![]()

An actor’s impact doesn’t disappear after their final performance. The legal documents they leave behind – like wills – are crucial for protecting their legacy and ensuring their wishes are carried out. These documents detail how things like their image, personal items, earnings, and funds for their children will be managed. Some actors have very specific plans, while others rely on state laws when they don’t leave a will. Here’s a look at what we can learn from famous examples.

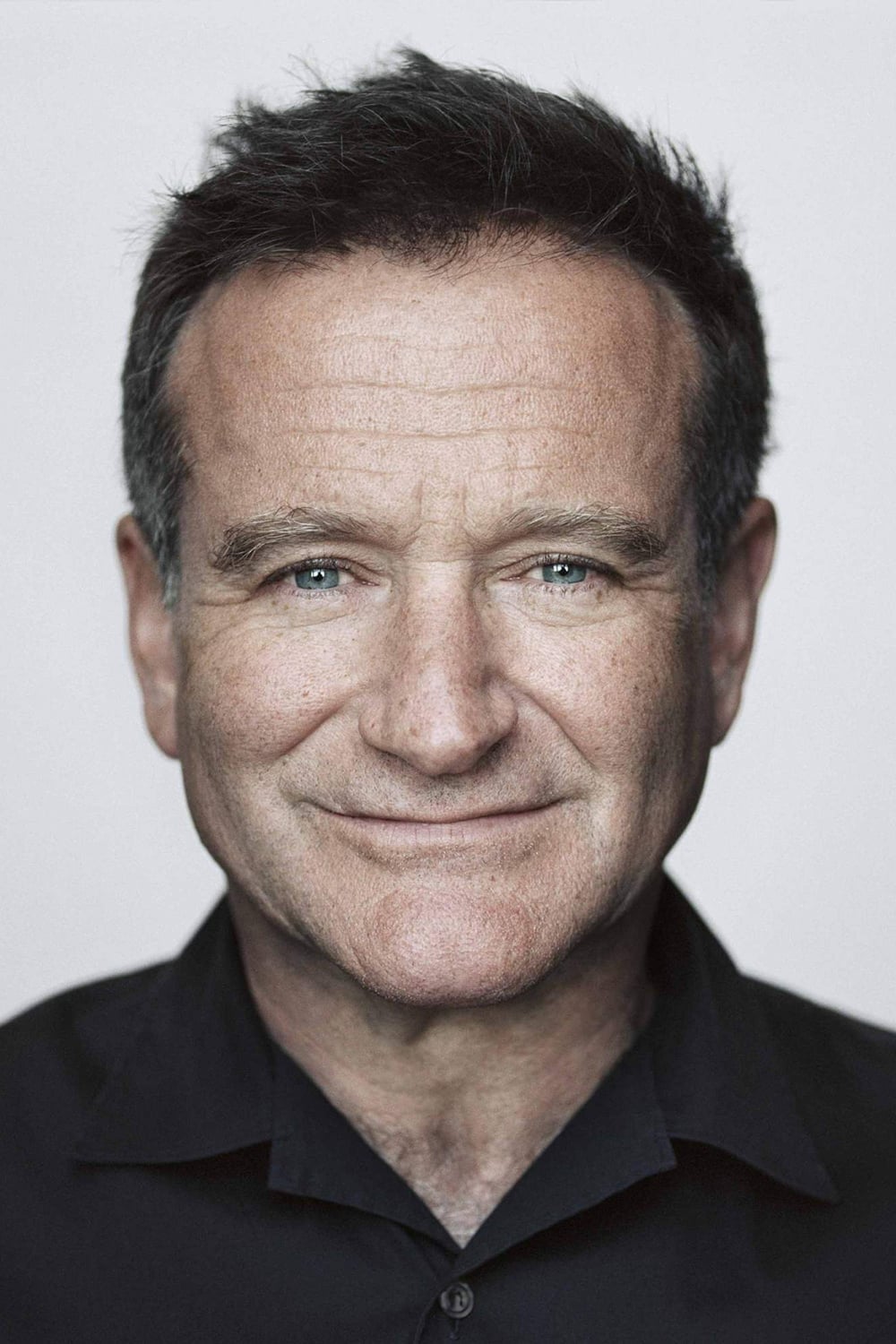

Robin Williams

He arranged for most of his possessions to be distributed to his children through trusts, with payments scheduled at certain ages. He also established guidelines for protecting his image and limited how it could be used for profit after he passed away. His wife retained rights to their home and some of their personal belongings. Any disputes regarding collectibles were handled through a pre-arranged agreement that ensured the main collections remained together.

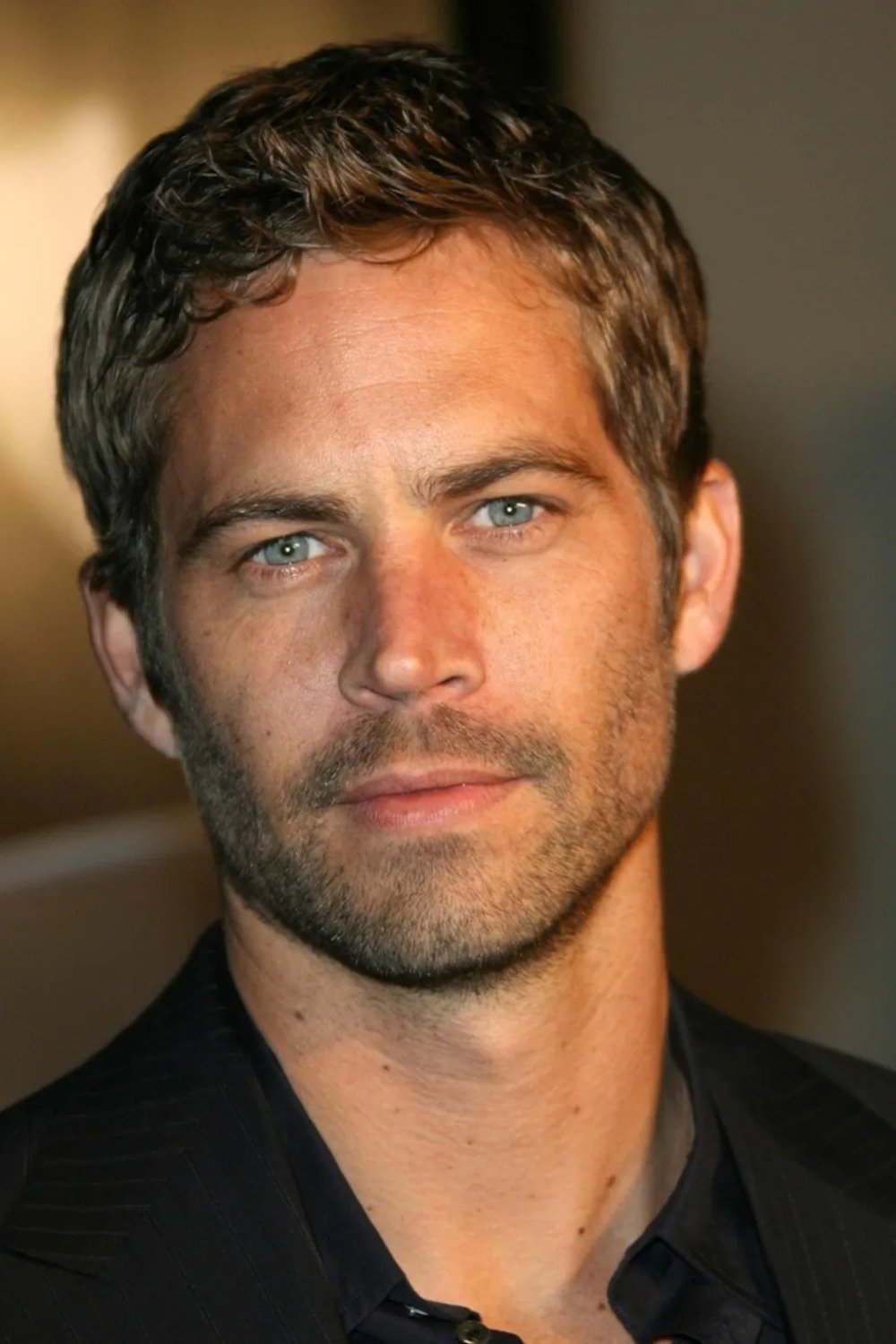

Paul Walker

In his will, he left everything to his daughter, placing it within a trust. He appointed a family member to manage the trust’s assets until she turned 18. To prevent disagreements, he chose one person to be in charge of carrying out the will. Both his properties and any income from them were managed through this trust for the long term.

James Gandolfini

He created a standard will outlining how his possessions would be distributed to his family and friends. He chose to give gifts directly, rather than setting up trusts for tax benefits. He specifically addressed an Italian property to follow local laws. The will also appointed several executors to manage assets in different countries and handle the necessary paperwork.

Philip Seymour Hoffman

He instructed that his partner should inherit what remained of his estate, while money for his children would be managed through trusts. He wanted his children to grow up in a large American city to broaden their experiences, but he deliberately avoided setting up long-term trusts that could discourage them from pursuing careers. This plan worked alongside separate arrangements he made for the legal guardianship of his children.

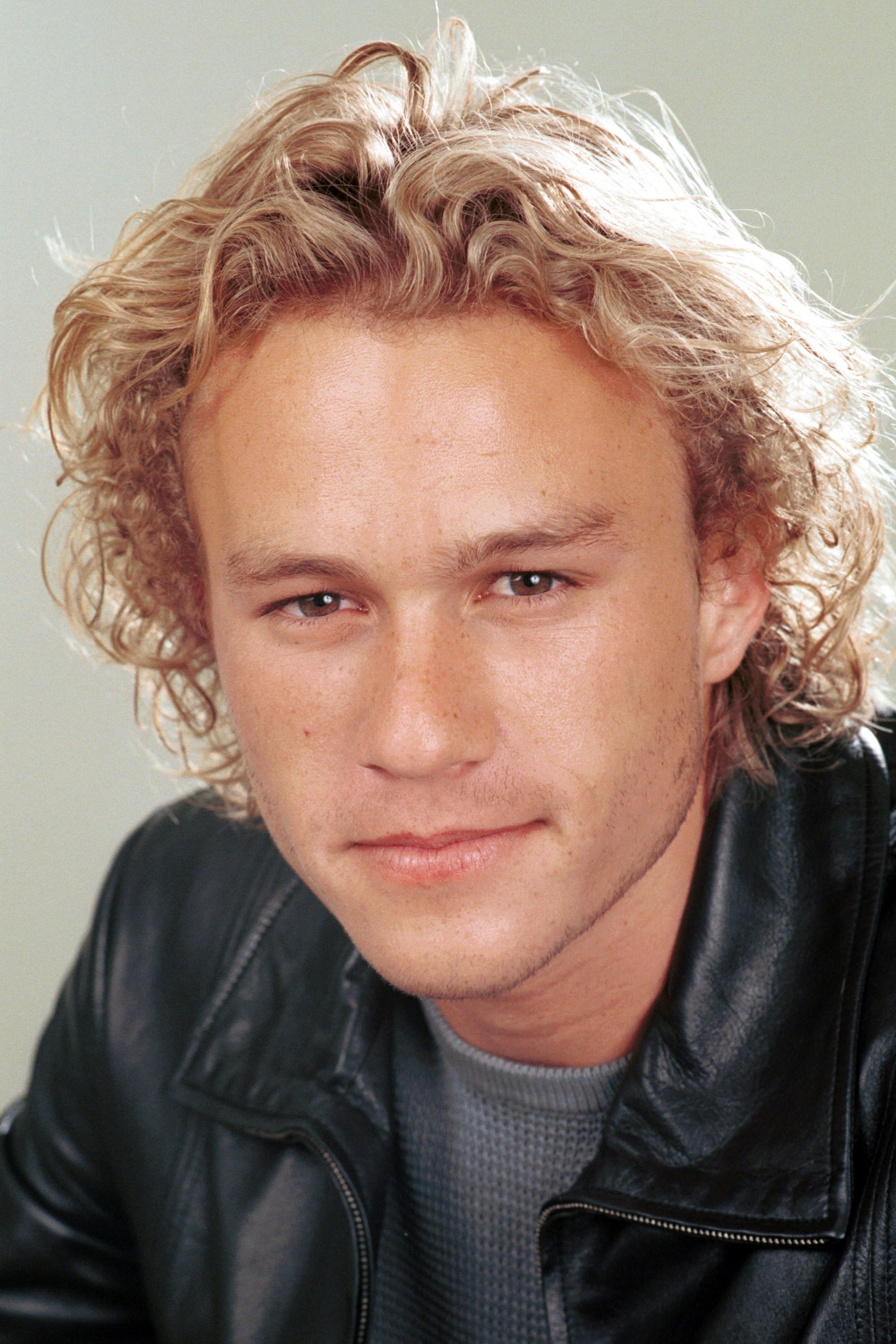

Heath Ledger

The father’s will was created before his daughter was born and didn’t originally name her as a beneficiary. However, his family stated she would still be taken care of financially. The people managing his estate combined his earnings from various sources into one account. His personal items, like notebooks and awards, were addressed in a separate agreement outside of the main will.

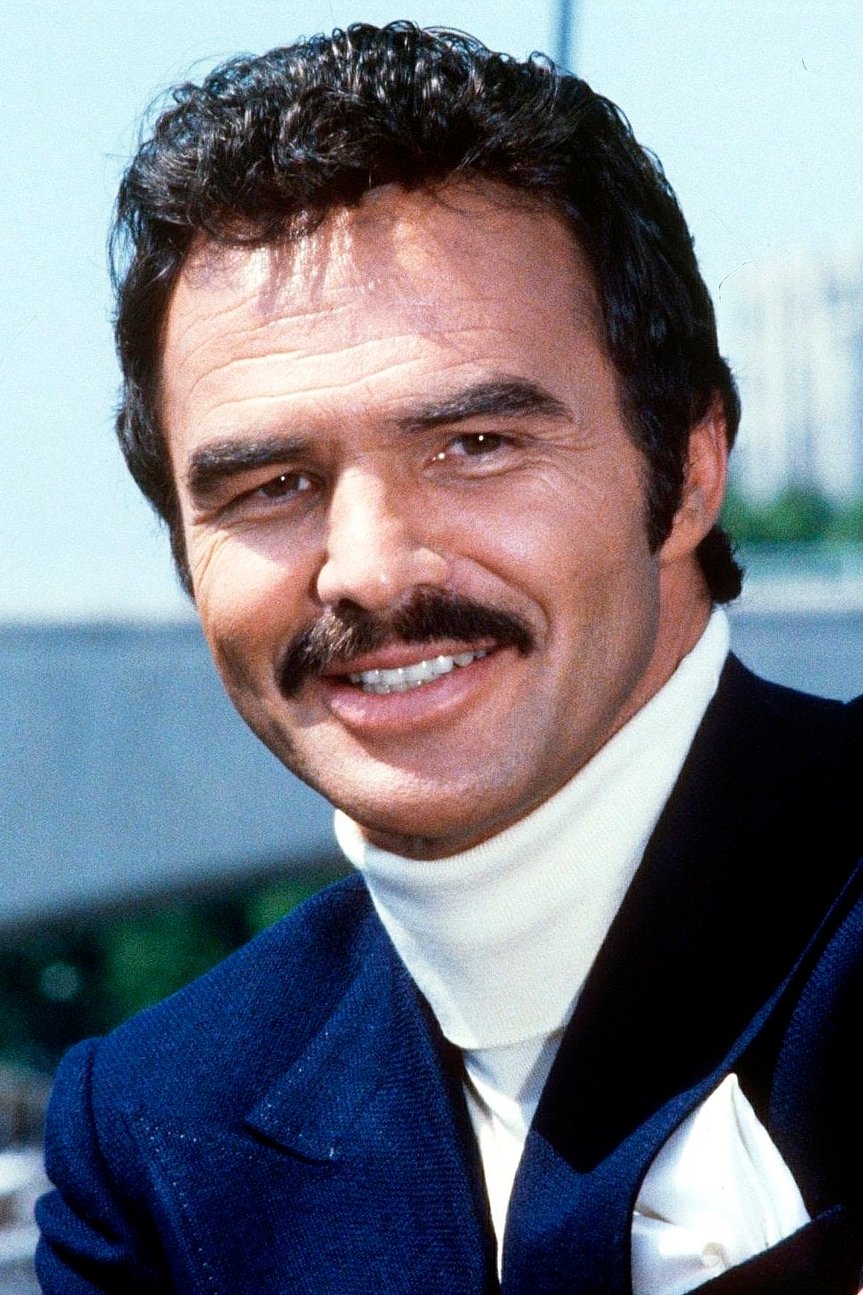

Burt Reynolds

He intentionally left out his son from the will because he already established a trust for him. The will primarily distributed his remaining possessions to his spouse, aligning with their prenuptial agreement. Any assets not specifically mentioned in the will were directed into the existing living trust. The trust also had the first opportunity to purchase any collectibles or scripts.

Kirk Douglas

He gave away most of his fortune through his family’s charitable foundation. His will and the foundation’s guidelines specified that grants should focus on areas like education and healthcare. Family members inherited personal belongings and cherished items. The people managing his estate were asked to sell any assets that didn’t support the foundation’s goals and use the money to increase its funding.

Jerry Lewis

Okay, so this guy’s will was pretty specific. He clearly stated which of his kids from a previous relationship wouldn’t inherit anything. The bulk of his estate – everything left over after debts and specific gifts – went to his current spouse and the child they adopted, but through a trust. The person handling the will – the executor – got the power to manage any money coming in from things like concerts and performances. And, as a bit of a movie buff myself, I thought this was interesting: the will also said that before anything from his collection of memorabilia could be sold or donated, it all had to be carefully cataloged. It’s like he wanted to make sure his legacy was preserved, even in the little things!

Mickey Rooney

When he passed away, he had a small estate and left the majority of it to a caregiver he trusted. His new will canceled any previous wills and limited what other people would receive. Because of worries about elder abuse, the person handling the estate decided to seek legal action to protect it. He also requested that awards and photos be donated to museums and archives.

Tony Curtis

He updated his will, leaving the majority of his possessions to his spouse and specifically excluding his adult children. The will explained that he had already provided for his children through previous gifts and financial planning. The people in charge of handling his estate were given permission to manage and profit from his name and signature. His properties were to be sold, and the money from those sales placed into a trust for his spouse.

Marlon Brando

His plan for distributing his assets included a will and several trusts that held income from his work and his properties. A detailed list specifically covered his house and belongings, including instructions for someone to care for them. The people in charge of his estate managed his right to control how his image was used and worked out agreements for others to use it. Any disagreements with former employees were resolved using a process outlined in his will.

John Wayne

He established a trust to manage income from his films and the use of his name, dedicating it to supporting his family and charitable organizations. The trust allowed his name to be used for causes he approved. His children will receive funds gradually, based on their age and educational achievements. He also instructed that his personal papers and records be preserved for research and public displays.

Alan Rickman

He left most of his possessions to his partner and also made specific gifts to various charities. The will named professionals to handle his copyrights and other intellectual property. Money earned from future performances will be collected and distributed according to pre-determined percentages. He also stipulated that personal letters and practice notes could not be sold for a certain amount of time.

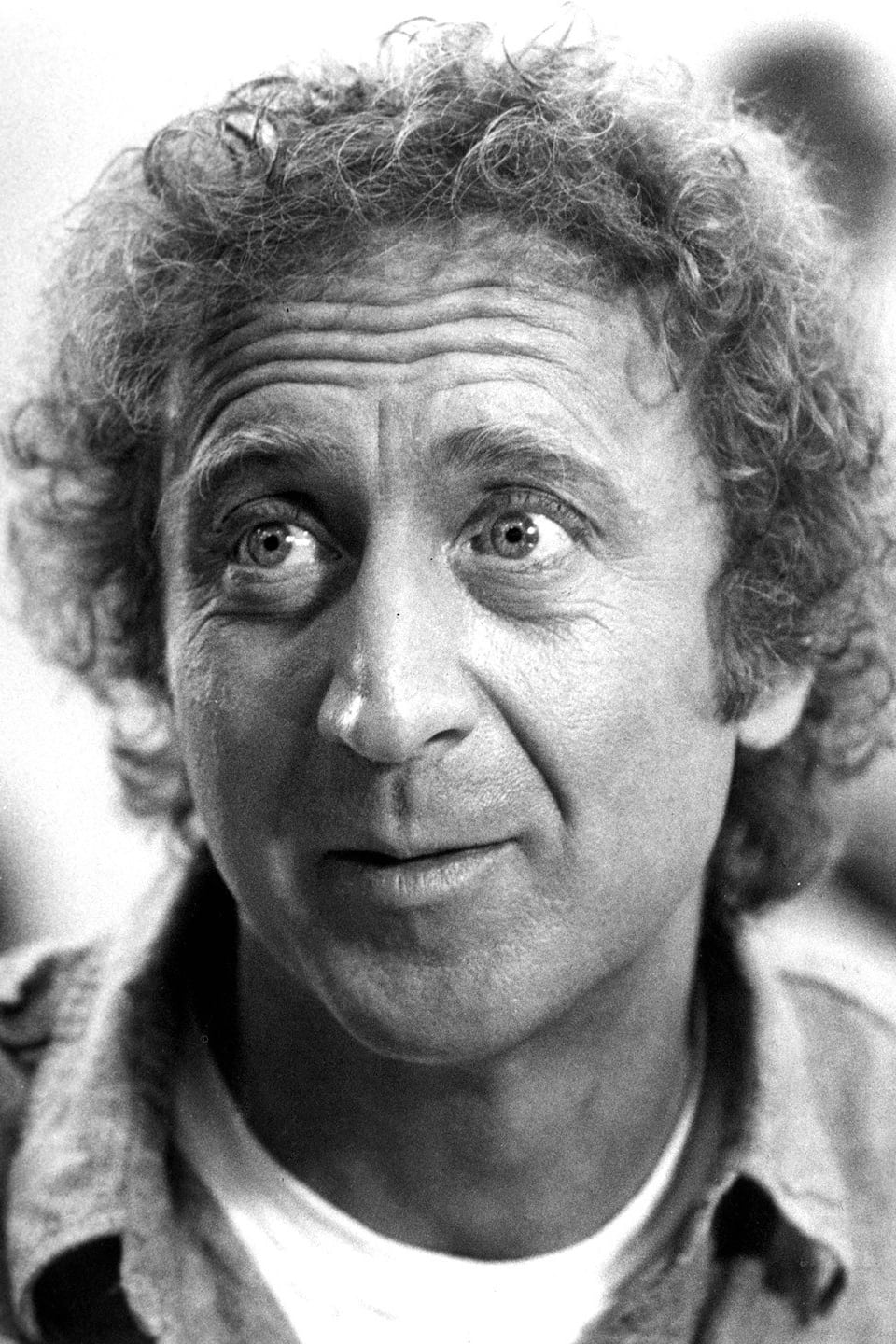

Gene Wilder

He took care of his spouse financially and made plans for managing his papers and personal items after his death. His will asked that details about his health not be publicly shared in any displays about his life. He directed his estate to prioritize donations to organizations that help people with cancer. Money earned from his films and television work was designated for a trust benefiting his family.

Chadwick Boseman

When he passed away without a will, his estate was handled by the probate court according to state law. The court named a family member to manage his assets and debts, and any money owed was distributed, prioritizing his surviving spouse. All income from royalties and residuals was collected and tracked under the court’s oversight.

Peter Falk

I was really surprised to learn what my friend wanted in his will. He left almost everything to his spouse, which is lovely, but he also put some restrictions on what his extended family could access. It turns out a previous legal case involving a guardianship really shaped who he trusted to make important decisions about his health and finances. The will also gave the person handling his estate control over things like how his image is used and even any costumes related to his work. And thankfully, that person was authorized to make charitable donations as they saw fit – it’s a cause he really cared about.

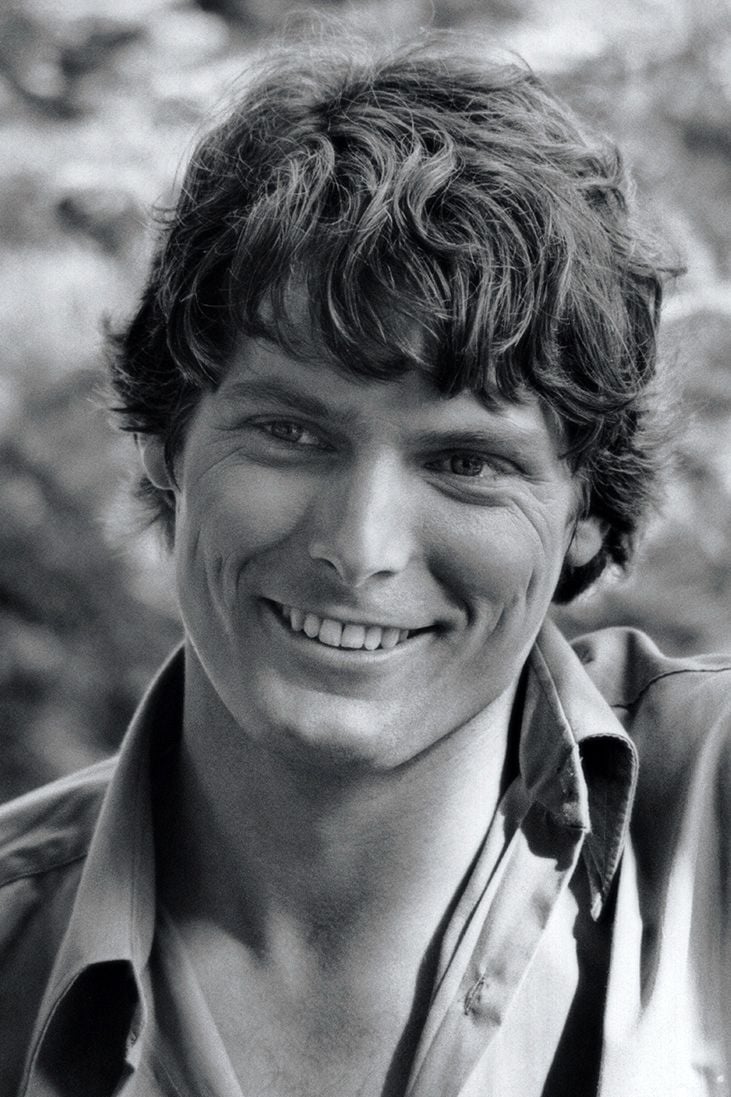

Christopher Reeve

His estate plan included trusts to financially support his wife and children. It was designed to work alongside his existing insurance policies. All income from his books and speaking engagements was managed by a single person. The plan also allowed for charitable donations, with the details decided at the trustee’s discretion.

Patrick Swayze

His will outlined how his assets would be distributed to his spouse and covered his ranch and other possessions. It also included private instructions for managing his medical records. The people handling his estate were authorized to finish any existing agreements for income from movies or music. Any collectibles or special items were to be offered to certain museums before being sold.

James Dean

When he passed away without a will, state law directed his property to his nearest relative. Later, the rights to his name and likeness proved valuable. The person managing his estate began licensing these rights for things like merchandise and photographs. The money earned from these licenses was used to pay taxes and provide funds to those who were entitled to them.

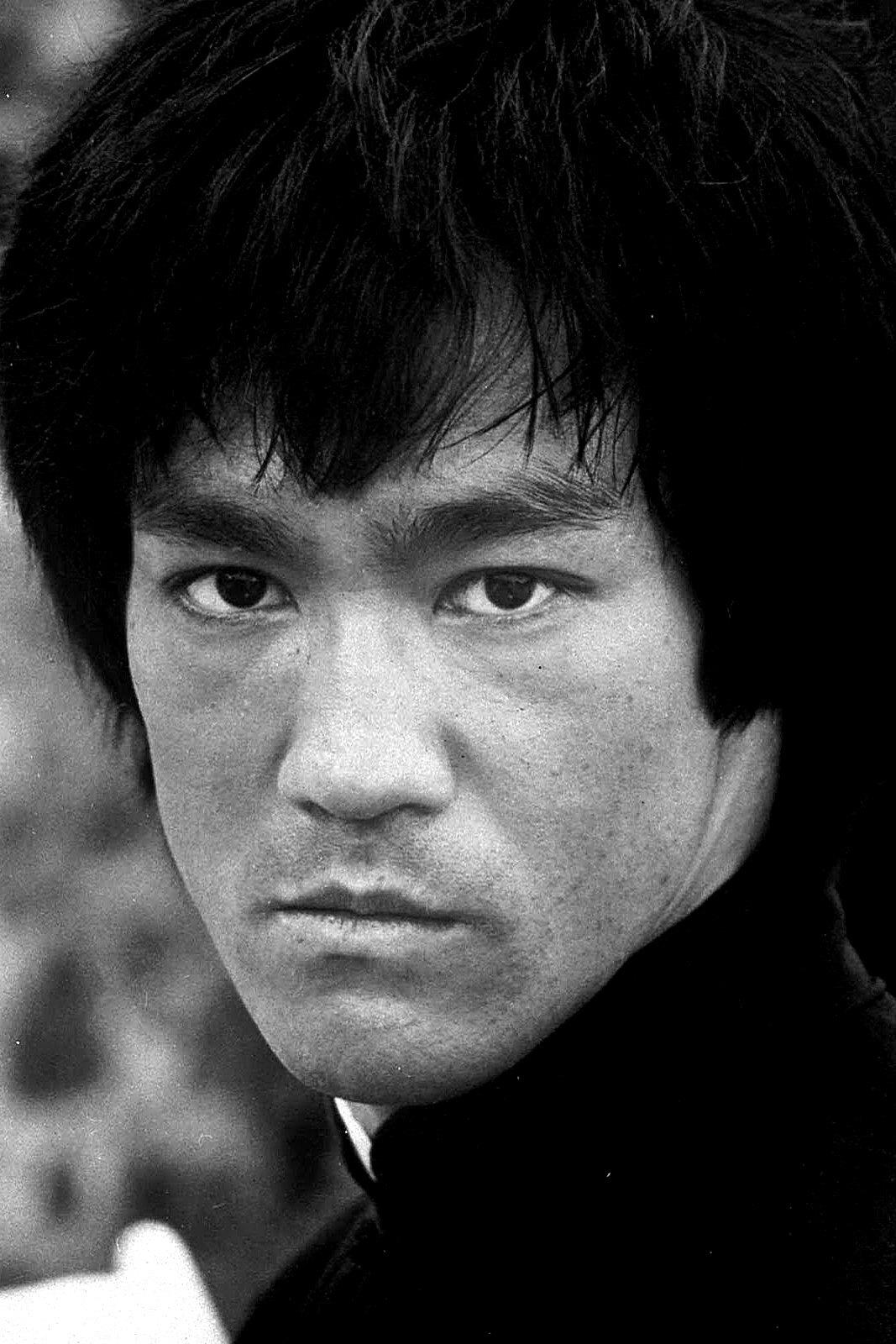

Bruce Lee

He left his possessions to his spouse, while setting up trusts to provide for his children. His estate also organized his image rights and training materials into one company. Those handling the estate worked to make licensing agreements consistent around the world, and carefully documented his personal writings and photos to keep them safe for the future.

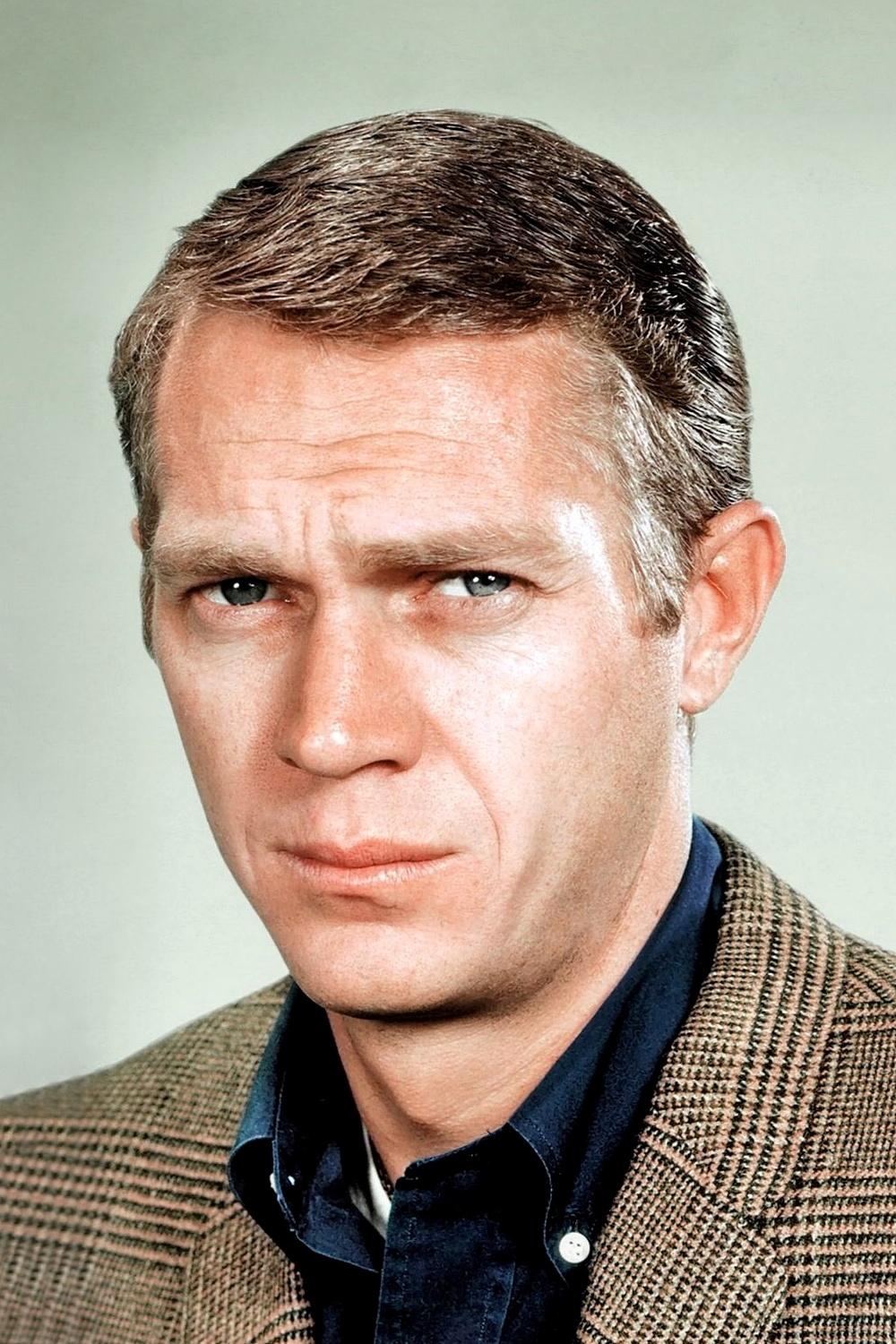

Steve McQueen

He divided his belongings between his children and also included gifts for several charities in his will. A separate list detailed his cars and racing collectibles. The people handling his estate sold off any extra items to save on storage fees. Money earned from film reruns was put into a trust for his family.

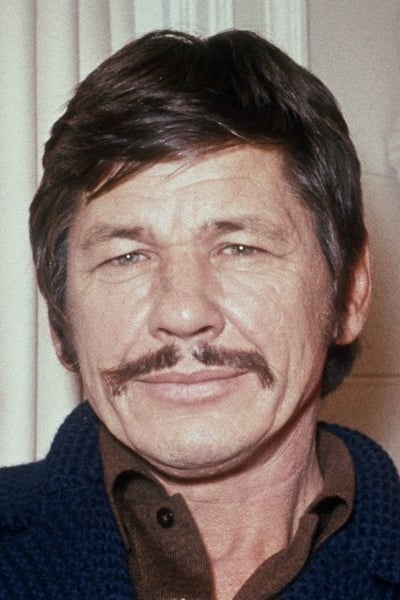

Charles Bronson

He used a trust to financially support his spouse and designated shares for his children. To ensure everything worked smoothly, he coordinated his healthcare wishes with his will. He also gave the person handling his estate clear instructions about dealing with any income from things like oil or gas rights. Finally, he made a list detailing how to divide keepsakes from his movie work.

Peter Sellers

According to his will, most of his assets went to his spouse, while his children received smaller portions. Professional trustees managed ongoing income like royalties and residuals. The will also allowed for combining accounts to make financial reporting easier, and any valuable keepsakes were assessed for their worth before being distributed.

Bela Lugosi

The bulk of his estate went to family, but his name and image became the most valuable assets later on. Arguments about who could use his image after his death significantly impacted how the estate was managed. Those in charge carefully controlled photos from his stage and film work to protect his reputation. Ultimately, legal decisions about his image set a precedent for how similar estates are handled today.

Paul Newman

His estate plan centered around charitable trusts. He directed the bulk of his assets into these trusts, outlining how they should be managed. The people in charge of the estate were given strict rules to avoid conflicts of interest and were required to report regularly. Income from trademarks related to his food and racing interests was also designated for charitable giving.

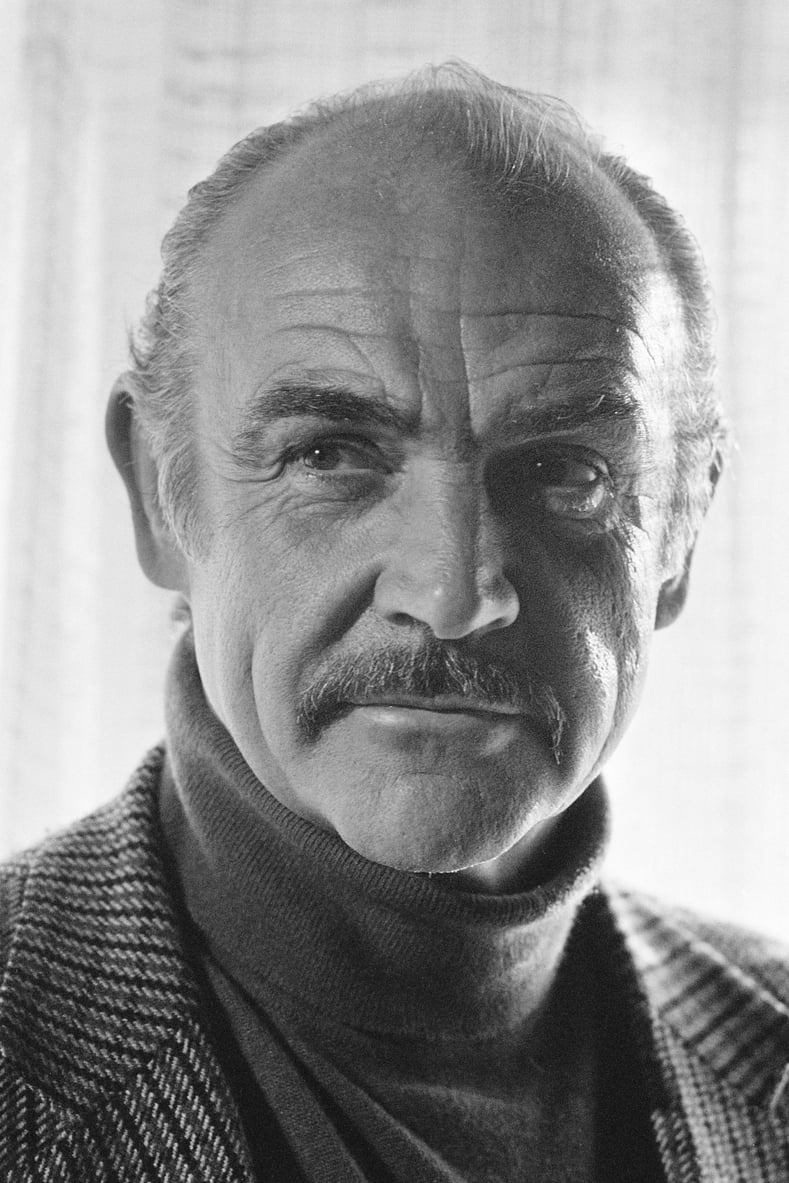

Sean Connery

His estate plan included a family trust to handle income from his work, like royalties and payments for appearances, as well as control over his public image. The people managing the estate were asked to combine all bank accounts from around the world for financial reporting and taxes. Properties located outside the U.S. were managed with the help of local lawyers in those areas. Before anything was given to his heirs, items like souvenirs and original copies of his work were professionally valued.

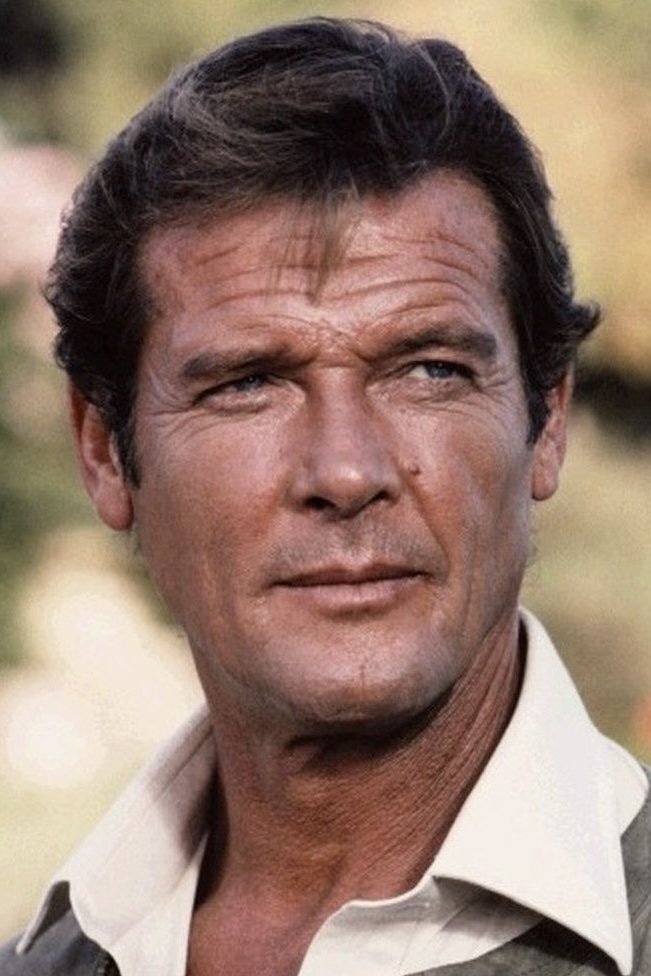

Roger Moore

He used a will and existing trusts to financially support his family. He appointed professional trustees to manage and license his image and name. After his debts and taxes were paid, he instructed that money be donated to medical charities. He also carefully documented his personal awards and costumes, and chose specific items to be given to institutions.

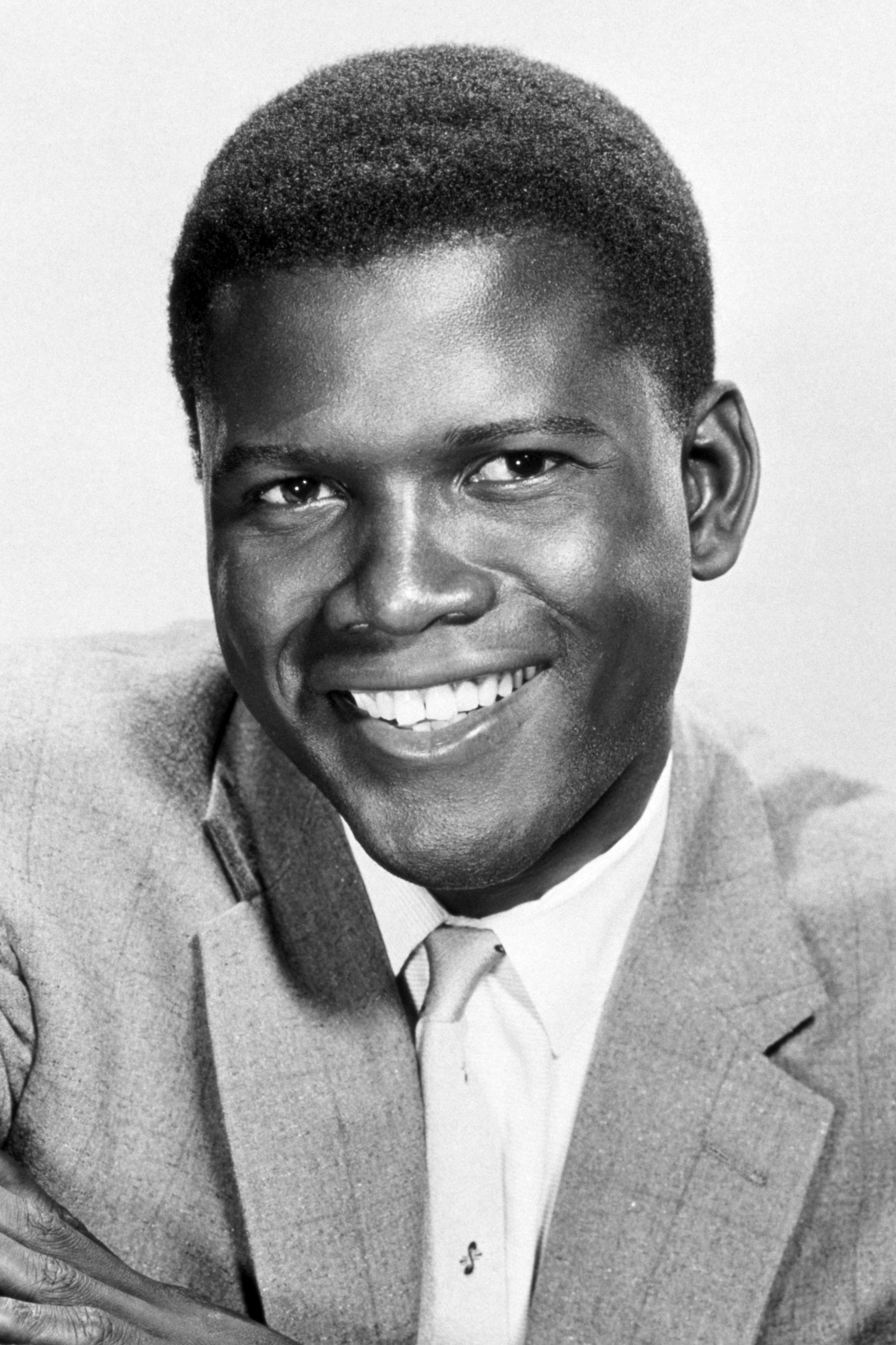

Sidney Poitier

His will provided financial support for his family, dividing assets into specific shares for his spouse and children. All rights to his writings and photos were placed under one person to handle licensing agreements. The people in charge of his estate could also approve how his image was used in films or for educational purposes. If there were disagreements about his personal belongings, they were to be settled with a separate written agreement, outside of the will itself.

Charlton Heston

Okay, so handling this film icon’s estate was… detailed. We set up everything with a will, advance healthcare directives, and a living trust to really speed things up and avoid that whole probate mess. The people handling things – the executors – got the power to manage all the income from his movies and commercials. There was also a lot of stuff that needed extra care – guns, props from films, historical pieces… we had to meticulously inventory everything and make sure it was stored super securely before anything could be transferred. And, because he was a generous guy, we set aside some money for charities he’d supported in the past – wanted to make sure his giving continued, you know?

Orson Welles

The legal documents regarding his possessions covered ongoing projects and ownership of any work he hadn’t released yet. His will allowed for arrangements with archives to safeguard his scripts, notes, and recordings. Those handling his estate were given the power to resolve disputes with anyone he’d worked with. Money earned from re-releasing or restoring his work was put into a special account to be managed separately.

Peter O’Toole

He arranged inheritances for his family and also appointed professionals to manage the estate. Money from ongoing sources, like royalties, was collected and distributed according to pre-determined percentages. The plan also included provisions to protect important papers and recordings, limiting who could access them and for how long. He allowed for the sale of properties to cover the costs and responsibilities of the trust.

Richard Burton

His will detailed how assets would be divided among his family, aligning with previous agreements from his divorce. The people managing his estate could decide whether to allow his recordings, scripts, and other works to be used in performances or preserved in archives. Before anything was sold, they were instructed to create a complete list of his books and scripts with his notes. Finally, money and bank accounts held in different countries were combined into one main estate account.

Laurence Olivier

He used a system built on trust to handle royalty payments and ownership of literary works. The will allowed museums to borrow costumes, photos, and recordings through agreements. Those managing the estate had to regularly report on money earned from licensing and related costs. Certain personal items were specifically designated to be given directly to family.

Alec Guinness

He appointed professional trustees to manage his copyrights and royalties. His will also supported the use of his archives for educational purposes through a standard lending program. Those handling his estate were authorized to create digital copies of delicate items to both protect them and make them more widely available. While his family received inheritances, a small portion of his estate was also designated for charitable giving.

Christopher Lee

He provided detailed instructions for managing income from his films, music, and books. His will authorized the executor to work with studios and record labels to handle releases. Items collected from movie and TV sets needed to be evaluated and carefully tracked. He also specified that trusted advisors, listed in the will, would handle his international taxes.

Peter Cushing

His will instructed that personal items like notebooks, photos, and letters be carefully preserved with help from an expert. Money left over was divided equally among family members. The people managing his estate could refuse requests to use his name or image if they thought it would harm his reputation. They were also allowed to sell any duplicate collectibles to save on storage fees.

Gregory Peck

He set up a trust as part of his estate plan to provide for future generations. The people managing his estate were authorized to handle ongoing income from his work and retirement funds. He also provided instructions for what to do with his awards and recognitions – whether to display them or donate them. The trust required yearly financial reports to be sent to those receiving income from it.

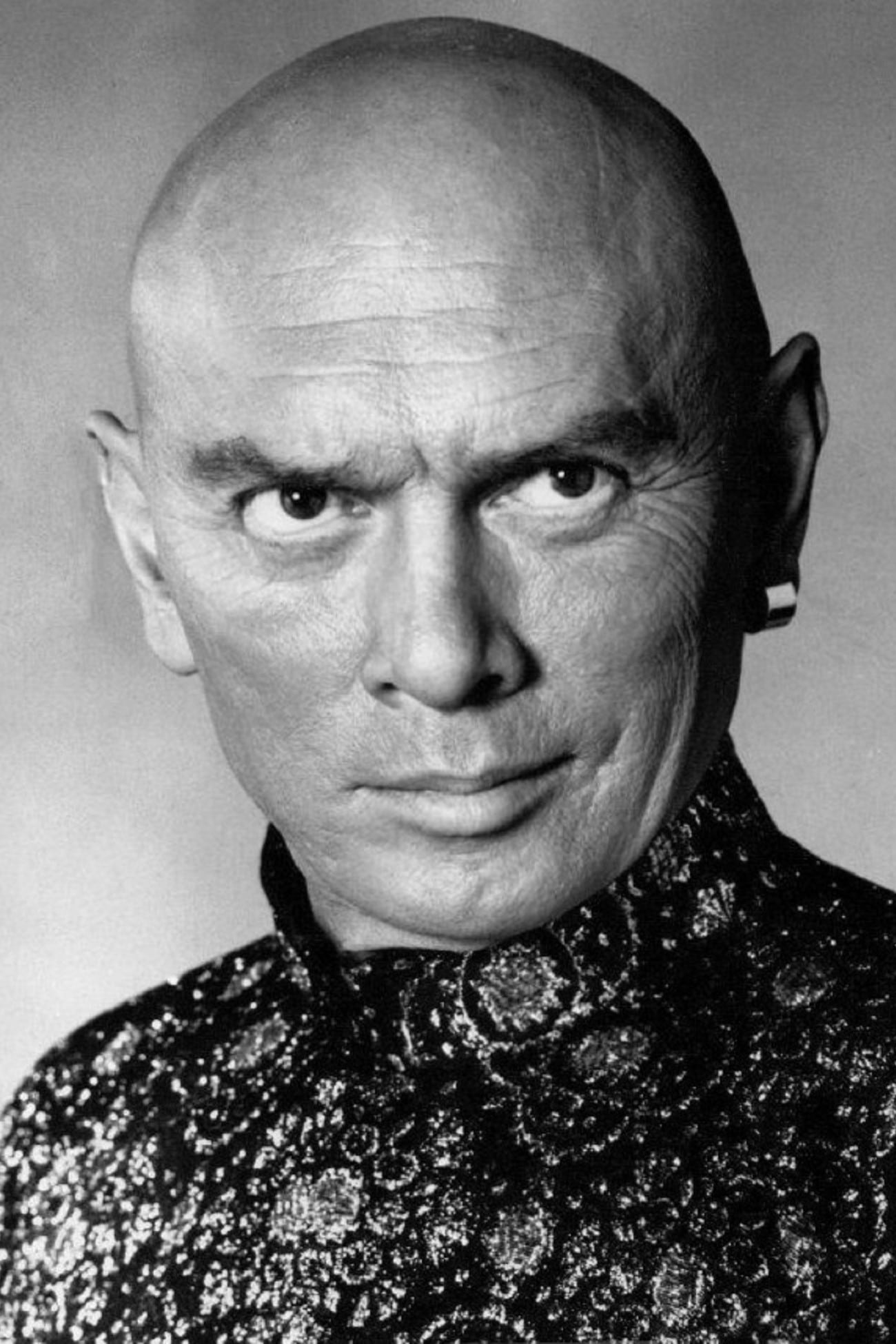

Yul Brynner

I just finished reviewing the details of this estate, and it’s remarkably well-organized. The creator really thought ahead, consolidating all rights – stage, film, and photography – under a single licensing agency. The people handling the estate were specifically told to create standard contracts for any future exhibits or memorial shows. It’s also great to see the family will receive trust distributions at key life stages, which is a nice touch. And before anything is sold, certain costumes and props are being carefully preserved for archival collections – a smart move to protect their legacy. It’s clear a lot of thought went into protecting both the financial and artistic interests here.

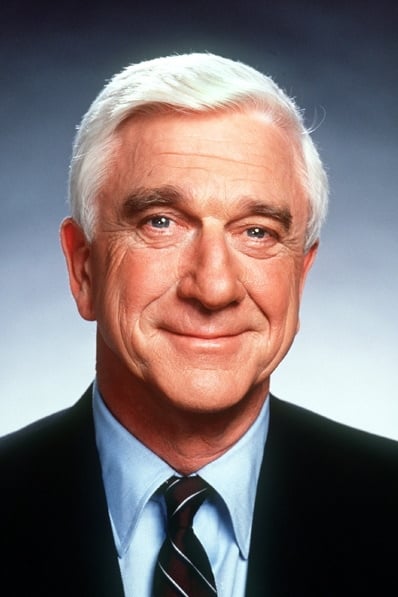

Leslie Nielsen

He used a living trust, with a will attached to catch any assets not already in the trust. All income from various sources was combined for simpler payments and record-keeping. The people handling his estate had the freedom to allow the use of behind-the-scenes footage and materials. His comedy props and scripts were carefully listed and then given to those specified in his instructions.

Oliver Reed

As a huge fan, I’ve been looking into how his estate is being handled, and it’s actually pretty smart. He made sure his family would be taken care of, but also put professionals in charge of handling all the money coming in from around the world. The will also allows them to settle any debts he had from unfinished projects or appearances. What’s really cool is that the people handling things can still let others use his image and voice, but they have to make sure it’s done with quality and respect. Finally, they’re able to sell any properties he owned to cover debts, taxes, and to make sure the trust funds are properly funded. It all seems very well thought out.

Share your thoughts on which of these estate plans surprised you the most in the comments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Banks & Shadows: A 2026 Outlook

- The Best Actors Who Have Played Hamlet, Ranked

2025-10-20 18:19