Once upon a time, in the land of sugary excess and indulgent capitalism, there stood a doughnut empire that had mastered the art of glazing not just pastries but also its balance sheets. Krispy Kreme, that venerable purveyor of circular delight, now finds itself embroiled in a saga more bitter than sweet. Its stock, which once soared like an overinflated soufflé, has fallen victim to the cruel whims of fortune, tumbling precipitously—a 77% decline from its zenith in 2022. Yet, as any historian of business might note with a sardonic smile, every great fall is preceded by an even greater rise.

Ah, the eternal question: when should one buy the dip? For those unfamiliar with this peculiar phrase, it refers to the act of purchasing shares at their lowest ebb, hoping they will rebound like a well-kneaded dough. It is a gambit as old as commerce itself, beloved by speculators and reviled by cautious investors alike. But beware, dear reader, for not all dips are created equal. To quote the immortal wisdom of Ostap Bender, “A fool and his money are soon parted, but only if the fool believes he’s found a bargain.”

The Anatomy of a Sugar-Coated Empire

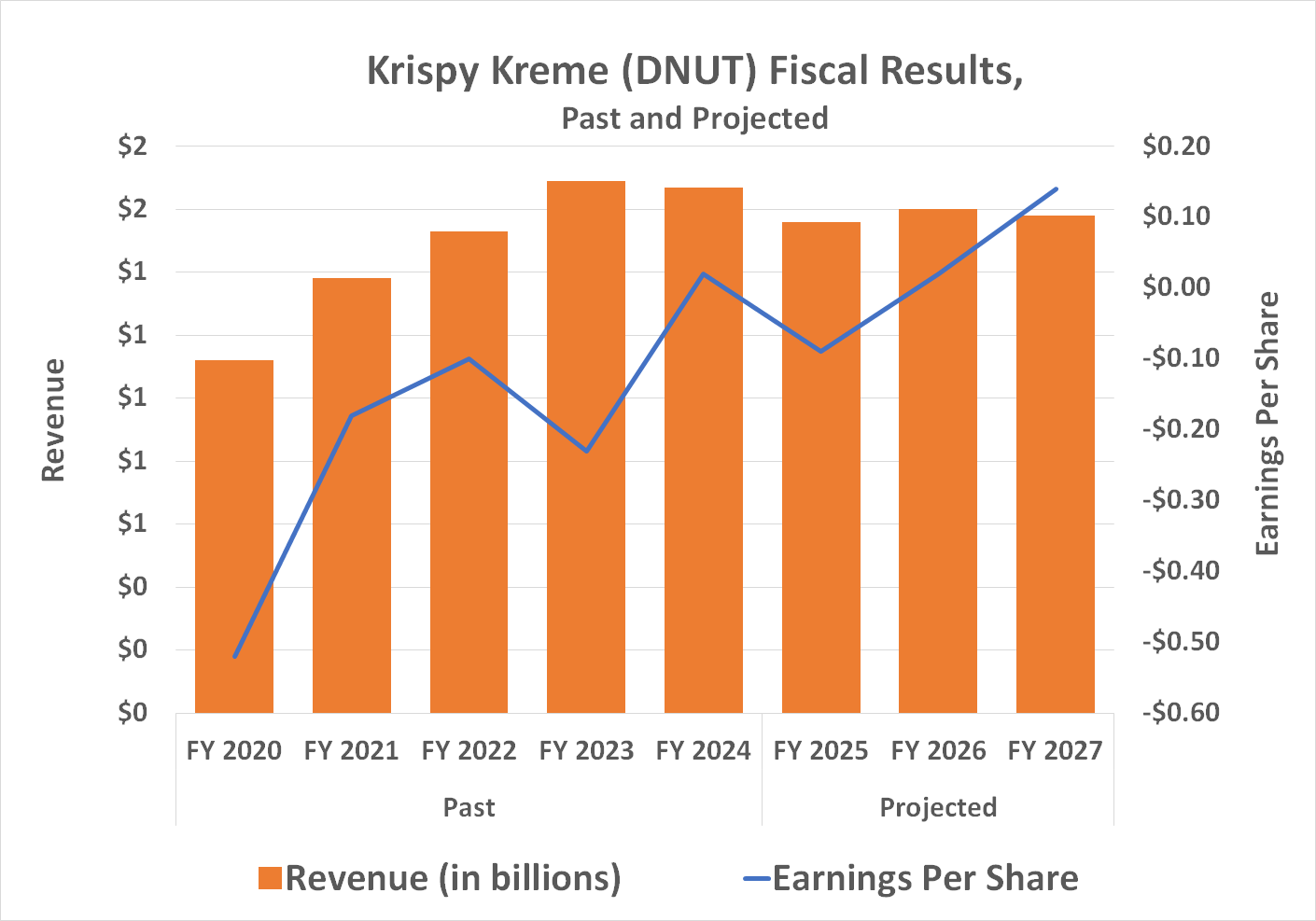

Krispy Kreme, that darling of American confectionery culture, peddles its wares through thousands of outlets worldwide. From humble grocery aisles to gleaming flagship stores where freshly baked rings of joy are served piping hot, the company has built a legacy on satisfying humanity’s insatiable craving for sugar. Last year alone, it raked in $1.66 billion—a figure so delectable one might mistake it for calorie count rather than revenue.

And yet, beneath this veneer of sweetness lies a tale fraught with drama worthy of a Shakespearean tragedy—or perhaps a vaudevillian farce. Consider the ill-fated dalliance between Krispy Kreme and McDonald’s. What began as a promising partnership dissolved into acrimony earlier this year, leaving behind little more than crumbs. While no one knows precisely how much this severance cost Krispy Kreme, we can safely assume it was substantial, given McDonald’s global reach. After all, losing a customer base larger than the population of several small countries is rarely inconsequential.

But wait—there’s more! Like a baker who cannot resist adding another dollop of frosting, Krispy Kreme has layered misstep upon misstep. The decision to slash dividend payments hardly inspires confidence, nor does the divestiture of its stake in Insomnia Cookies last year. Meanwhile, health-conscious consumers have turned their backs on the very indulgences Krispy Kreme specializes in, seeking instead salads and quinoa bowls to shed the pounds acquired during the pandemic years.

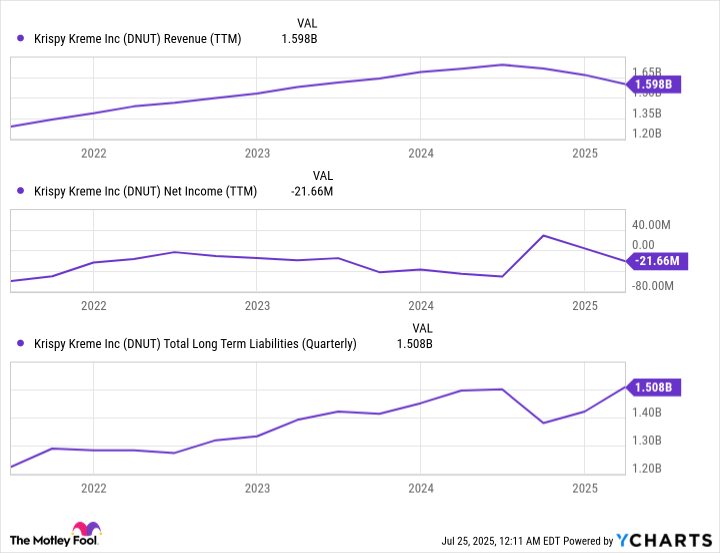

Then there is the matter of debt—a veritable mountain of obligations weighing heavily on the company’s shoulders. As of the first quarter of 2025, Krispy Kreme carried $1.5 billion in long-term liabilities, a sum that would make even the most jaded financier blanch. Compare this to the mere $1 billion it owed four years ago, before the coronavirus pandemic sent the world spinning into chaos. One might say that Krispy Kreme, like many businesses, feasted too heartily during the feast and now starves during the famine.

Yet, amid these tribulations, the company dreams of expansion. To achieve this lofty goal, it must first shed some of its burdensome weight, metaphorically speaking. Deleveraging is the new mantra, whispered fervently in boardrooms across corporate America. But as any seasoned observer of financial follies will tell you, transforming oneself while simultaneously shrinking certain operations is akin to performing surgery without anesthesia—it sounds impressive, but the patient may not survive.

Enough Reasons to Pause—and Ponder

So, is Krispy Kreme a worthy investment after its dramatic sell-off? Alas, the answer is as clear as molasses in January. Analysts predict continued losses for the foreseeable future, thanks to a combination of failed partnerships, mounting debt, and the costly transition to outsourced logistics. Outsourcing, mind you, is often touted as a panacea for inefficiency, yet it invariably introduces new expenses. Third-party delivery services, after all, do not operate out of altruism; they demand their pound of flesh (or perhaps a box of glazed doughnuts).

Furthermore, Krispy Kreme’s recent declarations about fostering a “performance-based culture” and allocating capital to high-return investments sound noble enough. But scratch beneath the surface, and you’ll find thinly veiled euphemisms for cuts and compromises. Initiatives deemed less profitable may languish unattended, much like forgotten dough left to harden on the counter.

And let us not forget the curious phenomenon of meme stocks—a modern twist on the age-old art of market manipulation. These are shares propelled by the collective enthusiasm (or disdain) of online traders armed with clever memes and boundless optimism. While such antics can temporarily inflate prices, they are as reliable as a chocolate fountain at a wedding—impressive at first glance, but prone to clogging unexpectedly.

Not Now, Perhaps Later

In summary, dear reader, Krispy Kreme presents neither a compelling opportunity nor a cautionary tale—merely a perplexing blend of both. Its struggles are real, its prospects uncertain, and its status as a meme stock adds an element of unpredictability that few rational investors would welcome. There are far safer harbors in which to anchor your savings.

Still, one must admire the audacity of attempting to reinvent oneself. Many companies, faced with similar challenges, would cling desperately to the status quo, fearing change like sailors fear storms. In two or three years, when analysts predict Krispy Kreme may finally return to profitability, it could be fascinating to revisit this chapter in its history. Until then, tread carefully, for the road ahead is paved with both sugar and thorns. 🍩

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Why Nio Stock Skyrocketed Today

- Games That Faced Bans in Countries Over Political Themes

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

2025-07-28 09:02