In a twist of fate that even the cherry blossoms would envy, the Japanese firm Metaplanet has unfurled a staggering capital raise of $745 million, setting a record for Bitcoin-focused equity funding in the annals of Asian stock market history.

With the audacity of a samurai, the firm has issued 21 million shares through 0% discount moving strike warrants, conjuring a magical 116 billion yen from thin air.

Metaplanet’s Bitcoin Quest: $745 Million Raise to Buy More Bitcoin!

These stock acquisition rights, priced at a mere 363 yen per unit ($2.33), come with adjustable exercise prices that dance to the tune of market value. This innovative financial choreography ensures that investors can pirouette gracefully while Metaplanet remains steadfast in its long-term Bitcoin accumulation.

On the day of this grand announcement, the company’s shares pirouetted 3% higher, with a year-to-date gain of 16%. Who knew finance could be so exhilarating?

“Metaplanet will issue 21 million stock options with a 0% discount rate, raising approximately 116 billion yen to purchase additional Bitcoin. This will be the largest Bitcoin purchase fund in the history of Asian stock markets,” the firm proclaimed on X (Twitter), as if announcing a new sushi roll.

Metaplanet’s strategy is akin to a game of shogi, leveraging substantial capital to become a dominant player in the cryptocurrency arena. As BeInCrypto reported, the company has set its sights on acquiring 10,000 Bitcoin by the end of 2025, significantly expanding its treasury holdings. This latest initiative is a testament to Metaplanet’s ambitious “Bitcoin-first, Bitcoin-only” mantra.

In a world where the yen wobbles like a drunken sumo wrestler, Metaplanet aims to fortify its cryptocurrency holdings. This isn’t the first time the firm has turned to Bitcoin amidst local currency jitters; it’s practically a tradition at this point.

Just seven months ago, alongside other titans like Sony, Metaplanet pivoted towards Bitcoin as the yen’s devaluation loomed ominously. They raised a modest $6.2 million through a bond issuance to bolster their Bitcoin stash. Talk about a financial glow-up!

The $745 million raise is merely a continuation of Metaplanet’s unwavering commitment to its Bitcoin-centric vision. Earlier this month, they announced plans to raise $62 million through another funding round for Bitcoin purchases. Consistency is key, after all!

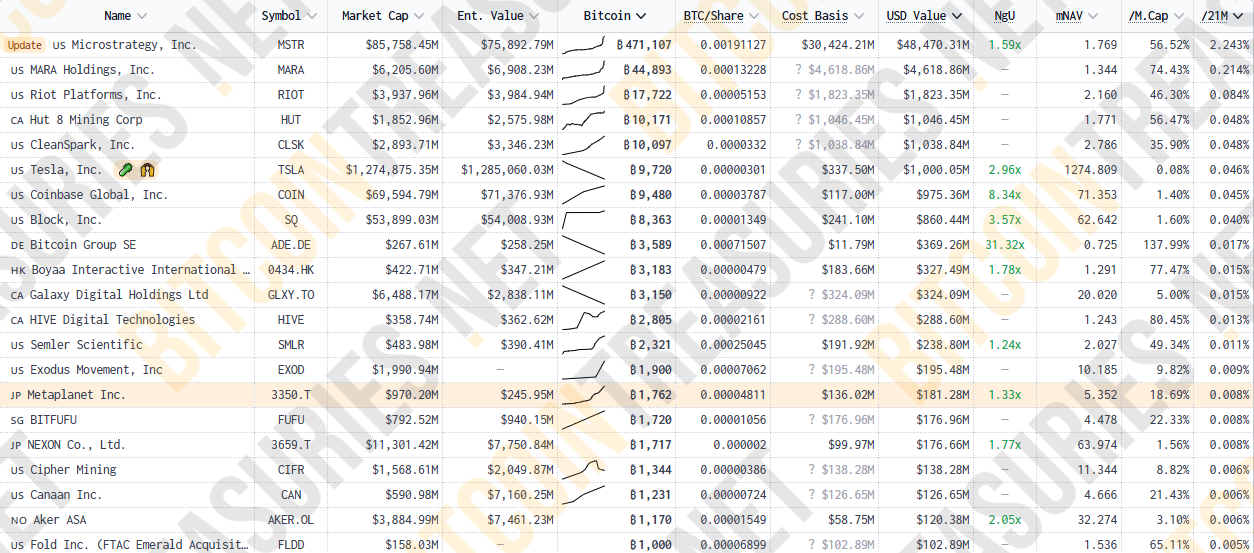

Data reveals that Metaplanet is now the fifteenth-largest publicly traded Bitcoin holder, boasting 1,762 BTC in its reserves. Not too shabby for a company that’s just getting started!

As the yen continues to face devaluation pressures, Metaplanet’s latest capital injection arrives like a knight in shining armor. BeInCrypto reported that the Bank of Japan (BOJ) recently announced a historic 25 basis point (bp) interest rate hike, raising its benchmark lending rate to 0.5%, the highest since 2008. Talk about a plot twist!

Analysts are buzzing about this forward-thinking move, given Bitcoin’s potential as a store of value and its growing institutional adoption. Who knew finance could be so thrilling?

“…it [Metaplanet] aims to strengthen its position as a global leader in corporate Bitcoin holdings,” a popular X user noted, probably while sipping matcha.

This strategy mirrors the playbook of US-based MicroStrategy, a pioneer in leveraging corporate balance sheets to acquire Bitcoin. By adopting a similar approach, Metaplanet aims to position itself as a leader in the cryptocurrency market while enhancing shareholder value. Even MicroStrategy’s founder, Michael Saylor, couldn’t help but comment on Metaplanet’s bold move.

Investor sentiment toward Metaplanet has been as favorable as a sunny day in Kyoto, evidenced by the company’s rising stock price and strong year-to-date performance. However, while the announcement of the $745 million raise has further bolstered confidence, the BTC price reaction was as muted as a silent film.

As of

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-01-28 18:55