Ah, the illustrious Ripple’s XRP, that charming rogue of the crypto world, has gallantly surged by nearly 10% in the past week, basking in the warm embrace of a broader market uptrend. As we pen this delightful missive, our dear XRP, the fourth-largest crypto by market capitalization, prances about at a princely $2.33.

Yet, dear reader, do not be beguiled by its shimmering facade! On-chain metrics whisper sweet nothings of overvaluation, raising the specter of a price correction as traders, those ever-cunning foxes, seek to lock in their profits. 🦊💸

Overvaluation and Profit-Taking: A Recipe for Decline

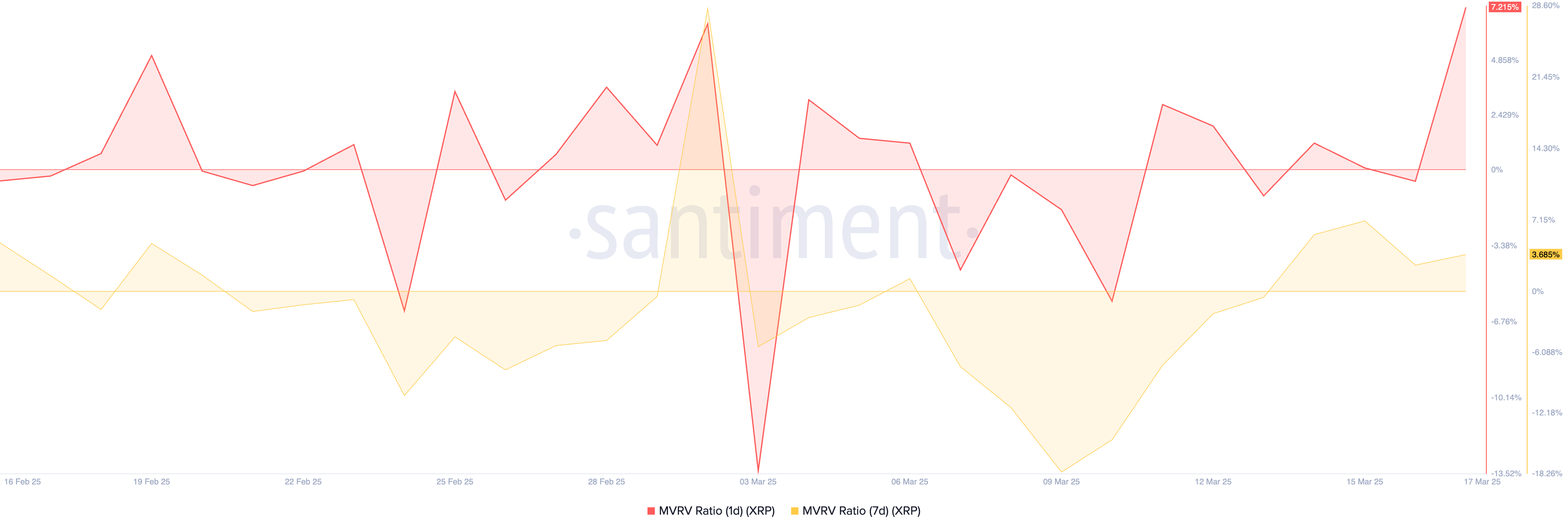

One particularly flamboyant indicator, the Market Value to Realized Value (MVRV) ratio, is flashing warning signs like a theatrical diva. This metric, measured with the grace of one-day and seven-day moving averages, currently stands at a rather alarming 7.21% and 3.68%, respectively. 🎭

The MVRV ratio, that delightful little measure, reveals the relationship between an asset’s market value and its realized value, helping us discern whether it is overvalued or undervalued. When this ratio is negative, it suggests our dear coin is undervalued, like a fine wine sold at a discount. 🍷

Conversely, when the MVRV ratio is positive, as is the case with our beloved XRP, it indicates that the market value is higher than the realized value, suggesting it is, alas, overvalued. This presents a golden opportunity for XRP investors who bought at lower prices to cash out before the inevitable correction, thus increasing selling pressure in the market. As more holders sell, the supply of XRP outpaces demand, leading to a delightful downward spiral in its price. 🎢

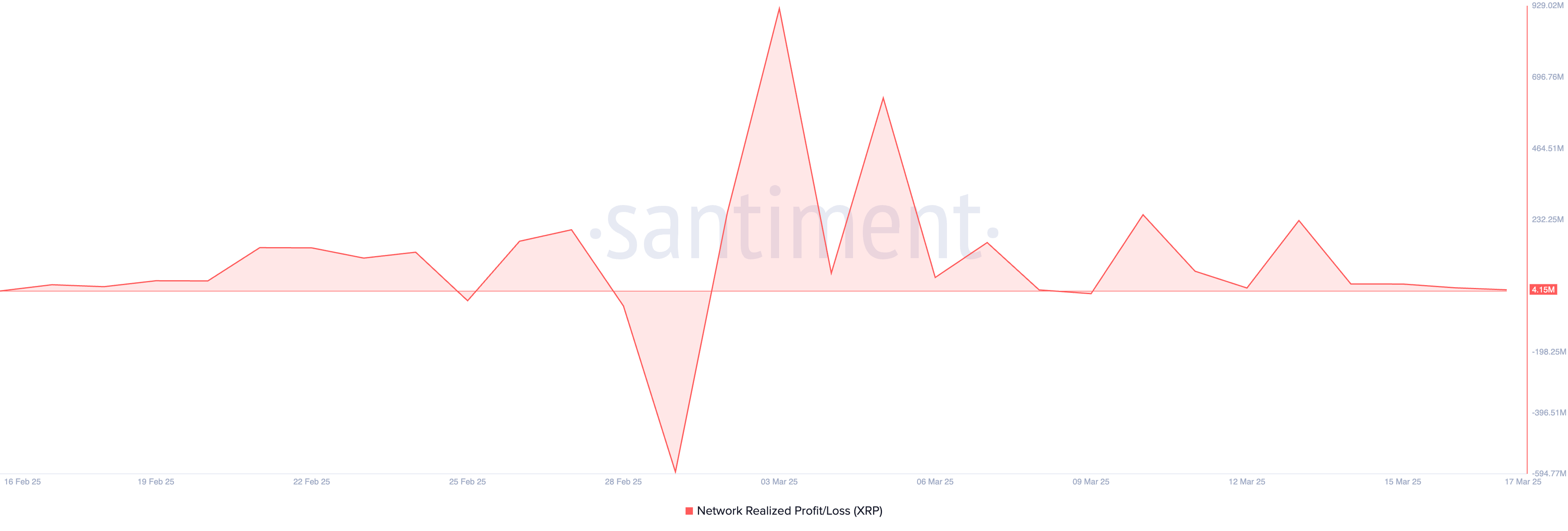

Moreover, the positive readings from the token’s Network Realized Profit/Loss (NPL) further support this bearish outlook. At this very moment, it stands at a staggering 4.15 million. 📉

The NPL, that charming little metric, measures the difference between the price at which an asset was last moved or sold and its current market price, tracking how much profit or loss coin holders “realize.” When the NPL is positive, it indicates that more investors are selling at a gain than at a loss, leading to an increase in XRP supply that could cause its price to tumble if demand does not keep pace with the sell-off. 🏃♂️💨

XRP Under Selling Pressure—Is a Steeper Drop on the Horizon?

As we speak, XRP trades at a modest $2.30, having noted a 3% price decline in the past day. As more traders heed this sell signal and distribute their holdings for gains, the downward pressure on XRP could skyrocket, like a balloon at a child’s birthday party. 🎈

In this rather grim scenario, its price could plummet to $2.13. If the bulls, those valiant defenders, are unable to uphold this support, XRP could extend its decline and tumble toward the depths of $1.47. 😱

However, should profit-taking lose its momentum, our dear altcoin may resume its uptrend and rally to a dazzling $2.61, leaving us all to wonder if this was merely a comedic interlude in the grand play of crypto. 🎭✨

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-17 17:06