On the fateful day of August 7, 2025, XRP found itself languishing at $3.06, with a market capitalization that could make a small country envious-$181.66 billion, and a trading volume that, at $4.44 billion, was about as exciting as watching paint dry. The digital asset danced within a narrow range of $2.97 to $3.08, a veritable waltz of indecision amid the broader market’s collective shrug.

XRP

On the 1-hour chart, XRP made a valiant leap to $3.089 before settling into a cozy range-bound existence. Resistance loomed ominously at $3.06 to $3.08, while psychological support hovered around $3.00 like a concerned parent. The intraday setup hinted at the possibility of short-term bullish trades, especially for those brave souls willing to enter between $3.00 and $3.02, with a stop-loss snugly tucked under $2.98. A breakout above $3.10? Well, that could unleash a flurry of momentum-driven scalps targeting $3.10 to $3.15, but let’s not get too excited-caution is the name of the game, given the lack of follow-through volume.

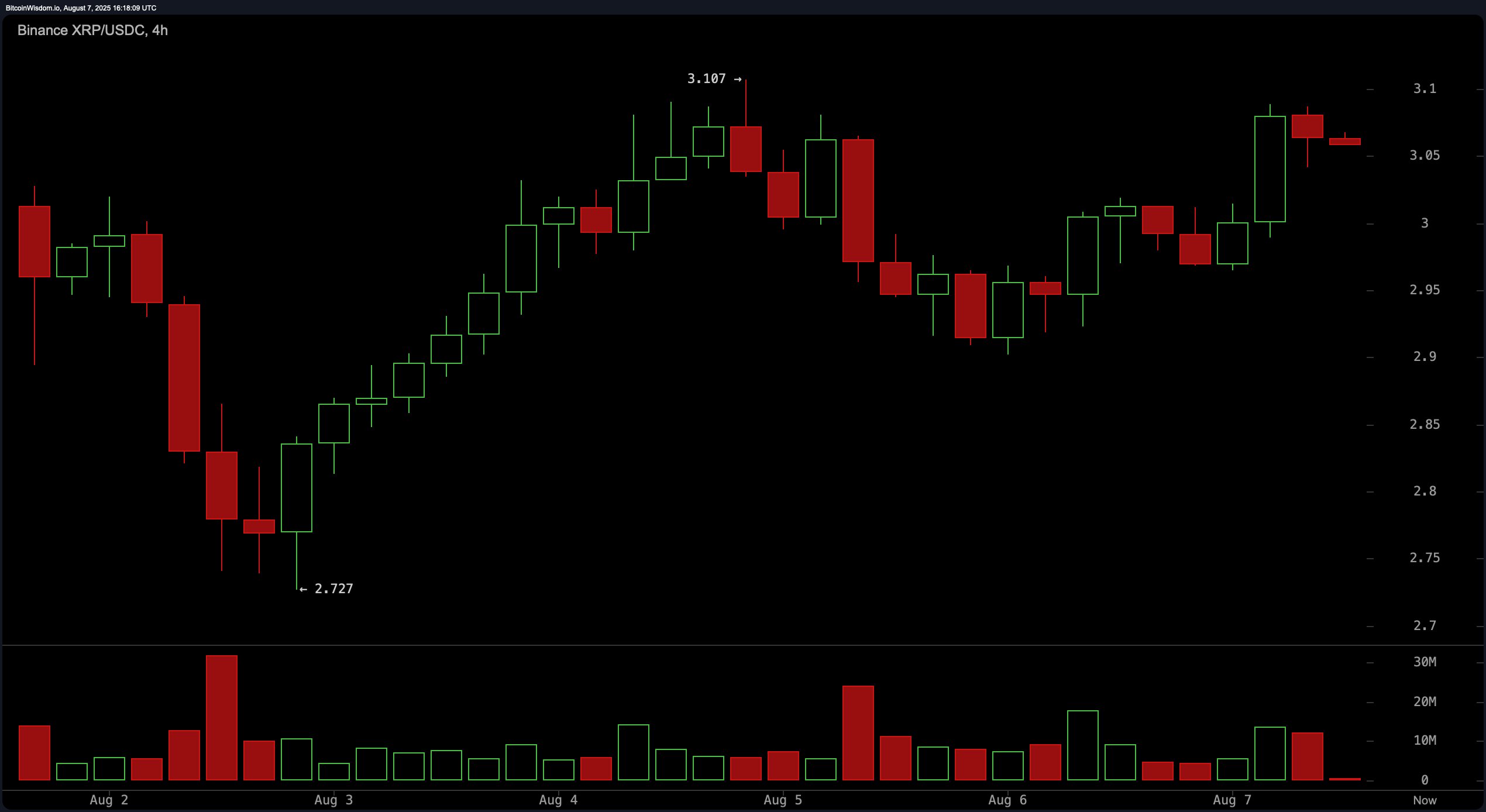

The 4-hour chart paints a picture of a broader recovery from $2.72 to $3.10, though recent price action suggests that momentum is fading faster than a magician’s rabbit. A minor head and shoulders formation is taking shape, with the neckline around $2.95-a key level to keep an eye on. This aligns with a series of lower highs following a peak at $3.107, hinting at either further consolidation or a near-term retreat. Weakening volume on recent price advances only adds to the drama, indicating a fragile bullish structure unless a convincing push above $3.10 occurs. Cue the suspenseful music!

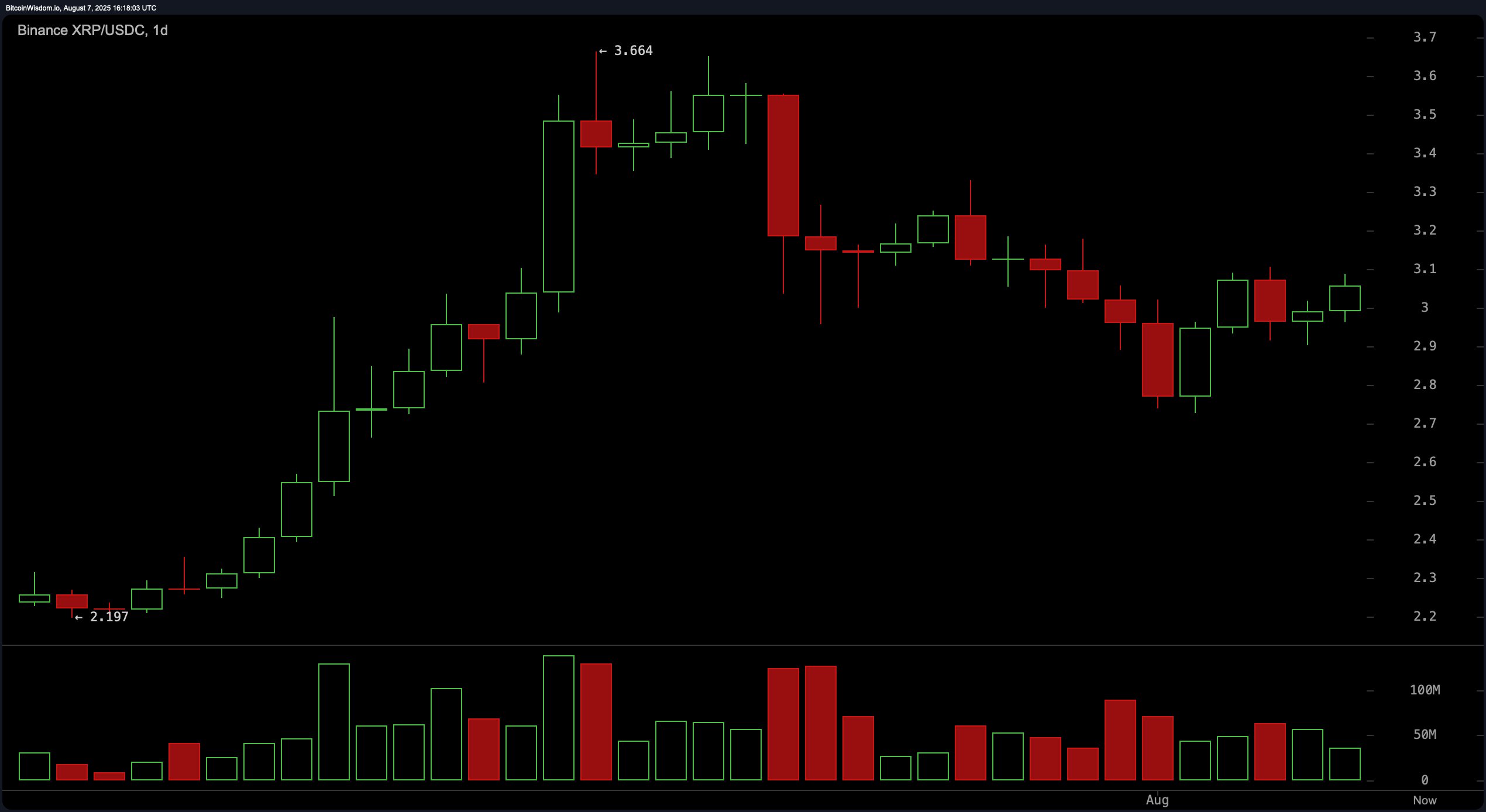

On the daily timeframe, XRP remains ensconced in a consolidation zone after correcting from a dizzying peak of approximately $3.66. The asset previously rallied from around $2.20, but has since entered a phase of stabilization, hovering near $3.05 to $3.10 like a cat on a fence. Notable support lies between $2.85 and $2.90, while resistance emerges at $3.30 to $3.40. Diminishing volume post-rally suggests that buyer conviction is about as strong as a wet noodle, and there’s currently no clear reversal pattern, such as a bullish engulfing candle. However, a daily close above $3.15 would strengthen the bullish thesis and could signal renewed momentum-if only we could find a crystal ball!

Oscillators on the daily timeframe indicate a neutral market posture with subtle bullish undercurrents, like a whisper in a crowded room. The relative strength index (RSI) reads 53.56, the Stochastic oscillator is at 42.35, and the commodity channel index (CCI) is at −47.76-all classified as neutral. The average directional index (ADX) at 29.79 also signals a non-trending market. Meanwhile, the Awesome oscillator shows a value of 0.00644, which is bullish, and the momentum oscillator at −0.06322 also gives a bullish signal. In contrast, the moving average convergence divergence (MACD) level at 0.04593 reflects a bearish signal, adding a note of caution to the overall mixed sentiment. It’s like a soap opera, really.

The moving averages lean slightly bullish in aggregate, particularly on shorter to mid-term scales. The 10-period exponential moving average (EMA) and simple moving average (SMA) stand at $3.02491 and $3.00066, respectively, both showing positive signals. The 20-period EMA at $3.02041 also supports the bullish trend, while the 20-period SMA at $3.14977 reflects a bearish outlook. Similarly, the 30-period EMA at $2.95721 gives off a signal, while the 30-period SMA at $3.06925 issues a Sell. Longer-term indicators, including the 50-, 100-, and 200-period EMAs and SMAs, all register positive signals, reinforcing a longer-term uptrend despite short-term hesitation. It’s like a rollercoaster ride-hold on tight!

Bull Verdict:

XRP continues to maintain structural support above key psychological and technical levels, with a majority of short- to long-term moving averages flashing bullish signals. If buying volume returns and price holds above $2.95, a breakout beyond $3.10 could open the path toward retesting the $3.30-$3.40 resistance zone, reinforcing a medium-term bullish outlook. Fingers crossed!

Bear Verdict:

Despite XRP’s stable consolidation, declining volume, neutral oscillator readings, and resistance at multiple timeframes raise caution. A failure to defend the $2.95 support or rejection near $3.10 would invalidate the short-term bullish setup and may expose the price to a deeper pullback toward the $2.75-$2.85 region, confirming a bearish reversal scenario. And just like that, the plot thickens!

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- The Weight of Choice: Chipotle and Dutch Bros

2025-08-07 20:29