On the fateful day of February 18, the illustrious US Securities and Exchange Commission (SEC), that grand arbiter of financial fate, deigned to acknowledge the audacious Bitwise’s XRP exchange-traded fund (ETF) filing. Yet, in a twist worthy of a tragicomedy, the price of XRP, that elusive creature, has responded with the enthusiasm of a sloth on a lazy Sunday, continuing its descent into the abyss.

With a bearish bias that could make even the most optimistic bull weep, this altcoin seems poised to tumble below a key support level, as if it were auditioning for a role in a financial horror flick.

XRP’s Performance: A Dismal Symphony

In a week that could only be described as a regulatory soap opera, the SEC has acknowledged a plethora of XRP ETF applications. On February 13, the regulator confirmed the filing from Grayscale, which had been submitted in the dim, distant past of late January.

On Tuesday, Bitwise’s filing, along with a similar one from CBOE, was formally recognized, despite being younger than a newborn puppy. Yet, in a plot twist that would leave even the most seasoned screenwriter scratching their head, XRP’s price reaction has been as thrilling as watching paint dry. It continues its downward spiral, now languishing at the lower trend line of its symmetrical triangle, a shape that is as exciting as it sounds.

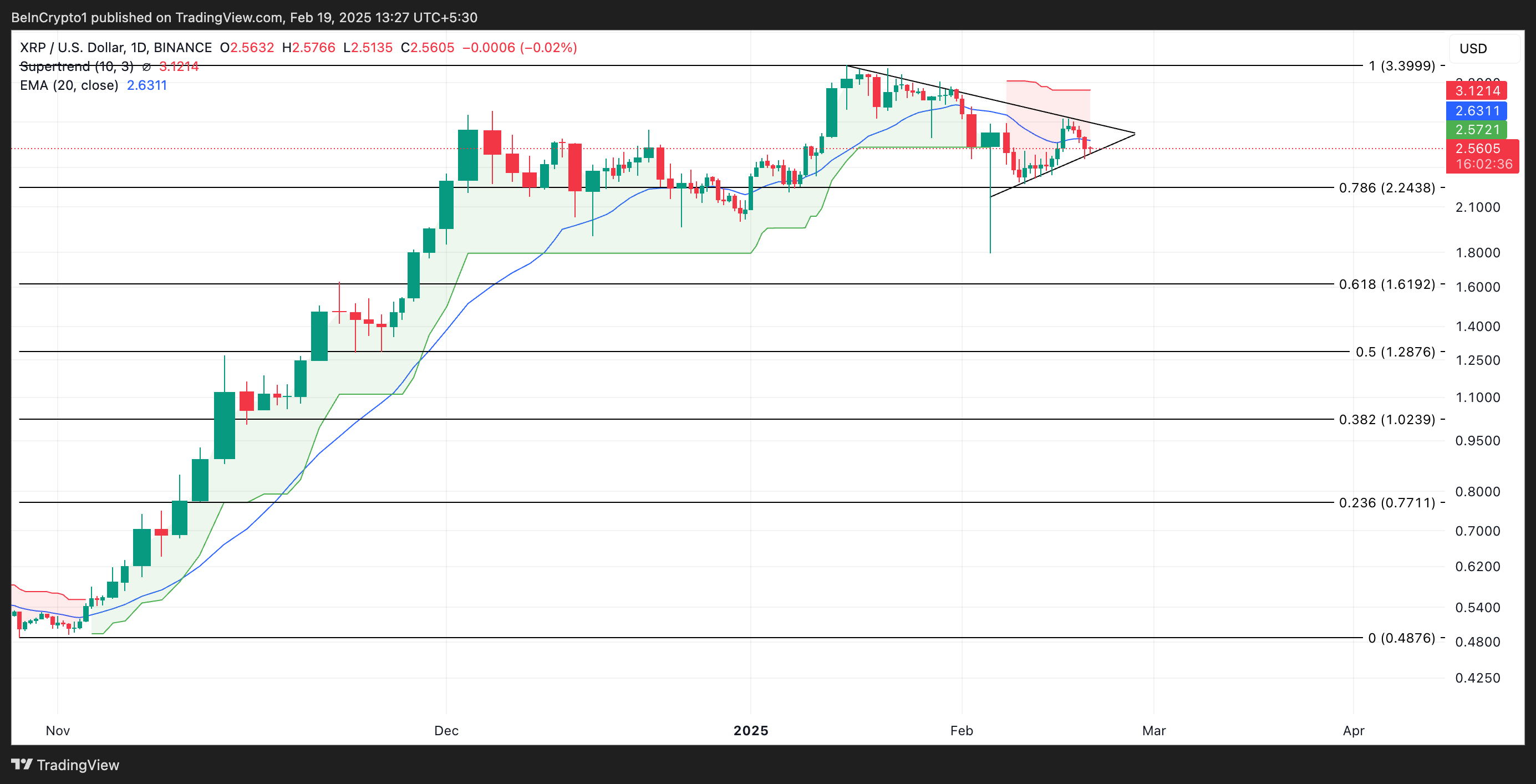

Upon a meticulous examination of the XRP/USD one-day chart, one might observe that this altcoin has been trapped within a symmetrical triangle pattern since it reached its all-time high (ATH) of $3.39 on January 16. This pattern, a veritable prison of converging trendlines, indicates a period of consolidation and a delightful decrease in volatility—perfect for those who enjoy a good nap.

However, as the selling pressure has climbed higher than a cat on a hot tin roof, XRP has found itself flirting dangerously close to the lower trend line of this pattern. This confirms the market’s penchant for selloffs and hints at the potential for a bearish breakout, should the support level decide to take a vacation.

Moreover, XRP finds itself trading below its 20-day exponential moving average (EMA), a clear signal that the bearish outlook is not merely a figment of our imagination.

This indicator, a sophisticated measure of an asset’s average price over the past 20 trading days, gives more weight to recent prices, reflecting the current market trends. When an asset’s price trades below it, it’s akin to a warning sign flashing “Danger! Danger!” as selling pressure mounts like an overstuffed suitcase.

XRP: The Make-or-Break Moment

As we reach the climax of this financial drama, XRP’s Super Trend indicator looms above like a dark cloud, forming dynamic resistance at $3.12. When an asset’s price trades beneath this ominous line, it signals a bearish trend, suggesting that selling pressure is the dominant force, much like a toddler in a candy store.

If the selloffs persist, XRP’s price could plummet below the lower trend line of its symmetrical triangle pattern, careening toward the depths of $2.24, a fate that would make even the most stoic investor shudder.

Conversely, should a miraculous shift in market sentiment occur, it would invalidate this bearish projection. If XRP demand were to soar like a phoenix from the ashes, its price could rally above the upper line of its symmetrical triangle pattern, attempting to breach the dynamic resistance formed at $3.12, much to the astonishment of all.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-19 16:21