If the stock market were a reality TV show, Jerome Powell would be the judge who finally says, “You’re overvalued, and your confidence is misplaced.” In less than five weeks, 2025 will end, and investors will likely toast to another banner year for Wall Street. The S&P 500, Dow Jones, and Nasdaq Composite? They’ve been playing a game of “Let’s Make a Record High” like it’s a dating app and every profile is a 10. But here’s the twist: volatility is the plot twist no one sees coming.

Wall Street’s indexes have been climbing like they’re on a caffeine IV drip, but stock valuations? They’ve joined the party with a “swipe right” mentality. Lower interest rates and AI hype have created a bubble so shiny, investors are wearing blindfolds just to enjoy the glitter. But Powell? He’s the friend who ruins the vibe by whispering, “This glitter is actually glitter glue, and it’s about to dry on your shoes.”

Reality Check: Powell’s Six-Word Script

The Federal Reserve’s job is to juggle two things: a healthy job market and stable prices. It’s like trying to balance a flaming sword and a toddler’s juice box. When Powell was asked if stock market moves factor into monetary policy, he leaned into his inner Tina Fey and said, “Equity prices are fairly highly valued.” Translation: “Your house is overpriced, but let’s not mention the termites.”

Greenspan did this dance in 1996 with his “irrational exuberance” speech. Three years later, the dot-com bubble popped like a piñata at a tech conference. Powell’s words are the same script-just with better lighting and a slightly less dramatic soundtrack. Wall Street’s reaction? “Not now, Jerry. We’re busy pretending this is a bull market, not a bubble.”

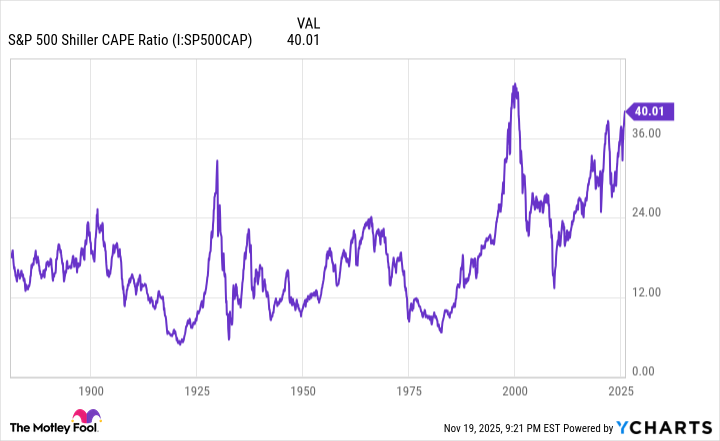

The Shiller P/E Ratio is Wall Street’s version of a lie detector. Right now, it’s screaming, “You’re buying at peak prices!” Since 1871, the average Shiller P/E has been 17.31. But lately, it’s been dancing above 40, like a stock analyst who thinks TikTok makes them an expert. The last time it hit 44.19? The dot-com bubble. The next time? Who knows, but history’s hint is: “Don’t bet the mortgage on this.”

Here’s the kicker: Every time the CAPE Ratio hits 30, the S&P 500, Dow, and Nasdaq take a nosedive. The Great Depression’s 89% drop is a cautionary tale, but even today’s 20% corrections feel like a rollercoaster with no seatbelt. Powell’s not wrong-he’s just the guy who tells you your Netflix password is “password123,” and you’re mad about it.

Opportunity Knocks (And It’s Wearing a Suit)

If history repeats itself, the S&P 500 will drop 20%-maybe more for the Nasdaq. But here’s the secret Wall Street won’t tell you: Corrections are just the market’s way of saying, “Let’s take a group photo.” Bear markets last 9.5 months on average, while bull markets stretch for 3.5 years. That’s like the difference between a Netflix show and a full-length movie. Corrections are the “cliffhanger ending” that forces investors to buy the sequel at a discount.

It’s official. A new bull market is confirmed.

The S&P 500 is now up 20% from its 10/12/22 closing low. The prior bear market saw the index fall 25.4% over 282 days.

Read more at https://t.co/H4p1RcpfIn. pic.twitter.com/tnRz1wdonp

Bespoke (@bespokeinvest) June 8, 2023

Bespoke Investment Group’s data is the financial equivalent of a “Get Rich Quick” manual. Bear markets are brief, bull markets are binges. If you’re investing for five years, corrections are just the market’s way of saying, “Here’s a sale. Don’t panic-buy.” The real trick? Treat downturns like a clearance rack at Nordstrom-discounted prices, not discounted hopes.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- Wuchang Fallen Feathers Save File Location on PC

- 9 Video Games That Reshaped Our Moral Lens

2025-11-22 18:32