As a seasoned researcher with over two decades of experience observing global financial markets, I have witnessed my fair share of market turbulence and volatility. However, the current state of Asian-Pacific stock exchanges, particularly Japan’s Nikkei 225, has left me quite intrigued and a bit concerned.

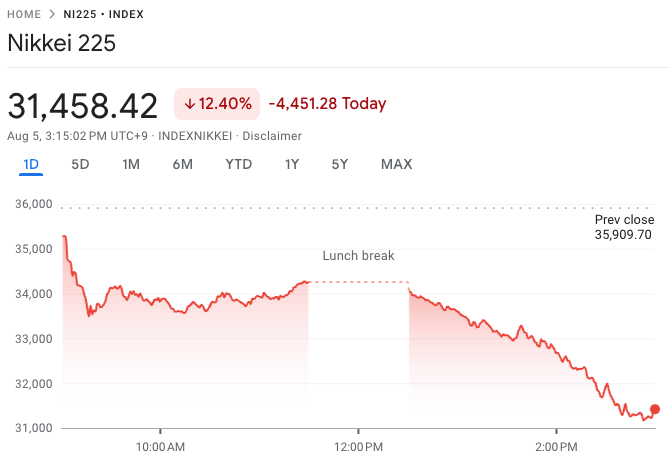

On Monday, Japan’s stock exchanges slipped into a bear market, reflecting a widespread decline in Asia-Pacific markets that started last week. The Nikkei 225 and TOPIX indices experienced a drop of more than 12%, indicating a substantial fall.

As per a CNBC report, by the end of Monday, the main indexes had fallen over 20% from their peak on July 11th. The Nikkei 225 saw a significant drop of approximately 12.4%, finishing at 31,458.42. This marked the worst day for the index since the “Black Monday” crash in 1987. In actual numbers, the Nikkei lost a record-breaking 4,451.28 points, wiping out all its gains for the year and pushing it into negative territory for the year to date.

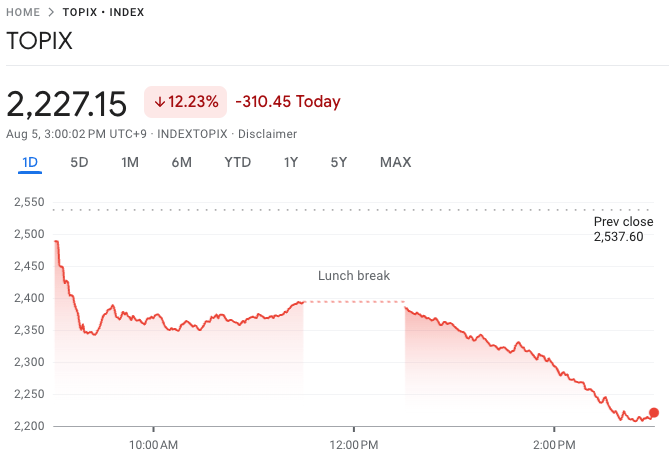

The TOPIX index, which covers many different sectors, experienced significant declines, ending at 2,227.15 after falling by 12.23%. Notable Japanese companies like Mitsubishi, Mitsui & Co, Sumitomo, and Marubeni all witnessed their shares drop more than 14%, with Mitsui experiencing a nearly 20% decrease in market value.

After substantial losses on Friday, both the Nikkei 225 and TOPIX experienced a steep decrease exceeding 5% and 6%, respectively. For the extensive TOPIX, this was the worst one-day plunge in eight years, whereas the Nikkei recorded its sharpest drop since March 2020.

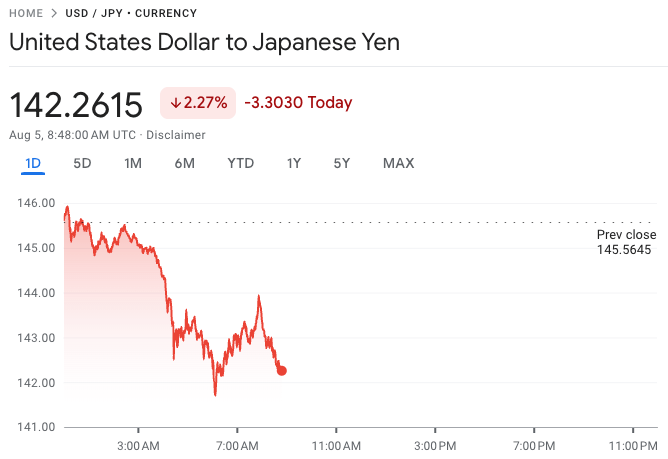

In the foreign exchange market, the Japanese yen has reached its strongest point relative to the US dollar in nearly eight months. By 8:48 a.m. UTC, it was being traded at approximately 142.09 Japanese yen for every one U.S. dollar.

In addition to the CNBC report, other regional markets were also hit by instability. South Korea’s Kospi index dropped by 8.77%, finishing at 2,441.55, and the smaller-cap Kosdaq experienced a more significant decline of 11.3%, ending at 691.28. The heavy selling caused circuit breakers to activate, momentarily halting trading on both indexes for approximately 20 minutes.

Taiwan’s stock market, the Taiwan Weighted Index, decreased by more than 8%, mainly because technology and real estate stocks suffered losses. Meanwhile, Australia’s S&P/ASX 200 dropped 3.7% to 7,649.6. The Reserve Bank of Australia started a two-day meeting on monetary policy on Monday, with predictions that interest rates will stay at 4.35%. But investors are eagerly watching for any hints about a possible rate increase in the bank’s statement.

In Hong Kong, the Hang Seng index was down 1.62% towards the end of trading, and mainland China’s CSI 300 index fell 1.21% to 3,343.32, the smallest decline in the region.

On Friday, U.S. stock markets experienced substantial drops due to a dismal July jobs report, causing concern about an approaching economic downturn. The Nasdaq was the first significant index to dip into what’s known as correction territory, with a decline of more than 10% from its highest point. Meanwhile, the S&P 500 and Dow Jones Industrial Average were down 5.7% and 3.9%, respectively, from their record highs. Specifically, the S&P 500 decreased by 1.84%, the Nasdaq Composite fell by 2.43%, and the Dow Jones Industrial Average lost approximately 611 points, or around 1.51%.

Today, Adam Khoo, a seasoned trader, shared his views on the turmoil affecting Japan’s financial markets. He emphasized the steep increase in the value of the Japanese yen relative to the U.S. dollar, leading to a large-scale unwinding of Yen carry trade positions. This strategy involves borrowing Japanese yen at low interest rates, converting it to U.S. dollars, and investing in U.S. stocks. As the Bank of Japan has increased interest rates, the yen has become much stronger compared to the dollar, worsening the predicament for these traders.

Khoo stated that traders currently have to pay more in interest for money they’ve borrowed in yen and are experiencing significant foreign exchange losses due to the strengthening of the yen. This situation means that the value of U.S. assets these traders hold may no longer be sufficient to repay their loans in yen. As a result, traders are liquidating their positions by selling U.S. stocks to gain dollars, which they then use to pay off their yen loans. This action puts additional pressure on U.S. stock prices and could lead to further price drops in the short term.

Amid mounting financial pressures, geopolitical issues such as the ongoing tension in the Middle East and political uncertainties in the U.S., which are causing widespread fear and panic, have added to the problem. However, Khoo sees this predicament as a potential chance for investors to buy top-tier American stocks at reduced prices, taking advantage of temporary price discrepancies due to short-term market chaos caused by these tensions.

1) A significant increase in the value of Japanese Yen (JPY) relative to the U.S. Dollar is leading to a large-scale liquidation of Yen carry trade positions and fueling the steep drop in American stocks. Here’s a simple explanation for those unfamiliar with this concept:

— Adam Khoo (@adamkhootrader) August 5, 2024

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-08-05 12:13