Ah, the tragic tale of XRP, a digital currency that has plummeted nearly 4% in the last 24 hours, and a staggering 21% over the past month, leaving its market cap languishing at a mere $144 billion. The specter of decline looms large, as key technical indicators, those harbingers of doom, flash ominous warnings. The Chaikin Money Flow (CMF) has descended to its nadir since June 2022, while the number of active addresses has plummeted by a shocking 53% in the past month. What a delightful mess! 😂

Moreover, the EMA lines of XRP are forming a death cross, a most poetic signal of impending doom, suggesting that if this trend persists, we may witness further descent into the abyss. With momentum waning, XRP stands at a critical juncture, as traders, those ever-watchful hawks, ponder whether the price will stabilize or plunge into a deeper correction.

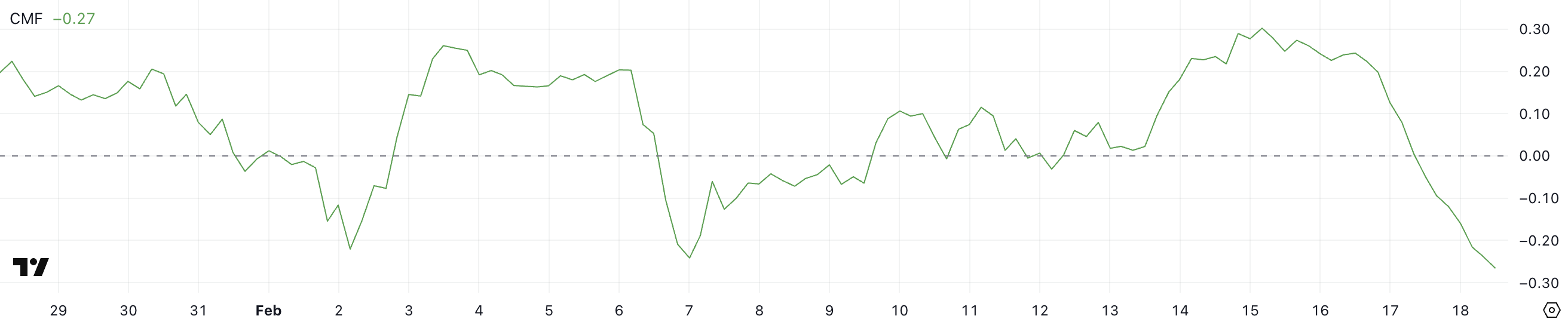

XRP CMF: A Record of Negativity

Behold! The Chaikin Money Flow (CMF) has plummeted to -0.27, a steady decline from the lofty heights of 0.30 just three days prior. The CMF, that fickle indicator of buying and selling pressure, reveals a grim reality: values above zero indicate accumulation, while those below signal distribution. Alas, the decline in CMF suggests that selling pressure is mounting, with more capital fleeing XRP than seeking refuge within its digital embrace. How tragic! 😢

This, dear reader, marks the lowest CMF reading for XRP since June 2022, a harbinger of despair for price action. Historically, such prolonged negative CMF levels have preceded extended downtrends, as they indicate a relentless outflow of capital. If this indicator remains in the negative, or worse, continues its descent, XRP may face further selling pressure, increasing the risk of deeper price losses. What a delightful predicament! 😏

Yet, should the CMF begin to recover, inching closer to zero, it might suggest a flicker of stabilization, granting the bulls a chance to reclaim their territory. For now, XRP remains in a precarious position, with traders anxiously observing whether the selling pressure will intensify or, perhaps, ease in the coming days.

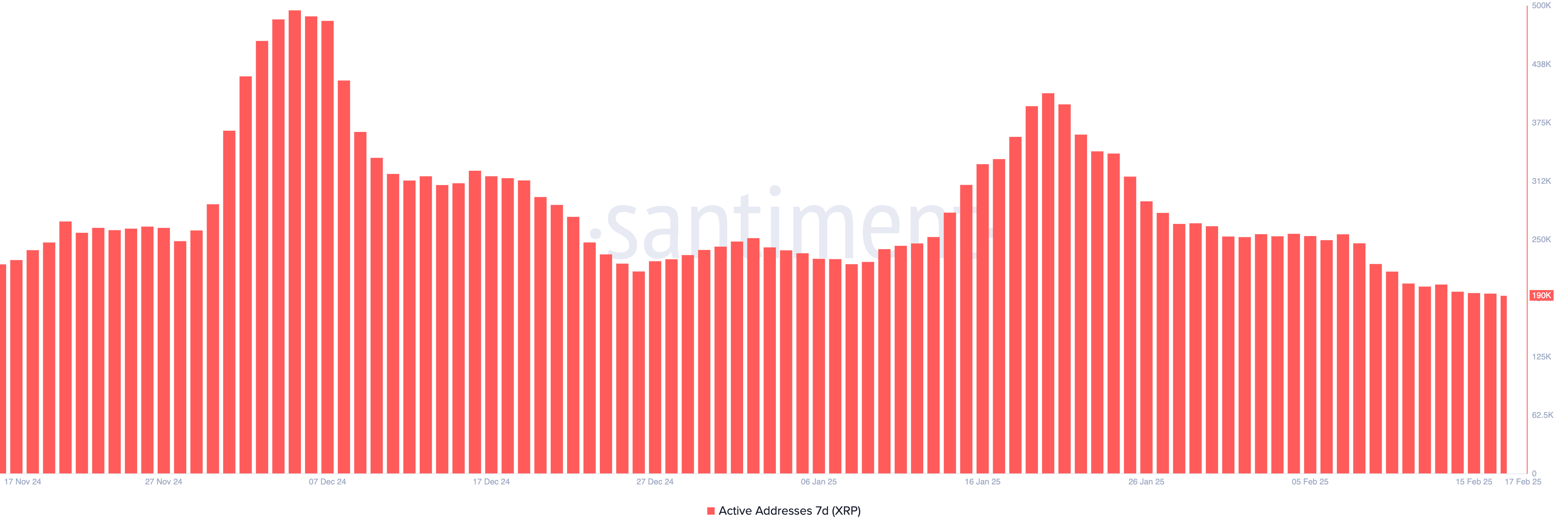

XRP Active Addresses: A 53% Plunge

In a most disheartening turn of events, XRP’s 7-day active addresses have plummeted to 190,470, a staggering 53% decline from the 407,000 recorded on January 20. This metric, a key indicator of network activity and user engagement, reveals a stark reality: reduced participation from traders and investors, perhaps signaling waning interest or diminished transaction demand. How utterly tragic! 😩

Such a decline often coincides with weaker price action, as fewer active addresses typically mean lower liquidity and diminished on-chain activity to drive market movements.

This marks XRP’s lowest 7-day active address count since November 14, 2024, reinforcing the concerns about declining user engagement. Historically, prolonged declines in this metric have heralded periods of price stagnation or downside pressure, as reduced network activity often reflects a fading momentum. What a delightful conundrum! 😆

If active addresses continue their downward spiral, it could indicate a weakening of investor confidence, making it increasingly difficult for XRP to sustain any significant bullish moves. However, should this metric stabilize or begin to rebound, it might suggest a renewed interest in the asset, potentially supporting price recovery efforts. For now, XRP remains in a cautious phase, with traders monitoring whether activity will pick up or continue its dismal decline.

XRP Price Prediction: A 29% Correction Looms?

As the drama unfolds, XRP’s EMA lines are forming a death cross, with short-term moving averages crossing below long-term ones, signaling a potential bearish trend. A confirmed death cross often suggests that the forces of downside momentum are strengthening, increasing the likelihood of further declines in XRP’s price. How thrilling! 😏

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-02-18 23:27