As a seasoned researcher with years of experience delving into the complex world of DeFi and blockchain technology, I find myself both intrigued and cautious regarding Lido’s recent surge in TVL. On one hand, it’s undeniably impressive to see such growth, particularly when it comes so close to the all-time high set just a few months ago. It suggests renewed confidence in the platform and its ability to provide competitive yields, which is always a good sign.

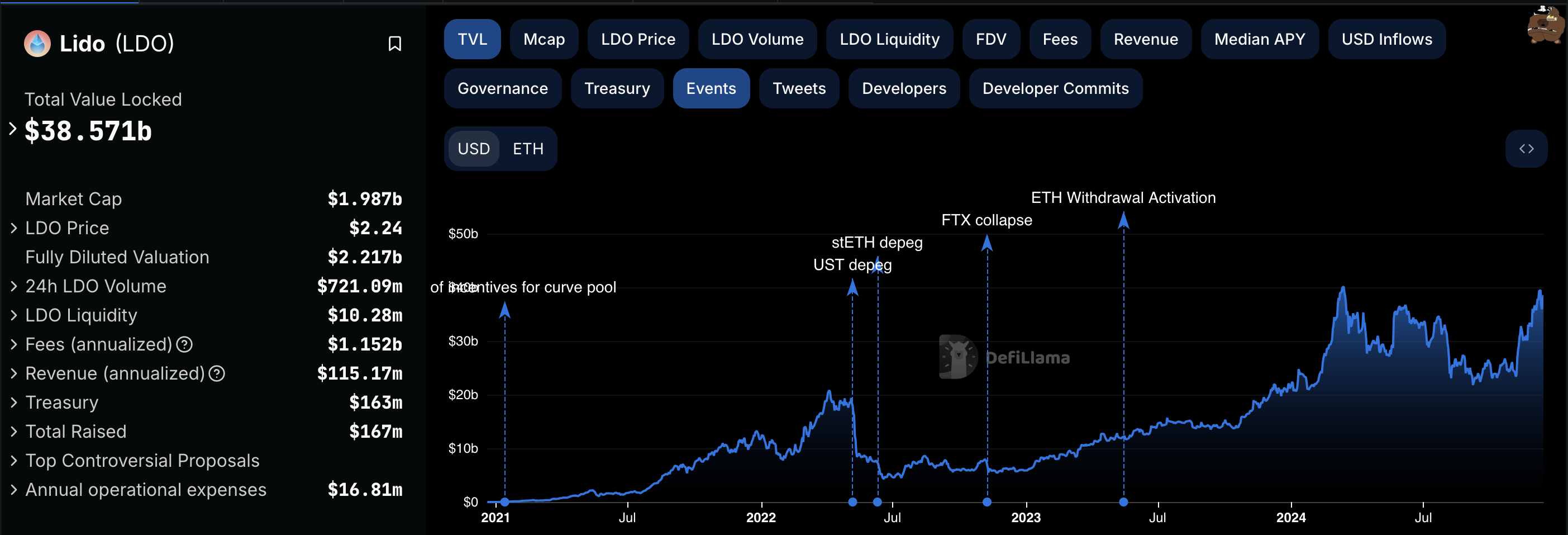

Over the past month, the Ethereum-linked liquid staking platform Lido has experienced a 25% increase in Total Value Locked (TVL), approaching its previous record high of $40 billion, a level last seen in March.

Although the value of Lido DAO Token (LDO) has been increasing, it could struggle to maintain its growth for several reasons. Let me explain.

Confidence in Staking on Lido Circles Back Toward March Peaks

In November, the Total Value Locked (TVL) in Lido’s network was approximately $24.6 billion. This metric signifies the combined value of all assets that are either deposited or staked on a blockchain. As the TVL increases, it indicates more assets are being secured within the platform.

As a researcher observing the dynamics of this platform, I’ve noticed that an increase in Total Value Locked (TVL) typically strengthens liquidity, boosts user trust, and potentially escalates the desire for the native token. Conversely, a decrease in TVL seems to signal a wave of asset withdrawals, implying reduced investor confidence.

As an analyst, I’ve been tracking the performance of Lido, and according to my latest findings from DeFiLlama, the Total Value Locked (TVL) is currently sitting at approximately $38.57 billion. That’s just under $2 billion away from its all-time high. This growth indicates a surge in investor confidence in Lido’s potential to deliver competitive yields.

Over the last day, this spike coincides with a 10% rise in LDO’s value. This upward trend could possibly be linked to the Grayscale Lido DAO Trust, suggesting that institutional investors now have an opportunity to invest in the cryptocurrency.

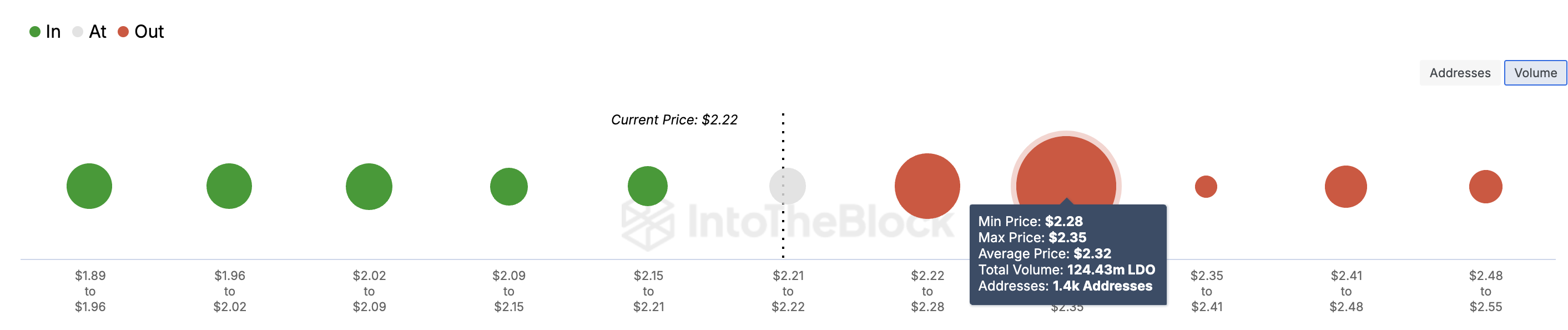

Nevertheless, the In/Out of Money Around Price (IOMAP) suggests that reaching the $3 target might prove difficult for this altcoin’s price due to strong resistance encountered at approximately $2.32.

In simpler terms, the IOMAP (Input-Output Map) categorizes addresses according to whether they hold tokens that are above, below, or at the break-even point. A higher number of tokens above the break-even point suggests there’s resistance, while a significant group below it also indicates potential resistance.

From the information presented, approximately 1,400 addresses collectively own about 124.43 million units of the asset, with an average purchase price of $2.32 each. This quantity exceeds the amount bought at prices ranging from $1.89 to $2.22, suggesting a significant resistance level near the current value. Under these circumstances, it’s possible that LDO could experience a substantial dip.

LDO Price Prediction: Altcoin Eyes Lower Levels

Looking at the technical aspect, the Awesome Oscillator (AO) on the daily graph shows a positive trend. Yet, this indicator, which gauges momentum, has displayed red histogram bars. These red bars in the AO suggest that the momentum related to LDO stock is decreasing.

Similar to the AO, the Moving Average Convergence Divergence (MACD) often indicates a bearish trend. When the MACD line is above zero, it usually signals a bullish momentum.

In this situation, the interpretation points towards a possible decrease in LDO’s price, potentially down to $1.65. This level corresponds with the 61.8% Fibonacci retracement line.

If the demand for purchasing LDO grows stronger, it’s possible that its price may rise to $2.38. If this trend continues and the Total Value Locked (TVL) of Lido reaches a new all-time high, there’s a possibility that the value of LDO could exceed $3 in the near future.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2024-12-13 14:40