As an analyst with a background in finance and experience following the cryptocurrency market, I find Metaplanet’s recent Bitcoin acquisitions intriguing. The company’s strategic investment in Bitcoin despite the recent market downturn demonstrates a long-term vision and belief in the potential of the flagship cryptocurrency.

Metaplanet, a Japanese corporation listed on the Tokyo Stock Exchange, recently disclosed the purchase of an extra 42.47 Bitcoins (BTC) at roughly 400 million yen, which is equivalent to approximately $2.3 million.

Following its recent purchase of 20.195 Bitcoins for approximately ¥1.8 billion (0.903,441 yen per Bitcoin) last week, the firm has now acquired an additional 42.466 Bitcoins at a cost of around ¥4.02 billion (9,419,300 yen per coin).

The company currently owns a total of 203.734 Bitcoins, purchasing each coin for an average price of approximately 10,062,500 yen. The cost for acquiring all these Bitcoins amounts to around 2.05 billion yen.

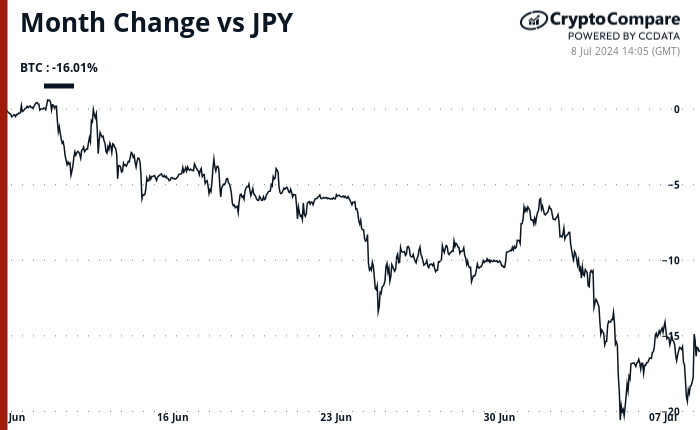

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin’s value has dipped to approximately 9,180,000 yen per coin based on data from CryptoCompare. This decline represents a substantial drop of over 16% over the past month, contributing to the broader downturn in the cryptocurrency market.

As a researcher, I’d describe Metaplanet Inc.’s role in the business world as diverse and dynamic, with its headquarters situated in Tokyo, Japan. The company’s primary areas of engagement are technology and finance. Metaplanet is publicly listed on the Tokyo Stock Exchange under the ticker symbol 3350. Renowned for its innovative approaches and investments, the company is making significant strides in emerging financial technologies such as cryptocurrencies.

As an analyst, I’ve observed that the company has been gradually accumulating Bitcoin. However, according to Bitcoinfides, my data source, its Bitcoin holdings are still not enough to place it among the top corporate holders of this cryptocurrency. Currently, MicroStrategy takes the lead with 226,331 BTC in its treasury, and Marathon Digital Holdings follows closely behind with 18,536 BTC.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Zenless Zone Zero 2.0 – release date, events, features, and anniversary rewards

2024-07-09 01:18