Jabil (JBL) lost altitude Thursday, diving 9.7% by mid-morning before settling at a 6.7% deficit. The electronics manufacturer delivered quarterly results surpassing Wall Street forecasts and issued optimistic guidance. Yet shareholders responded like startled pigeons.

When numbers dance but wallets stay closed

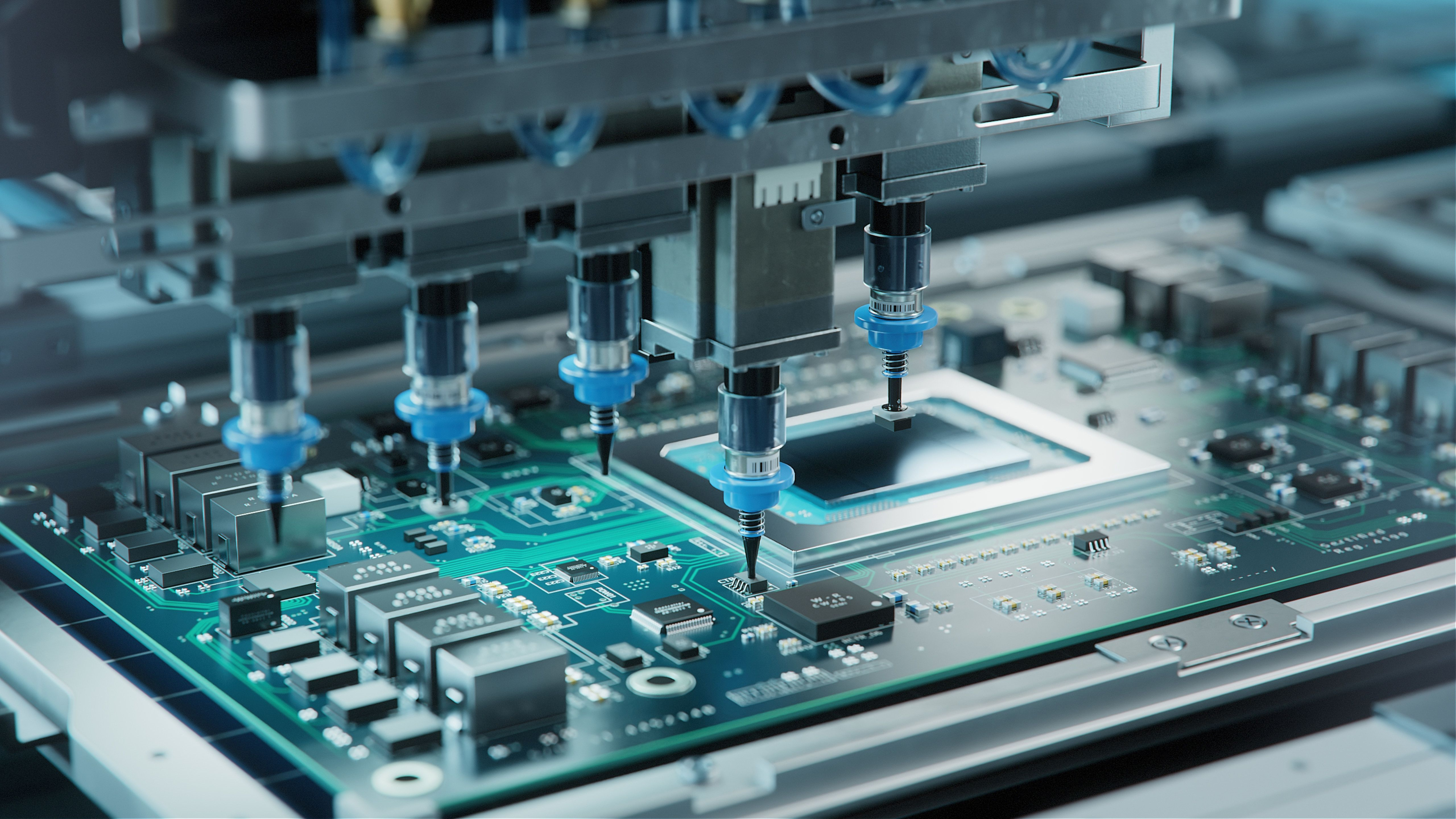

Jabil exceeded expectations handsomely and dedicated significant time to its AI-driven efficiency upgrades, projecting 25% growth in AI-related revenue. The earnings call might have qualified as a tech rally speech. Yet the market’s response resembled a shrug.

This contradiction requires no decoder ring. Jabil arrived at this moment inflated-up 99.6% year-over-year, trading at 43.7 times earnings. Exceptional results became expected, and expectations had priced in miracles.

Beneath the AI spotlight, other divisions faltered. Automotive sales dipped 5%, healthcare crawled upward 4%, and “connected living” plunged 27%. These figures expose a company betting heavily on one roulette number.

The projected 25% AI growth, while notable, follows 2025’s 80% leap. The law of large numbers waits for no disruptor. The rocket fuel is evaporating.

Expensive lessons in arithmetic

Bears found ammunition, but context remains essential. After Thursday’s correction, Jabil still towers 86% above its 52-week starting line. The stock trades at 41 times earnings-a premium for a manufacturer dabbling in AI, not mastering it.

This is not a fire sale. It’s a recalibration. Markets occasionally remember that circuit boards and algorithms don’t grow on trees. 📉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-09-26 00:19