As a seasoned analyst with over two decades of experience in financial markets, I have seen my fair share of market cycles and trends. While the recent surge in Bitcoin‘s price to $101,449 has sparked speculation about a possible top, I believe that these fears are largely unfounded and based more on personal opinion than historical data.

After Bitcoin (BTC) reached over $100,000 and set a new record high, some people have been discussing whether it has peaked for this cycle. Nevertheless, various crucial Bitcoin indicators hint that this view may be subjective rather than backed up by previous data trends.

Currently, a single Bitcoin is being traded for approximately 101,449 U.S. dollars. An examination of its on-chain activity suggests that there may be potential for further growth in the coin’s price, even after recent periods of consolidation.

Bitcoin Continues to Remain in a Bullish Phase

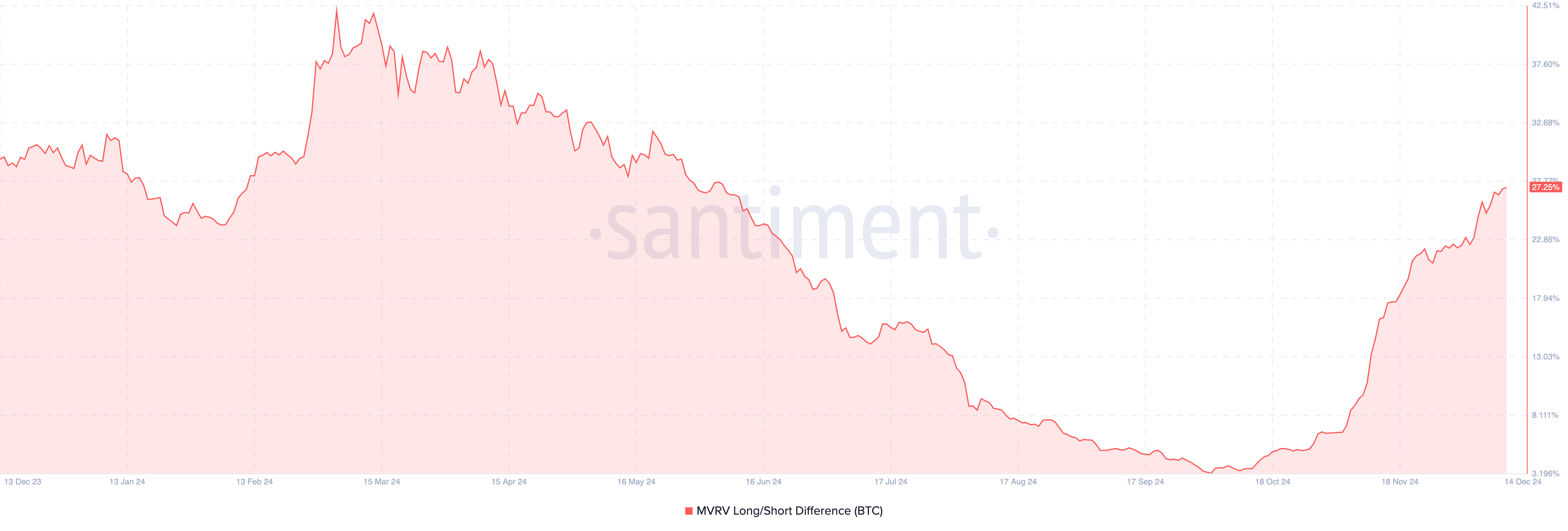

One simple rephrasing could be: The gap between Bitcoin’s Market Value to Realized Value (MVRV) long and short positions may indicate that the price of Bitcoin could rise again. This ratio has, in the past, shown when Bitcoin is in a bullish phase or if it has shifted into a bear market.

As a researcher delving into Bitcoin analysis, I’ve observed an intriguing metric: the MVRV (Memppool Value in Use) long/short difference. When this difference is positive, it suggests that long-term holders have accrued more unrealized profits than their short-term counterparts. From a price perspective, this condition typically indicates a bullish trend for Bitcoin.

Based on Santiment’s analysis, the Bitcoin MVRV long/short difference has climbed up to 27.25%, suggesting we’re in a Bitcoin bull market at the moment. Yet, it’s significantly lower than the 42.08% it reached in March, following which there was a prolonged period of consolidation and correction. Using past trends as a guide, this current state implies that Bitcoin could potentially surpass its record high before reaching the peak of this cycle.

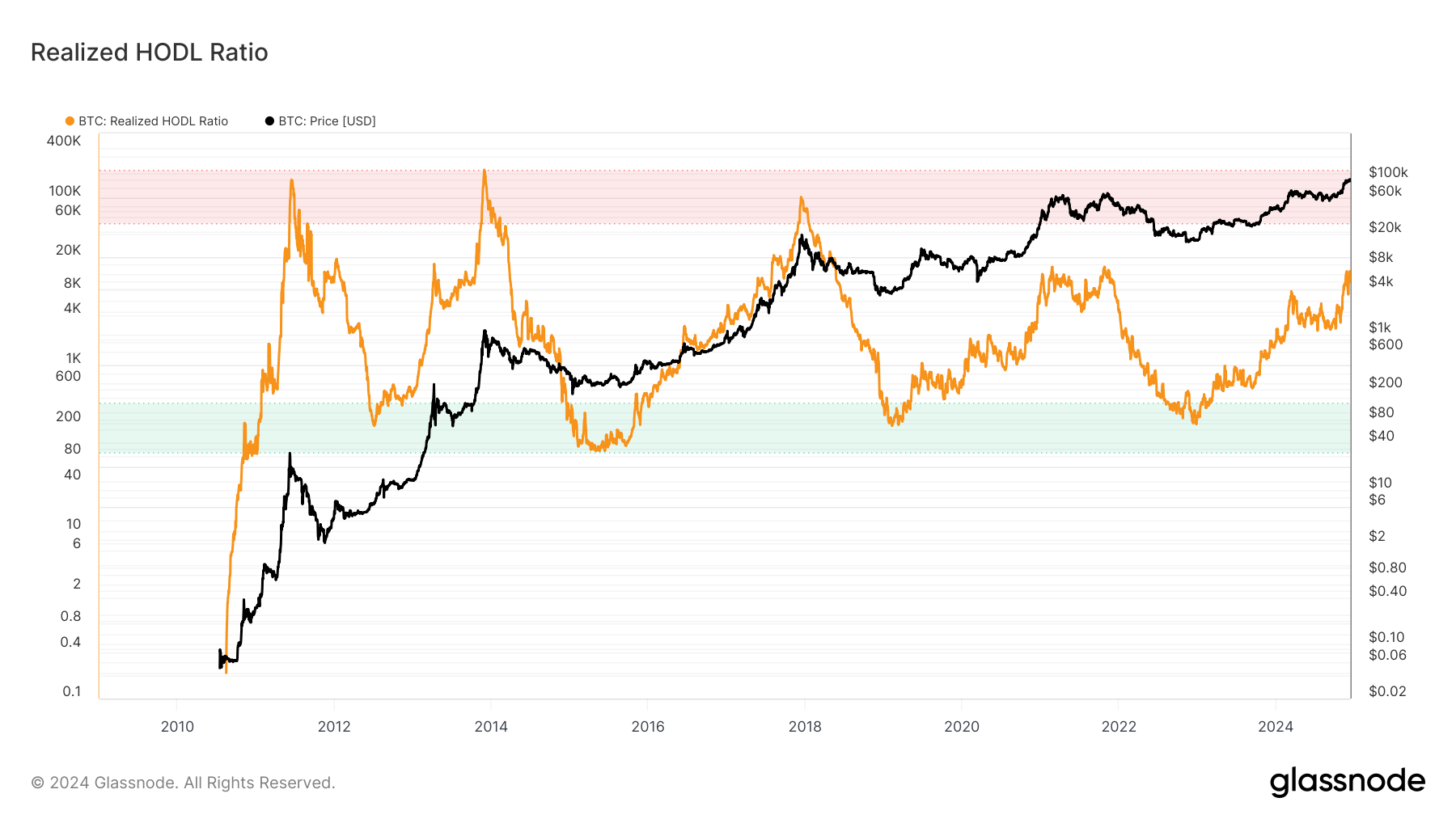

As an analyst, I find the Realized HOLD (RHODL) ratio to be another crucial Bitcoin indicator that aligns with my perspective. This RHODL ratio is a well-respected market metric used to identify potential market highs and lows in the Bitcoin market.

A high RHODL ratio typically means the market is experiencing intense short-term activity and may be overheated, potentially signaling a peak or upcoming correction. In contrast, a low RHODL ratio usually reflects robust long-term holding behavior, suggesting that the asset might be undervalued.

As a researcher, I’ve been closely examining the Bitcoin HODL Ratio data from Glassnode. Currently, the ratio is situated in the ‘green zone’, suggesting that the bottom phase for Bitcoin may have passed. However, it remains below the ‘red area’, implying that the BTC price has yet to reach its peak. If this trend persists, there’s a potential for Bitcoin to surge past its previous all-time high of $103,900.

BTC Price Prediction: Coin to Hit Higher Values

Glancing at the day-to-day graph reveals that Bitcoin seems to have shaped a ‘bull pennant’. This is a technical configuration that hints at a possible prolongation of the rising trend. The structure consists of the ‘flagpole’, representing the initial powerful surge in pricing.

At present, the upward trend reflects active buying and higher trading activity. However, this trend often leads to a period of sideways movement or even a decline close to the peak of the initial surge. This pattern is known as a “flag” and can assume either a rectangular or pennant shape, characterized by slightly lower peaks and troughs compared to the initial move.

It seems that Bitcoin has surpassed the upper limit of a flag pattern, suggesting potential growth towards approximately $112,500 in value.

If the price of Bitcoin (BTC) falls beneath the flag’s bottom line or if crucial BTC indicators shift negative, this prediction may no longer hold true. Such a scenario might lead the value to drop down to approximately $89.867.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2024-12-14 23:49