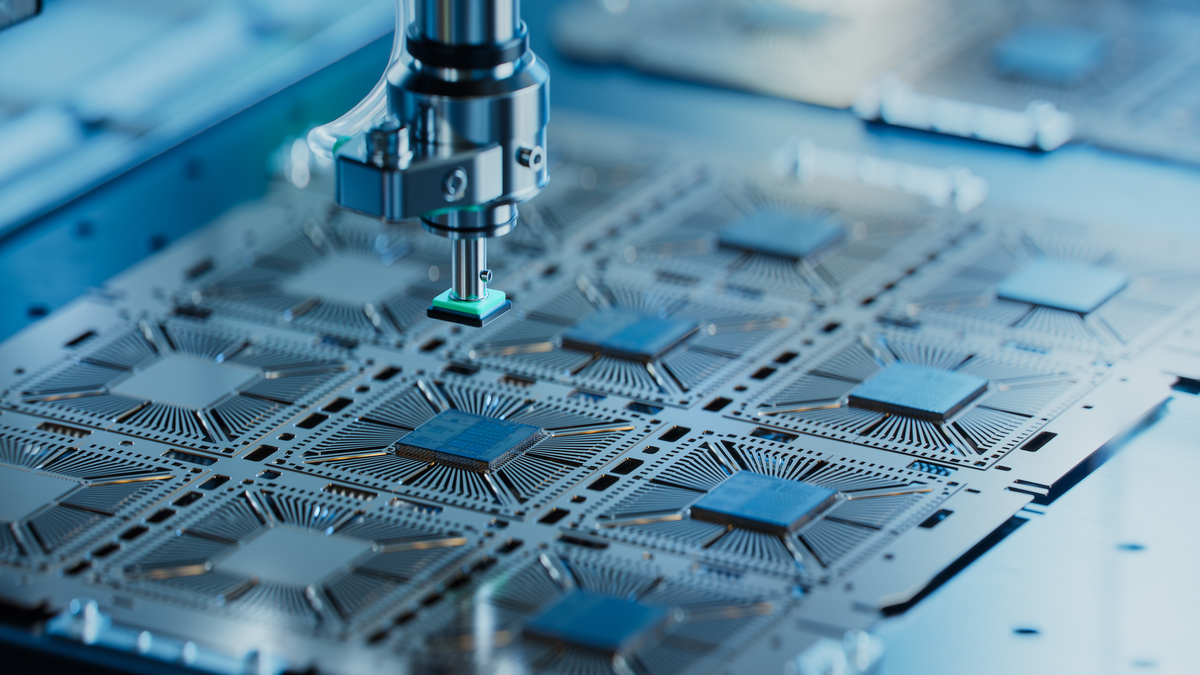

So, KLA Corp (KLAC +9.01%) is up. Nine-point-zero-one percent. Nine! It’s just…excessive. Apparently, Taiwan Semiconductor Manufacturing Company (TSM +5.17%) had a good quarter. A good quarter. Like they planned it. And now everyone’s supposed to be thrilled? I mean, TSMC earned $2.98 a share. Fine. $32.7 billion in sales. Okay. But the fanfare! It’s always the fanfare. They’re forecasting “strong demand” for their chips. “Strong demand!” What does that even mean? It’s marketing speak, that’s what it is. And now KLA, who makes the equipment to make the chips, gets a boost? It’s a house of cards, I tell you. A house of cards.

And then Wells Fargo, of all places, upgrades KLA. Joseph Quatrochi, that’s the analyst. Quatrochi. Sounds like a pasta dish. He thinks demand for these 2-nanometer chips is going to explode in 2026. Explode! Like it’s some sort of…firework display. They’re just starting on these 2nm things, and suddenly everyone’s anticipating a windfall? It’s preposterous. He says 63% of TSMC’s shipments are these 5nm and 3nm chips. 63%! That’s a suspiciously round number. And Intel, apparently, is “increasing process control intensity.” What does that even mean? It sounds like they’re trying to sound important. Like they’re suddenly doing things with…intensity.

Look, the numbers. Quatrochi predicts $12.7 billion in revenue for KLA in 2025, growing to $14.1 billion in 2026 and $15.7 billion in 2027. Eleven percent growth. It’s…acceptable. Earnings are projected to grow 13%. Fine. But here’s the thing. The stock is trading at 45 times earnings. Forty-five! That’s…a lot. Even if they hit these growth targets, paying 45 times earnings for 13% growth? It’s a stretch. A significant stretch. They call it a PEG ratio. It’s more than 3. More than 3! It’s just…irresponsible. It’s like they’re daring you to find a flaw. And I will. I always find a flaw.

So, everyone’s getting excited about KLA. The analysts, the investors, the people who probably haven’t even looked at a semiconductor in their life. And I’m sitting here, thinking, “This feels…wrong.” It’s a gut feeling. A perfectly reasonable gut feeling. And you know what? I’m going to trust my gut. KLA stock is a sell. A definite sell. I just…I can’t be a part of this. It’s just…too much.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- USD PHP PREDICTION

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2026-01-15 21:42