnifying Glass

President Milei now finds himself under a heap of scrutiny, much like a riverboat gambler caught with his hand in the cookie jar. Though he denies any direct fiddlin’ with the token, many reckon his public cheerleading was tantamount to a nod of approval. Like a cat that got the cream and then dashed off, his original post vanished quicker than a summer mirage, leaving folks to wonder if his support was for entrepreneurship or for ill-conceived financial horseplay.

Now, the opposition’s not letting this one slide. They’re hollering that both Milei and his kin, including his sister and presidential advisor Karina Milei, oughta show up before the committee. “We ain’t done until every last soul explains themselves,” declared lawmaker Sabrina Selva.

Meanwhile, detectives of the law are chasing down fraudulent fiddle-faddle, working to freeze accounts and track the trail of shady transactions. Rumor has it that Interpol’s been asked to hunt down Hayden Davis, the supposed brain behind the LIBRA caper, who emptied his pockets of over $107 million before the great collapse.

The Curious Case of Market Shenanigans

What at first looked like a promising romp in the crypto corral soon unraveled like a poorly knitted sweater. On-chain records revealed a mess of insider trading and liquidity hijinks. Word is, outfits like Kelsier Ventures, among others, hoarded up to 85% of the token supply—forcing the rest of us simple folk to suffer the fallout when they cashed in their chips during the high tide.

A class-action suit in New York, headed by Burwick Law, now accuses these rascals of masterminding a “pump-and-dump” racket worthy of the scoundrels in a dime novel.

LIBRA: A Rocky Road to Redemption?

Even amidst this confounded hullabaloo, the town criers of crypto remain split in their bets. Some, like Mudrex, reckon LIBRA might crawl to somewhere between 10 and 50 cents by 2025, while the optimists at DigitalCoinPrice see a glimmer of hope between 29 and 70 cents. The plan is to bank on a crypto rally in that lonesome year, though doubts about regulation and a bruised reputation keep many a furrowed brow in check.

“The fundamentals of LIBRA are as muddled as a river on a foggy morn,” observes crypto sage Hassan Shafiq. “But if this project can break free of its political hangover and win back a bit of trust, there’s still a twinkle of speculative interest in its tokenomics.”

Looking out to 2030, some predict LIBRA could swing between a measly 20 cents to as high as $1.75—though that’s about as sure a thing as a cat chasing its own tail in a whirlwind.

A Pivotal Moment for Crypto Oversight Down Under

The LIBRA fiasco has lit a fire under debates about crypto regulation in Argentina. With inflation soaring and economic storms brewing, the lure of quick buck-making remains as tempting as a candy store in a dry town. Yet now, lawmakers and money-watchers alike are under pressure to craft rules that keep token promotions honest, especially when high-ranking officials get involved.

“This here mess shows plain as day the need for a sturdy regulatory framework,” said Representative Oscar Agost Carreño. “We must mend the tattered trust of the public and ensure that digital innovation ain’t a free ride on the back of deceit.”

And so it goes, as the LIBRA saga continues to stir up quite the commotion down here in Latin America—a scandal that might just rewrite the rules of crypto governance in tumultuous times.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-04-10 13:37