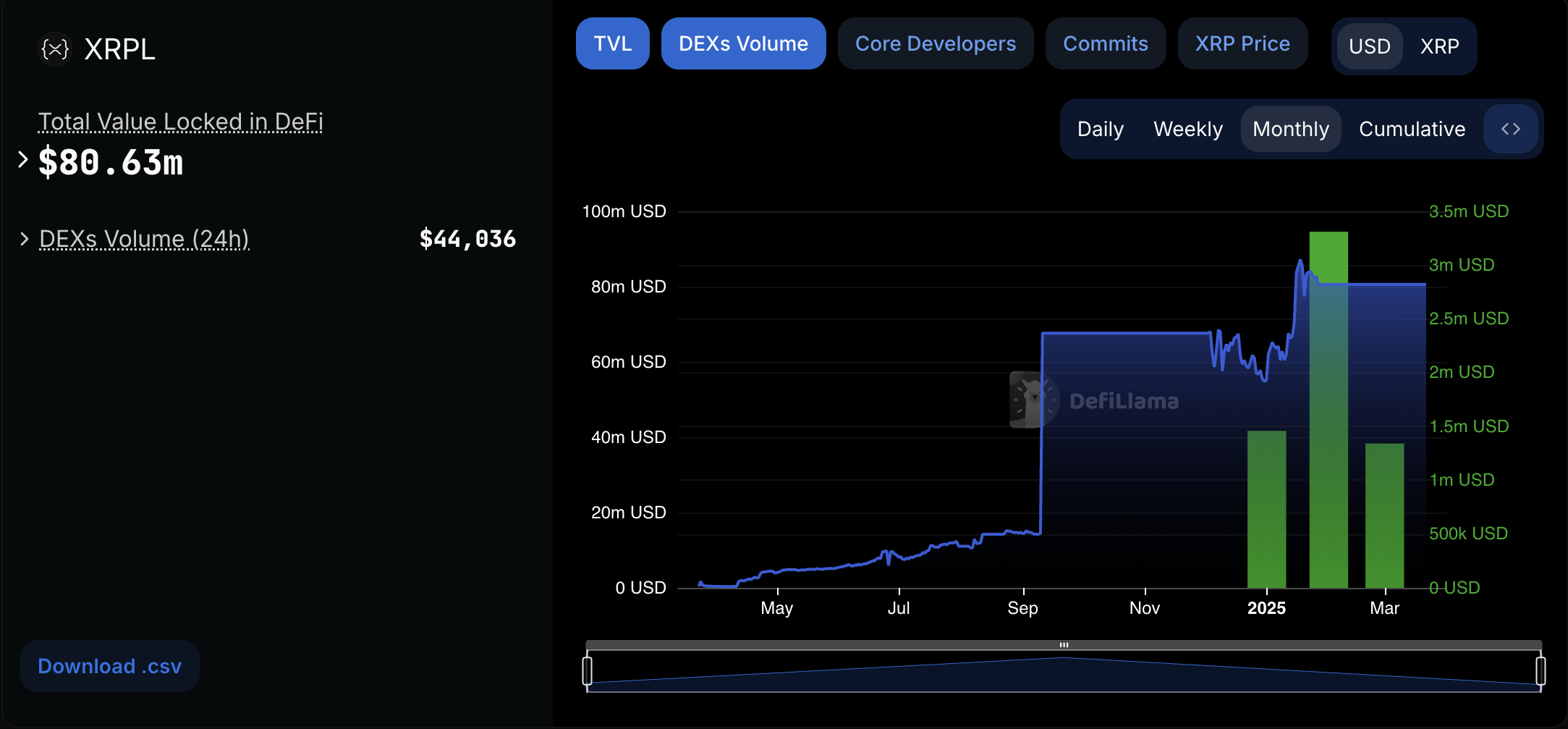

In the dusty corners of the XRP community, a murmur of concern rises like the morning fog. The DEX trading volumes and Total Value Locked (TVL) are as low as a snake’s belly in a wagon rut. Despite the shiny allure of a $137 billion market cap, the network limped along with a paltry $44,000 in daily DEX trading volume yesterday. It’s enough to make a grown man weep and question the very essence of utility and adoption.

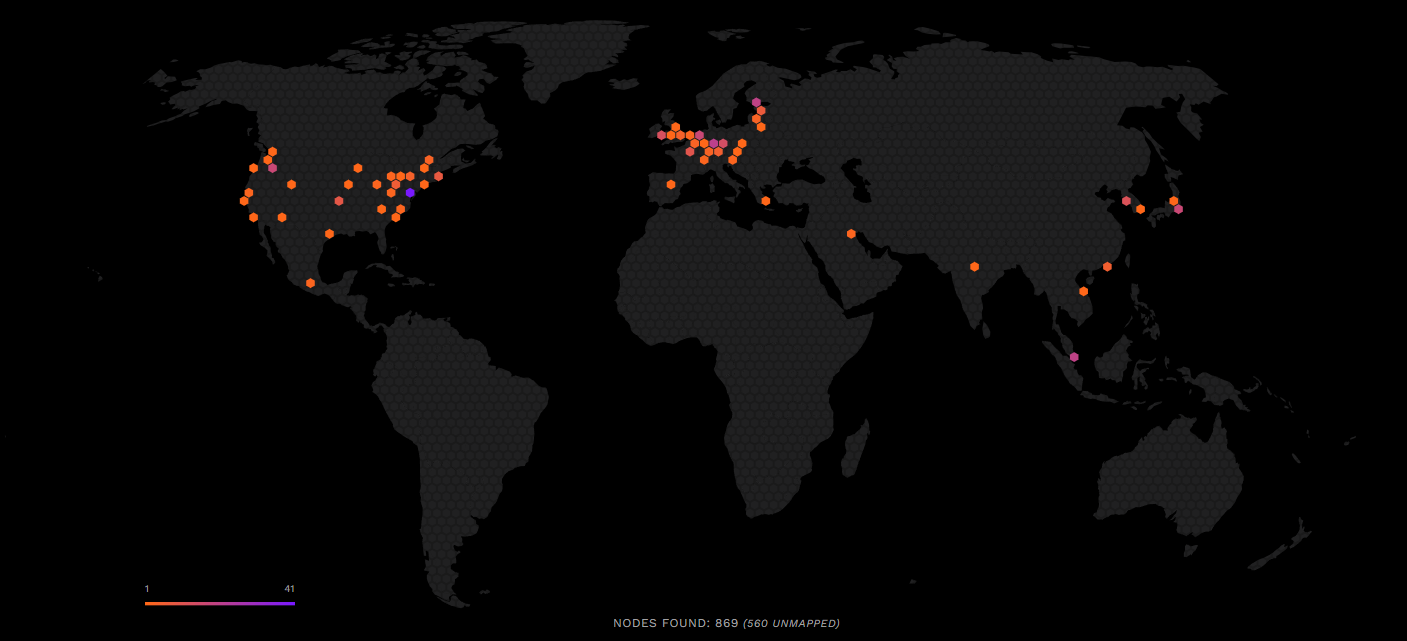

When one casts a glance at the leading blockchain networks, the XRP ledger stands out like a sore thumb, suffering from a dearth of nodes, validators, and smart contract token holdings. This glaring discrepancy paints a picture of misalignment between the altcoin’s lofty market valuation and the practical usability of its blockchain network. It’s like having a fancy car that won’t start.

XRP Ledger Reflects Massive Issues

Ever since Donald Trump’s re-election in November 2024, XRP has been the belle of the crypto ball, trending like a cat video on the internet. Thanks to the SEC’s newfound love for crypto, XRP has surged nearly 300% in the past four months, strutting its stuff as the 4th largest asset in the market. But hold your horses! Despite this meteoric rise, the XRP Ledger has shown about as much improvement in trading activity as a tortoise in a marathon.

Most notably, the SEC finally dropped its long-running lawsuit against Ripple, igniting a flicker of hope that the token could reach an all-time high. Yet, here we are, with the XRP Ledger still dragging its feet in the trading department.

“I think XRP is the biggest financial scam the world has ever seen. There has never been something which has produced less value that has reached this market cap ($140 billion). The XRP ledger did $44,000 in volume in the last 24 hours, according to DefiLlama,” quipped on-chain researcher Aylo on X.

A quick peek at DefiLlama’s data reveals the stark reality. So far, the network’s volume in March was a meager $1.5 million, and its TVL is a mere $80 million. In layman’s terms, there’s practically zero utility for its size. It’s like having a giant elephant in the room that no one wants to talk about.

This trade volume and TVL data is a crucial window into the state of XRP, but there are other vital clues lurking in the shadows. According to its own website, XRP currently boasts 386 nodes and 96 validators. Compare this to the big boys: Bitcoin with nearly 22,000 nodes, Ethereum with 11,000, and Solana with 4,700. It’s like bringing a butter knife to a gunfight.

In other words, general crypto traders seem to be giving the cold shoulder to the network’s utility. It’s a troubling sign that the majority of the community views XRP primarily as a speculative asset, rather than a reliable tool.

However, let’s not throw the baby out with the bathwater. While XRPL DEX volume remains modest, Ripple is busy establishing itself as a key infrastructure provider for global banking institutions. Ripple’s technology is like a well-oiled machine, streamlining cross-border payments by reducing settlement times and lowering costs, attracting leading banks and financial service providers worldwide. This strong institutional focus drives interest in XRP, as it supports efficient liquidity management.

In this context, XRP’s value proposition extends beyond conventional crypto trading. It plays a larger strategic role in modernizing global financial transactions and bridging traditional finance with emerging digital payment solutions. So, while XRPL’s low trading volume is concerning, there’s a good reason why it doesn’t align with the altcoin’s valuation. It’s a wild ride, folks! Buckle up! 🚀

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-21 23:46