Experts at JPMorgan anticipate a strong optimism towards altcoin Exchange-Traded Funds (ETFs) by the year 2025. They believe that funds focused on XRP and Solana could potentially draw an impressive $14 billion in investments.

Even though these ETFs haven’t been authorized just yet, the bank’s experts anticipate that there will be a high level of interest for these funds within the institutional investment market.

JPMorgan Bullish on Solana and XRP ETF

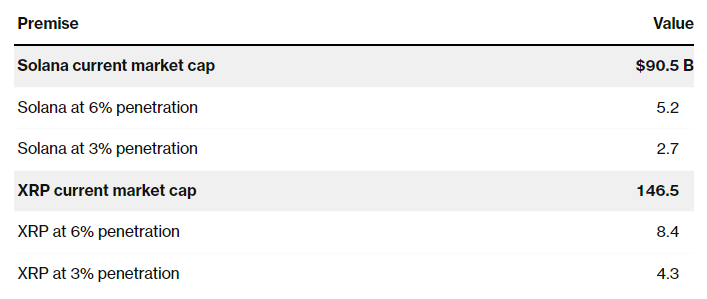

It appears that JPMorgan, one of the world’s top investment banks, expresses a positive outlook towards potential Exchange-Traded Funds (ETFs) based on XRP and Solana. In their latest analysis, JPMorgan’s experts predict that an XRP ETF could generate profits ranging from $6 to $8 billion within 6 to 12 months of its launch.

The same research stated that a Solana ETF might generate $3 to $6 billion in the same period.

The main issue at hand is still the doubt surrounding investor interest in acquiring more financial products, particularly newly launched crypto Exchange-Traded Products (ETPs), according to JPMorgan’s analyst team led by Kenneth Worthington.

The company is always vocal about significant shifts in the cryptocurrency market. For instance, last year, JPMorgan revealed sizeable Bitcoin ETF investments and aimed to pioneer the RWA tokenization sector, among other actions.

At present, neither XRP nor Solana have Exchange-Traded Funds (ETFs), but the company anticipates massive growth once they receive the necessary approval for these investments.

Brad Garlinghouse, CEO of Ripple, predicted several months back that a Exchange-Traded Fund (ETF) based on XRP was unavoidable. Although there have been some obstacles with the Securities and Exchange Commission (SEC), prominent issuers continue to pursue their applications.

In October 2024, Canary Capital and Bitwise submitted their applications, followed by WisdomTree in December. This increased interest suggests that the XRP ETF could have a greater potential, as indicated by JPMorgan.

Despite experiencing more obstacles compared to XRP, Solana ETFs continue to attract significant support from influential investors. Furthermore, predictions by Polymarket in early 2025 were highly favorable, suggesting a high probability of approval within the same year.

As a researcher examining the cryptocurrency market, I’ve noticed an optimistic stance by JPMorgan regarding the approval of altcoin ETFs. Their confidence stems from the election of Donald Trump, who, in his tenure, appointed a pro-industry Chair to lead the Securities and Exchange Commission (SEC), replacing Gary Gensler. Furthermore, he established a “crypto czar” position, aimed at advocating for the interests of our community within the government, which could potentially pave the way for ETF approvals in the future.

It’s very probable that, as the favor for cryptocurrencies grows stronger, XRP and Solana will secure ETF approval at some point in the future.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-15 02:00