As an analyst with over two decades of experience in financial markets, I have witnessed the rise and fall of many economic giants. The current debate between Bitcoin and the U.S. dollar, particularly under President Trump’s administration, is an intriguing development that I find myself closely observing.

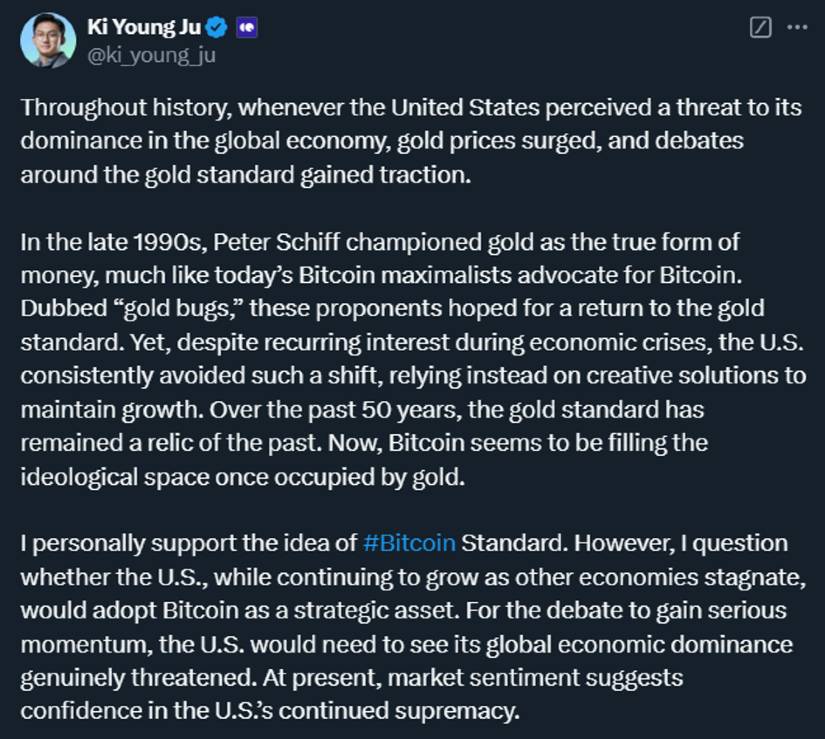

Ki Young Ju’s insights on Bitcoin being a hedge against financial collapse are compelling, but his caution about the digital currency’s potential as a strategic reserve asset due to the U.S. dollar’s dominance resonates with me. I have seen similar patterns in the past; gold’s appreciation during times of economic uncertainty is a testament to this trend.

However, it’s important to remember that political rhetoric often plays a significant role in shaping public perception and policy decisions. Trump’s pro-Bitcoin stance may indeed be more about politics than conviction, as suggested by analysts like Ju. The focus on U.S. economic dominance could potentially clash with the promotion of a decentralized asset seen as a threat to the dollar’s dominance.

Stablecoins, on the other hand, seem to be gaining traction as they bridge traditional finance and blockchain technology. Their utility, particularly in countries experiencing hyperinflation, is undeniable. However, whether they can truly challenge Bitcoin’s position remains to be seen.

In a world where political maneuvers often dictate economic policies, it’s hard not to see Trump’s pro-Bitcoin statements as a political ploy rather than a definitive policy direction. But then again, who would have thought that we’d be discussing the potential of a digital currency in the White House in the first place? It reminds me of the old joke: “They laughed when I sat down at the piano, but when I started to play, they came flocking from all over town.”

As we continue to watch this fascinating interplay between Bitcoin and the U.S. dollar, one thing is certain—the answer to whether Bitcoin can coexist with or challenge the dollar’s supremacy under Trump’s administration is indeed tied to the evolving dynamics of global finance. And as an analyst, I can’t wait to see how this unfolds!

Although Trump has advocated for supportive cryptocurrency policies, such as the concept of a national Bitcoin reserve, experts in the field are skeptical about the practicality of these proposals.

Bitcoin vs. Dollar Supremacy

As per Ki Young Ju, CEO of CryptoQuant, the stance of the U.S. government towards Bitcoin is significantly linked to the nation’s dominance of the dollar. He explains that Bitcoin, often referred to as “digital gold,” tends to flourish during periods of economic instability. Historically, the value of gold would increase whenever there was a perceived issue with the U.S. economy. However, today, Bitcoin is increasingly seen as a protective asset against both inflation and financial collapse.

As a crypto investor, I understand the significance of the U.S. dollar as a global safe-haven asset. It seems that as long as this status persists, the concept of Bitcoin serving as a strategic reserve asset might remain elusive.

He mentioned that in growing economies experiencing a rapid decrease in the value of their local currency, there is a greater preference for U.S. dollars rather than Bitcoin or gold.

The Political Rhetoric Behind Pro-Bitcoin Policies

Trump’s election campaign hinted at the adoption of Bitcoin as part of a forward-thinking monetary strategy for the United States. However, experts such as Ju believe that these proposals might stem from political motives rather than genuine conviction.

Essentially, Trump’s speeches emphasized American financial supremacy, which might clash with the advocacy of a decentralized asset perceived as challenging the dollar’s hegemony.

Ju believes that if preserving the U.S. dollar’s dominance is a top priority for the administration, then policies favorable to Bitcoin might be sidelined or delayed.

Stablecoins: Extending Dollar Dominance

In simpler terms, Bitcoin might encounter obstacles, but digital currencies tied to the dollar (such as stablecoins) are growing in importance as they serve as a link between conventional banking and cryptocurrency. The CEO of Paxos, Charles Cascarilla, recently emphasized how crucial stablecoins are for maintaining the usefulness of the US dollar within blockchain systems. At a recent international gathering, he explained that stablecoins allow the swiftness and global reach of the internet to be applied to traditional currencies, making them essential in the digital economy based on blockchain technology.

Stablecoins are popular in countries experiencing high inflation, such as Turkey, which had an inflation rate of 67% for its lira in March 2024. As reported by Chainalysis, over half of the digital asset transactions in Latin America involve stablecoins, showcasing the increasing involvement of these regions in global financial networks.

Uncertain Prospects for Bitcoin Policies

Although Donald Trump’s positive comments about Bitcoin have been welcomed by cryptocurrency supporters, specialists advise against excessive optimism. Alex Thorn, who leads research at Galaxy Digital, noted that the American administration could potentially investigate Bitcoin-linked reserve tactics, but it’s not likely they will engage in substantial purchases.

Ju posited that if the U.S. doesn’t view Bitcoin as a critical threat to its economic supremacy, it will continue to be sidelined in national monetary strategy. His analysis of Trump’s remarks at the National Bitcoin Conference suggests they might be more about political positioning than setting clear policy guidelines.

The ongoing relationship between Bitcoin and the US Dollar attracts global attention, leading us to ponder: Will Bitcoin harmoniously exist alongside or potentially contest the dollar’s dominance during Trump’s presidency? At this moment, the response is contingent on the ever-changing landscape of international financial systems.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-30 16:06