Y’all ain’t seen nothin’ ‘til you’ve witnessed a South Korean exchange’s XRP/KRW pair bein’ gutted by a relentless algorithm, dancin’ the 24/7 sellin’ jig for ten months straight. Crypto researcher Dom, with his peepers sharper than a hawk’s, claims he’s spotted a bot so persistent, it’d make a hound dog weep. This critter’s been offloadin’ 3.3 billion XRP like it’s ridin’ a runaway train, and it’s got the market in a tizzy-kinda like a barnyard full of confused chickens.

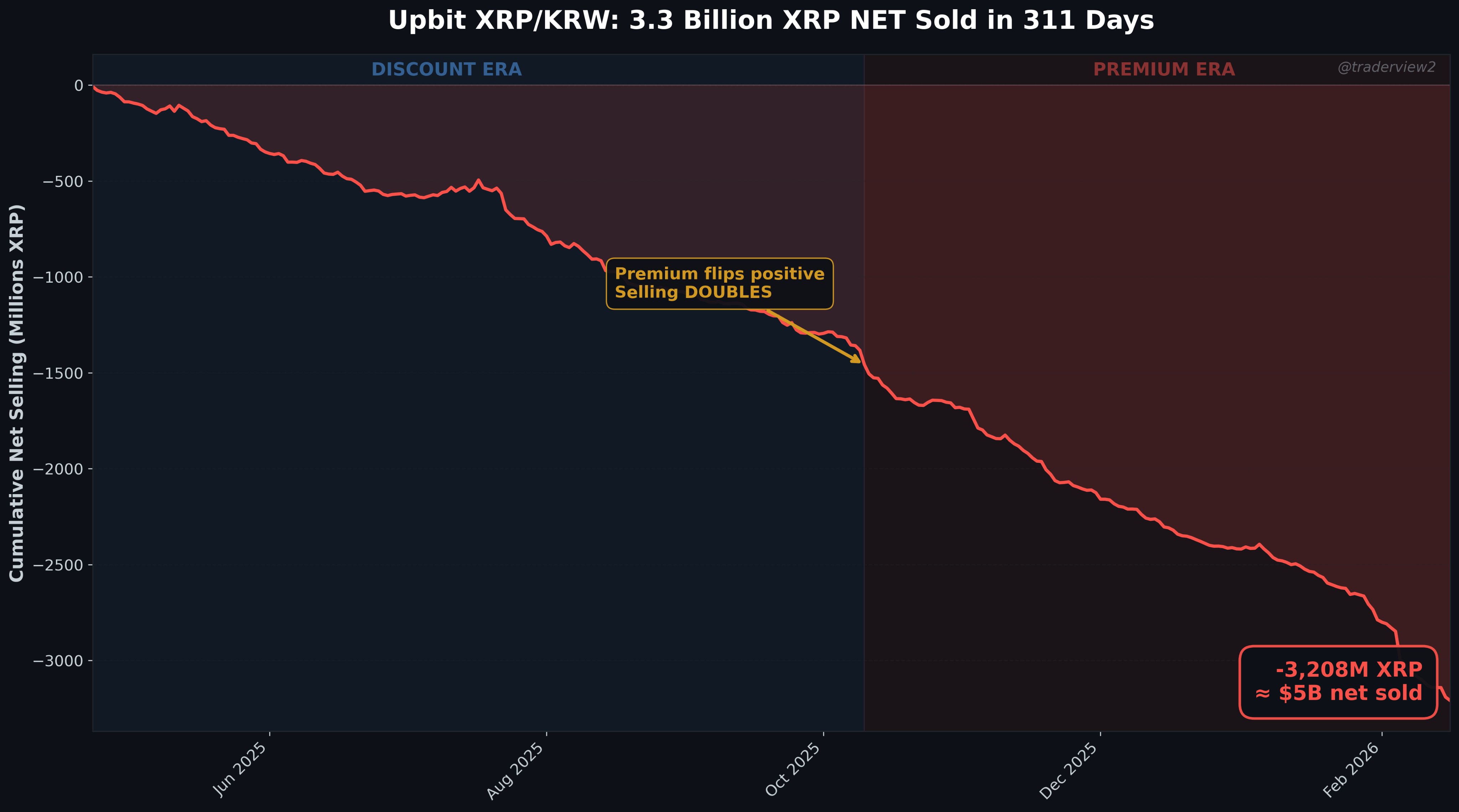

XRP/KRW Saw $5 Billion in Net Selling

Dom, with his nose to the grindstone, analyzed 82 million trades and found a “$5 billion one-directional sellin’ pipeline” runnin’ nonstop. It’s like watchin’ a man try to drink a river with a thimble-no luck, but plenty of determination. The bot, it seems, took a 33-second break once, probably to sip on a cup of coffee and check its emails.

“It looked insane,” Dom wrote, describin’ a -57M XRP cumulative volume delta over 17 hours. “So I ran forensic queries-bot fingerprintin’, iceberg detection, wash trade checks. The sellin’ was real. Algorithmic. 61% of trades fired within 10ms.” Sounds like a bot with more nerve than a rattlesnake and more speed than a caffeinated squirrel.

Instead of callin’ it an outlier, Dom zoomed out and found it matched a longer pattern. “-57M ain’t no fluke,” he said, listin’ months with massive net sellin’: “Apr: -165M,” “Jul: -197M,” “Oct: -382M,” and “Jan: -370M.” In total, he reckons it’s 3.3 BILLION XRP-enough to fill a cargo ship and then some.

Dom argued the flow’s unusually consistent. “Only 1 week outta 46 was positive. One,” he wrote. “No weekday/weekend distinction. No time of day where buyin’ outweighs sellin’.” It’s not a trader-it’s a machine, workin’ round the clock like a miller in a windstorm.

A key part of the thread? Cross-venue comparison. Dom said Binance’s XRP/USDT market showed “2-5x less sellin’ pressure.” Imagine a man tryin’ to sell a pig in a python’s den-no one’s interested. “Binance was net positive while Upbit bled -218M,” he wrote. Talk about a lopsided dance.

He also flagged a weak relationship between the two venues’ flow, claimin’ “hourly correlation is only 0.37.” That’s like two people talkin’ different languages-no wonder the market’s confused.

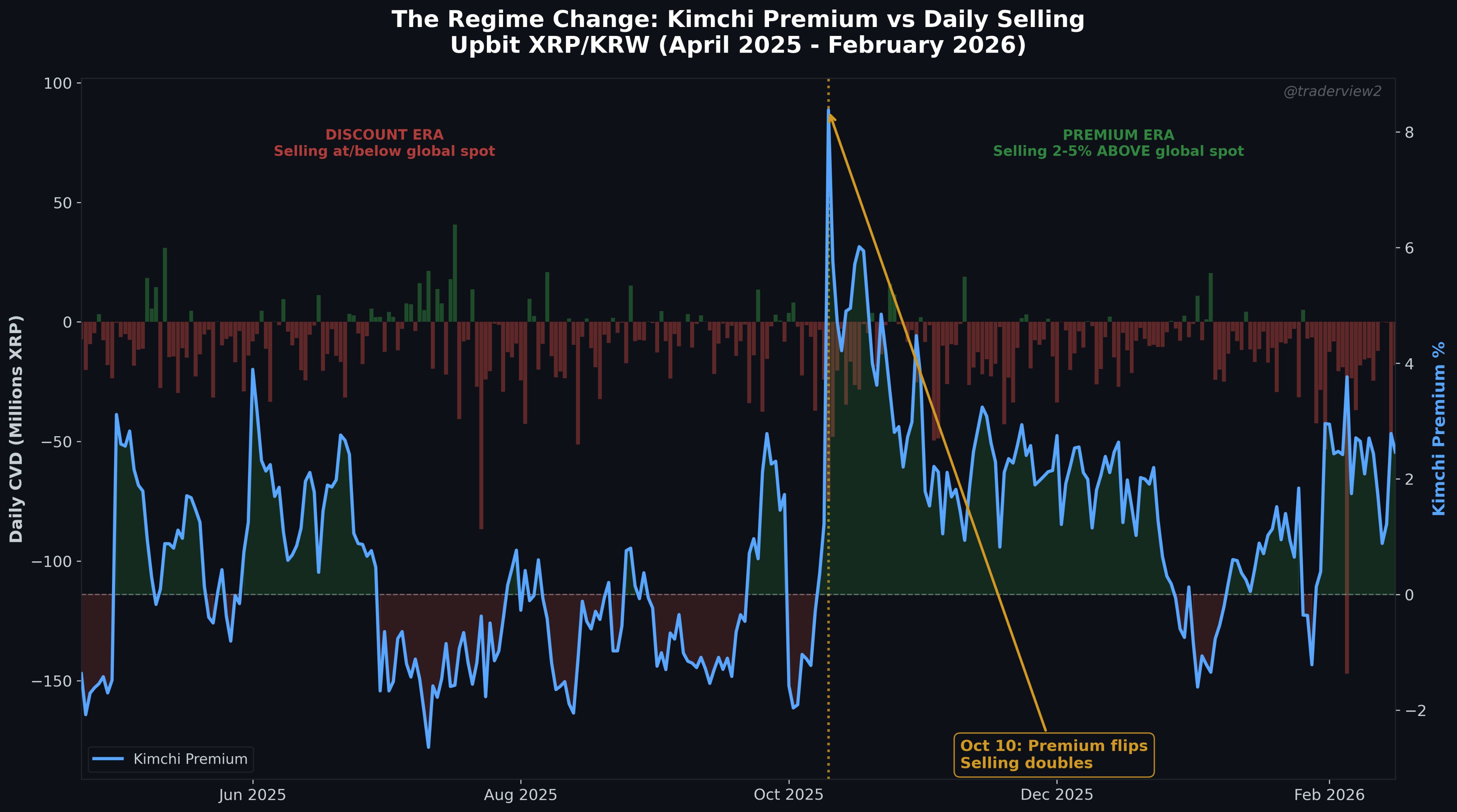

XRP Traded Cheaper In Korea For Months

Dom’s pricing observations added another layer. From April through September, Upbit XRP traded “3-6% BELOW Binance,” callin’ it a “reverse Kimchi discount.” It’s like the Koreans got the short end of the stick, acceptin’ worse deals than the rest of the world. “They don’t care about the price,” Dom wrote. “They need KRW, are mandated to use Upbit, and/or are Korean holders takin’ profit…” Sounds like a man with a suitcase full of cash, no time for fancy talk.

“The sellers were acceptin’ 6% worse fills than available on global markets, for many months,” Dom wrote. “They don’t care about the price. They need KRW…” It’s like a man sellin’ his soul for a dollar-no regrets, just a quick deal.

He then pointed to a structural break around Oct. 10. “Korean retail went insane. Premium flipped from -0.07% to +2.4% in a single day. Trades 5x’d to 832K,” Dom wrote. “And the sellers? They doubled their daily rate. From -6.3M/day to -11.2M/day.” Talk about a bot with more grit than a mule.

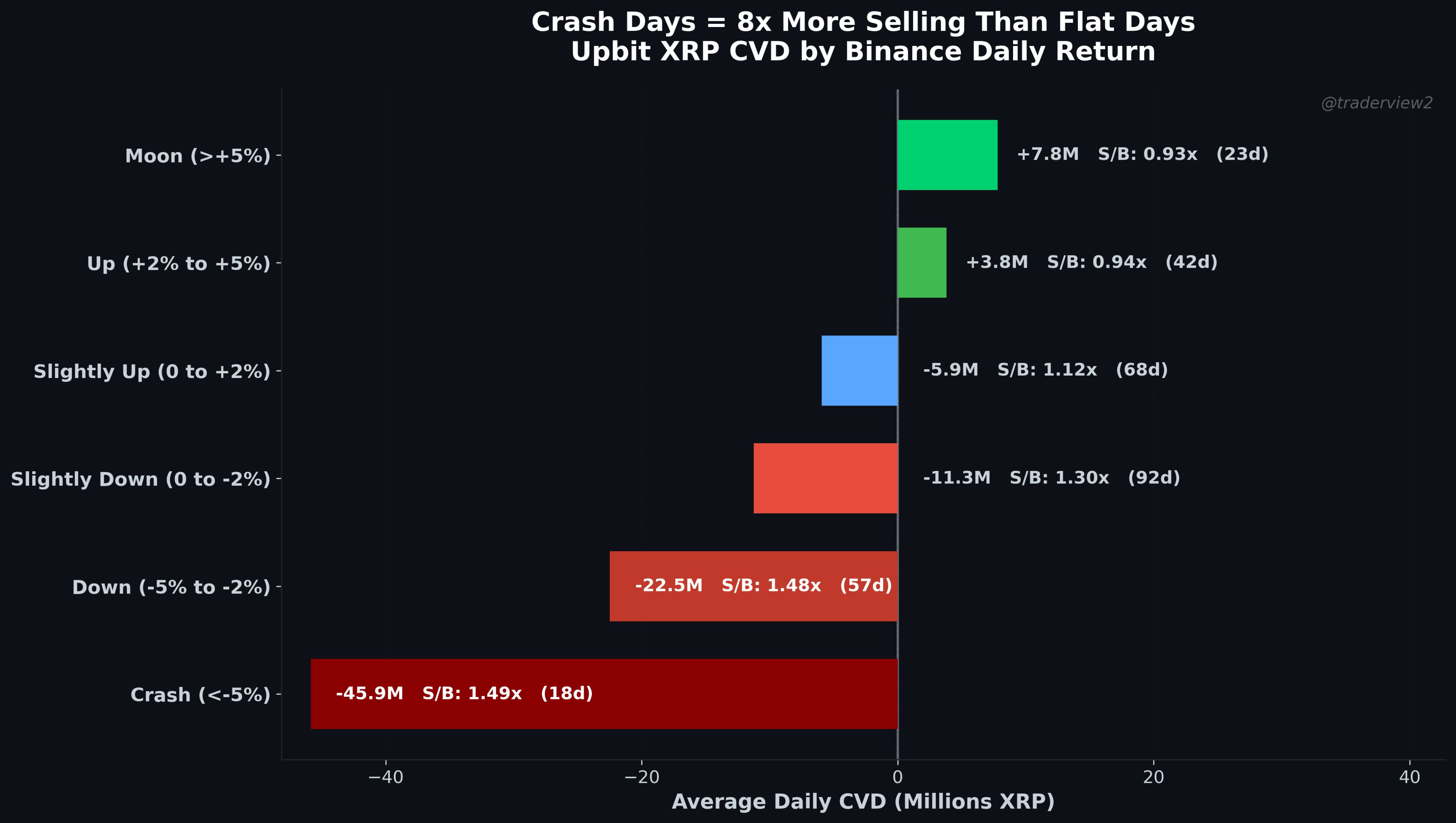

Dom tried to connect that behavior to market regimes, “bucket[in’] every day by what XRP did on Binance globally.” It’s like a man tryin’ to read the stars to predict the weather-no guarantee, but plenty of guesswork.

He summarized the dynamic as feedback between a systematic seller and retail behavior: “On moon days, Korean retail becomes a NET BUYER. They’re accumulatin’,” he wrote. “On crash days, sell intensity is 8x heavier. The systematic seller + retail panic amplify each other.” It’s like a dance between a ghost and a ghost-no one’s in control, but the show goes on.

To support the “machine versus retail” framing, Dom contrasted order-size fingerprints. He claimed the sell side used round-number clips-“10, 50, 100, 500, 1000 XRP”-with “57-60% of all trades fire within 10ms,” while the buy side showed “tiny fractional sizes.” It’s like a bot with a calculator and a retail customer with a pocket watch-no match.

The scale claim is also central to why the thread traveled. Dom said “3.3 billion XRP” represents “5.4% of XRP’s entire circulating supply,” moved through “a single trading pair, on a single exchange, in 10 months.” It’s like a man dumpin’ a treasure chest into a river-no one’s sure why, but it’s a sight to behold.

Dom stopped short of namin’ a specific entity behind the sellin’, instead askin’ a question he framed as the next investigative step: who can sustain “300-400M per month for a year straight,” seemingly “doesn’t care about 6% discounts,” and “needs KRW specifically or is in some walled garden and can only use Upbit?” It’s like askin’ a magician to reveal their secrets-no one’s that generous.

At press time, XRP traded at $1.45. A price so low, it’s like a man beggin’ for change in a world of gold.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Hulk Hogan Dead at 71: Wrestling Legend and Cultural Icon Passes Away

2026-02-18 11:30