One does not simply invest in Lemonade (LMND) without first consulting a crystal ball, a compass, and a bottle of aspirin. In December 2020, I, a man of modest means and boundless optimism, purchased shares at the stock’s zenith-a decision as prudent as building a house on a sandcastle. The automated insurance utopia, with its AI-driven promises, seemed as solid as a magician’s vow. Yet here we are, two years later, with a portfolio that has weathered a storm of red ink and a 54% decline.

But ah, the contrarian heart beats on. While the market yawns, I, a man of eccentric convictions, doubled down in 2021 and 2022. A fool’s errand, some might say, but what is life without a touch of madness? The numbers, though, tell a tale of resilience: a 16% gain, a testament to the alchemy of patience and poor judgment.

Now, the question lingers like a bad smell: where does Lemonade go from here? Let us dissect this lemon, peeled back to its bitter core.

Lemonade’s recent progress (less pulp and more sugar)

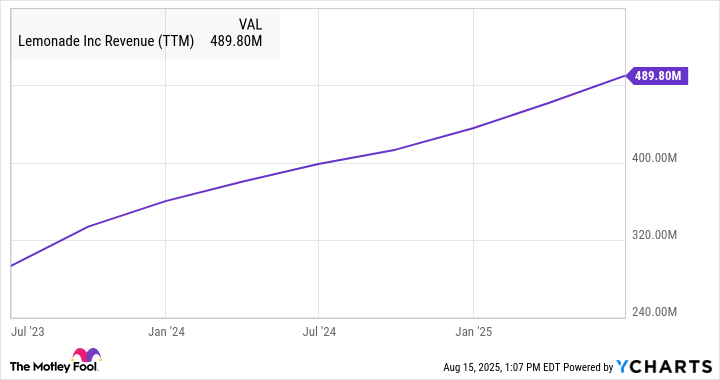

Behold, the numbers: 2.69 million clients, a 41% surge in two years. The premium balance, once a trickle, now a modest stream. The loss ratio, though still a gaudy 70%, has shrunk like a sun-bleached sock. Revenue, that fickle mistress, has taken flight. Yet, one must ask: is this progress, or merely the first notes of a symphony played on a broken violin?

The AI, once a phantom in the machine, now hums with the confidence of a man who’s just won a bet. But let us not mistake a growing customer base for a cure-all. The data may stack up, but so too do the risks, like bricks in a house of cards.

Growing pains and room to improve

Free cash flow, that elusive ghost, remains a mirage. Management, ever the optimist, claims it will materialize by 2025. One can only hope their crystal ball is cleaner than their balance sheet. The geographic expansion, a tale of slow but steady creep: 10 states for car insurance, 28 for homeowners, and a European rollout that feels more like a teaser than a launch.

Yet, as the saying goes, the devil is in the details. A Frenchman’s lack of earthquakes may simplify matters, but it also raises the question: can a company built on data thrive without the chaos of the real world?

What’s next for Lemonade?

Will Lemonade be a titan or a footnote? The answer lies in the hands of the market, a fickle lover. The road ahead is paved with potential, but also with potholes. More states, more customers, more data-yet the specter of loss lingers like a bad smell.

To the investor, I say: approach with caution, but not with fear. Lemonade is a gamble, yes, but a gamble with a twist of hope. It is not a sprint, but a marathon-though one might need a wheelchair to finish.

In the end, the stock market is a grand farce, and Lemonade, a curious act in the circus. For those who dare, a sip may be worth the risk. But remember: the best lemonade is made with patience, not panic. 🍋

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-08-17 14:14