The market, dear reader, has birthed a peculiar offspring: the leveraged Exchange Traded Fund. Once a modest gathering, a quiet coterie of funds tracking indices and sectors, it has swelled into a boisterous, unruly crowd – several hundred strong, half of them appearing as if by magic since the dawn of 2025. One begins to suspect a pact with…well, let us simply say, forces beyond our comprehension.

These instruments, promising amplified returns, are, in truth, treacherous things. Like a beautifully crafted mirror, they reflect not reality, but a distorted, accelerated version of it. Even wielded with the best intentions, they possess a capacity for swift, dramatic loss. The ancient wisdom – know what you are investing in – is here not a suggestion, but a desperate plea for self-preservation.

For the common investor, the everyday soul navigating the labyrinth of finance, these funds are generally…ill-advised. They are not intended for the long haul, for the patient accumulation of wealth. Rather, they are tools for a fleeting, almost reckless, speculation. But even a devil may occasionally find a use for a hammer. Let us, therefore, examine the supposed virtues and undeniable vices of this peculiar breed of financial instrument.

Pro: A Margin Account, Without the Bureaucracy

To attempt the strategies these leveraged ETFs embody independently requires navigating the murky waters of margin accounts. Approvals, collateral, the endless paperwork… a veritable bureaucratic nightmare. It’s enough to drive a man to write a novel about a talking cat. These ETFs, however, offer a shortcut. A simple purchase, a few clicks, and one is instantly leveraged, as if by a particularly efficient imp.

The ease of use, it must be admitted, is alluring. It’s the financial equivalent of a self-stirring teacup. But remember, dear reader, convenience often comes at a price. And in this case, the price may be your entire fortune.

Con: Volatility – The Devil’s Playground

Ah, volatility. The very lifeblood of the market, and the undoing of many a hopeful speculator. For leveraged ETFs, it is a particularly insidious foe. In a stable market, they may offer a modest boost. But in a choppy sea, they become unpredictable, monstrous things. The daily resetting of leverage, intended to amplify gains, instead magnifies losses. It’s a cruel irony, wouldn’t you agree?

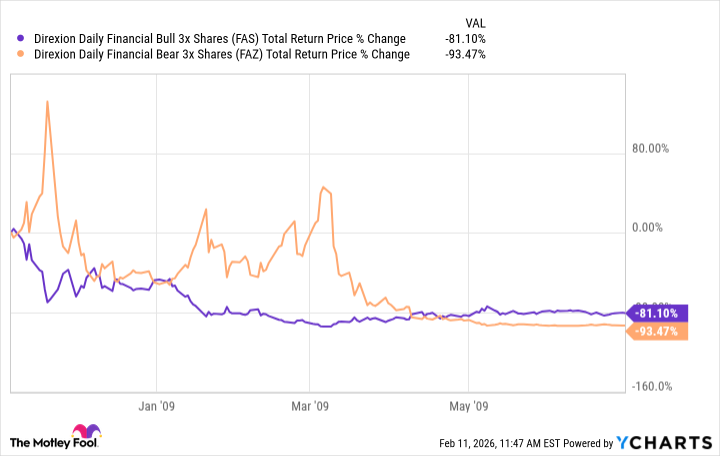

Consider the financial crisis. The Direxion Daily Financial Bull 3x Shares ETF (FAS 0.14%) and its bearish counterpart, the Direxion Daily Financial Bear 3x Shares ETF (FAZ +0.22%), plummeted with a ferocity that defied logic. Both, intended to profit from market movements, delivered…well, let’s just say they provided a stark lesson in the perils of leverage. It was a spectacle worthy of a particularly gloomy opera.

The more volatile the underlying asset, the greater the risk. It’s a simple equation, yet so many seem determined to ignore it. Perhaps they believe they are somehow exempt from the laws of physics…or, more accurately, the laws of finance.

Pro: Simplicity Itself

Leverage, properly applied, is a complex art. It requires understanding of margin, risk management, and a healthy dose of audacity. To attempt it independently is to invite disaster. These ETFs, however, offer a pre-packaged solution. All the calculations, all the complexities, are handled for you. It’s like ordering a gourmet meal, rather than attempting to cultivate the ingredients yourself.

Con: The Erosion of Time

These ETFs are designed to amplify daily returns. Hold them for longer, and the illusion begins to crumble. The constant rebalancing, the daily resetting of leverage, eats away at your profits like moths to a silk gown. On a flat market, a 2x leveraged ETF will almost certainly lose money. It’s a slow, insidious decay, a financial entropy that is both predictable and heartbreaking.

These are not investments, dear reader. They are trading tools. Meant for fleeting speculation, for tactical maneuvers. They are not suited for the patient, long-term investor. To treat them as such is to court ruin. Most sensible individuals would simply avoid them altogether. Resist the temptation to juice returns. The devil always asks a price.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- The Most Anticipated Anime of 2026

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-16 08:23