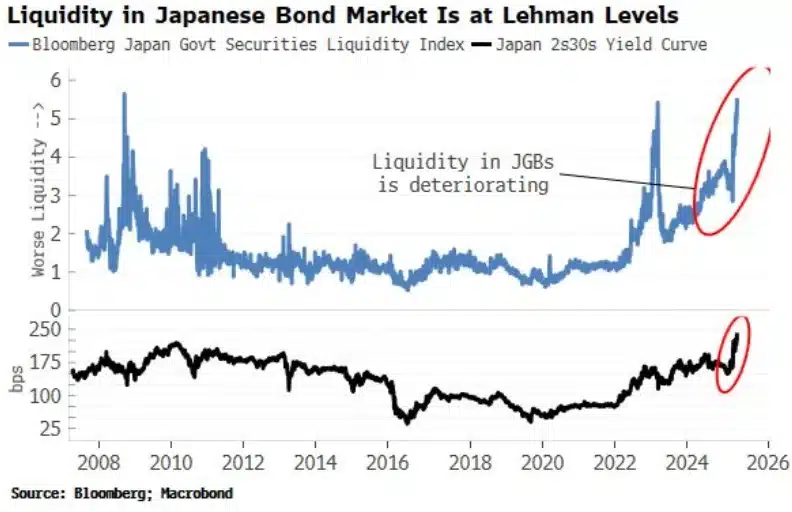

- Japan’s bond market is in a liquidity crisis, echoing the ominous whispers of 2008’s financial chaos.

- Crypto assets are becoming the shiny new toys for investors seeking refuge amid Japan’s economic circus.

Ah, Japan’s government bond market, once a bastion of stability, now floundering in the murky waters of its deepest liquidity crisis since the infamous 2008 global financial meltdown. One can almost hear the echoes of panic as concerns of a wider financial shock loom, threatening to spill over into the digital asset realm like an unwelcome guest at a tea party.

In a dramatic twist worthy of a Dostoevsky novel, long-term bond yields have skyrocketed, with the 30-year yield reaching a staggering 3.20%—a 100 basis point spike that would make even the most stoic investor clutch their pearls. Meanwhile, the 40-year bond has taken a nosedive, erasing over $500 billion in market capitalization faster than you can say “financial apocalypse.”

Once the pride of Japan, these long-dated bonds are now under such intense stress that analysts, like the ever-dramatic Financelot, are warning that liquidity conditions resemble those seen during the Lehman Brothers collapse. A sign of brewing systemic threat? Oh, you bet your last yen!

“Japan’s bond market liquidity has plummeted to levels reminiscent of the 2008 Lehman crisis. Are we on the brink of another financial catastrophe?”

Japan’s Economic Crisis Deepens

The upheaval in Japan’s bond market can be traced back to the Bank of Japan’s abrupt change in monetary policy. After years of aggressive bond purchases, the BOJ decided to scale back its intervention, unleashing a flood of supply that sent yields soaring higher than a kite on a windy day.

Despite this reduction, the central bank still clutches a staggering $4.1 trillion in government debt—over half of all outstanding bonds—creating a lasting distortion on market dynamics and investor sentiment. Talk about a financial funhouse mirror!

And let’s not forget Japan’s national debt, which has ballooned to a jaw-dropping $7.8 trillion, driving its debt-to-GDP ratio to a record 260%—more than double that of the United States. It’s like watching a game of Jenga where the tower is made of money!

The economic fallout has been swift and severe, with Q1 2025’s real GDP contracting by 0.7%, far worse than the most pessimistic forecasts, while inflation climbed to 3.6% in April. Meanwhile, real wages have dropped by 2.1% year-over-year, fueling fears of an entrenched stagflationary cycle. What a delightful cocktail of economic despair!

Community Reactions

As expected, amidst such financial pandemonium, the chatter about Bitcoin has been as loud as a marching band in a library. One analyst chimed in, adding to the cacophony.

Japan’s Crypto Journey

Despite the mounting stress in Japan’s bond market, the nation’s crypto industry is expanding like a well-fed cat. The Japan Virtual and Crypto Assets Exchange Association reported 32 registered crypto-asset exchange operators as of April 30. Who knew chaos could be so lucrative?

Trading activity remains robust, with February figures showing spot volumes nearing JPY1.9 trillion (USD13.1 billion) and margin trading volumes close behind at JPY1.5 trillion. It’s a veritable buffet of trading opportunities!

Meanwhile, Japan is pushing forward with regulatory clarity, as the ruling Liberal Democratic Party’s Web3 Project Team advocates for formally recognizing crypto-assets as a separate asset class under the Financial Instruments and Exchange Act. Because why not add a little more complexity to the mix?

In this tumultuous landscape, Bitcoin [BTC] is increasingly viewed as a hedge against traditional financial instability, especially as the once-reliable yen carry trade comes under mounting pressure. It’s like finding a life raft in a sea of uncertainty!

Thus, as Japan’s debt turmoil intensifies, crypto-linked assets are swiftly becoming the preferred safe haven for investors. Who would have thought?

How is Metaplanet Acting as an Example?

In a twist of fate, Metaplanet’s stock surged by 15.55% on May 27, hitting its upper limit once again as confidence in its Bitcoin-centric strategy strengthens amid rising bond yields and economic instability. It’s like watching a phoenix rise from the ashes of financial despair!

Simultaneously, Cardano [ADA] has been capturing the attention of Japanese retail investors, with growing demand for the ADA/JPY pair. It seems the crypto party is just getting started!

This shift in sentiment suggests that as traditional financial structures falter, Japan’s crypto landscape may emerge as a critical refuge for capital seeking resilience and clarity. Who knew the future could be so unpredictable?

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Everything We Know About DOCTOR WHO Season 2

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

2025-05-28 09:17