As a crypto investor, I’m excited to share that I’ve just learned about KernelDAO, a pioneering re-staking protocol, unveiling a $40 million Ecosystem Fund. This move is designed to supercharge the development of their platform and solidify their influence within the BNB Chain ecosystem, which I find quite intriguing!

Under this project, KernelDAO is demonstrating a commitment towards enhancing the realm of Decentralized Finance (DeFi) by developing robust security measures through their restaking strategies.

KernelDAO’s New Fund: What to Know

The recently established Ecosystem Fund is designed to assist developers working with KernelDAO’s staking framework. This action comes after KernelDAO successfully managed over $2 billion worth of assets spread across various blockchains, such as Ethereum and BNB Chain.

Amitej Gajjala, the CEO and Co-Founder of KernelDAO, shared with BeInCrypto that the introduction of the Ecosystem Fund marks a substantial advancement in our mission to intensify the construction of the restaking and DeFi environment on the BNB Chain. By providing developers with the tools to create projects within Kernel, we strive to foster innovation across middleware and applications that utilize restaking.

Notable venture capital companies such as Laser Digital, SCB Limited, Hypersphere Ventures, and Cypher Capital have shown interest in the Ecosystem Fund. These investors are joining forces with KernelDAO, aiming to help them establish a prominent position as the foremost re-staking infrastructure on the BNB Chain.

Bill Qian, as Chairman of Cypher Capital, emphasized the possible effects that KernelDAO’s groundbreaking method for reinvesting staked assets could have.

It’s our conviction that KernelDAO’s groundbreaking methods in reinvestment and collective security will significantly impact the development of the BNB Chain community. At Cypher Capital, we are committed to boosting cutting-edge initiatives, and KernelDAO is certainly one of them,” he expressed.

Beyond financial support, KernelDAO is reserving 5% of its total tokens for grants within its ecosystem. The purpose behind this effort is to foster rapid expansion and solidify KernelDAO’s influence in the relevant field.

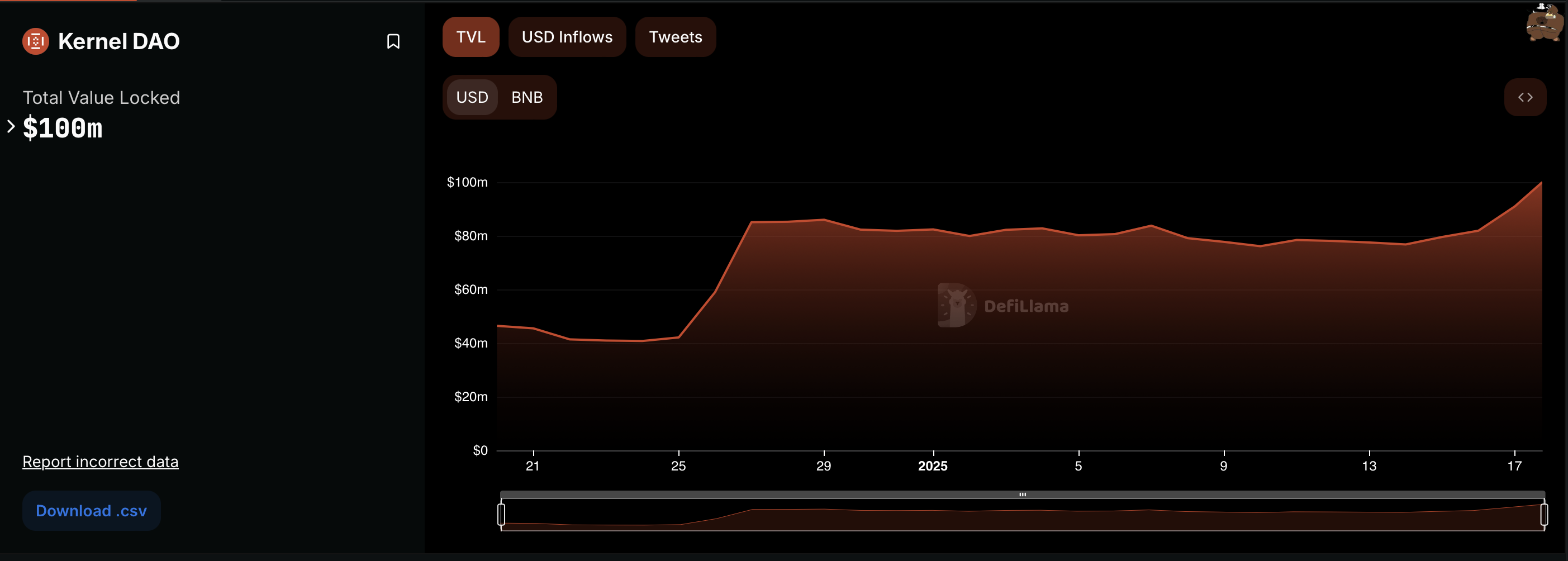

KernelDAO TVL Surpassed $100 Million

After debuting its mainnet in December 2024, KernelDAO has experienced rapid growth. Within the first week, its total value locked (TVL) reached $50 million and has since exceeded $100 million. As for Kelp, KernelDAO’s liquid restaking protocol, it currently oversees TVL worth over $2 billion, positioning itself as a significant figure in the liquid staking tokens (LST) market.

The $40 million Ecosystem Fund symbolizes a fresh phase for KernelDAO. With backing from leading investors and more than 20 Dynamic Validation Networks (DVNs), such as AI and Zero-Knowledge Proofs projects, it underscores the platform’s expanding influence within the blockchain industry.

Developers and partners can find more details about the fund on the KernelDAO website.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-01-17 19:01