speculative and high-risk! Hold onto your seats! 😱

Canary Capital, the digital asset fund manager, just set the stage for something epic. Their filing with the SEC has crypto lovers buzzing-could an “altcoin season” be on the horizon? Is this the dawn of U.S.-made altcoin dominance? Let’s dig in and analyze what it means for cryptos like XRP, Cardano, Chainlink, Solana, and Stellar. The top 5 in the made-in-USA category, ranked by market cap. 🍿

Table of Contents

Canary Capital’s SEC Filing for Proposed ETFs

Hold onto your hats! Canary Capital’s filing reveals that they plan to create an ETF that tracks the made-in-America blockchain index. Yup, they’re going all-in on U.S.-based crypto, folks. The idea is to track cryptocurrencies that were born, bred, and minted in the good ol’ U.S. of A. 🇺🇸

The idea is that the trust will generate rewards through validating transactions on the blockchain. Talk about digital innovation-this is the future! 💻

But that’s not all! Canary is also working on an ETF for a Trump coin and a Staked Injective ETF. Let’s just say they’re covering all the bases! No word yet on when this will get the green light from the SEC, but we’re on the edge of our seats. 🛋️

Ethereum (ETH), Cardano (ADA), Solana (SOL), and Avalanche (AVAX) are mentioned as examples in the filing. Let’s see if any of these will go to the moon. 🚀

How Bitcoin and Ethereum ETFs Impacted Prices

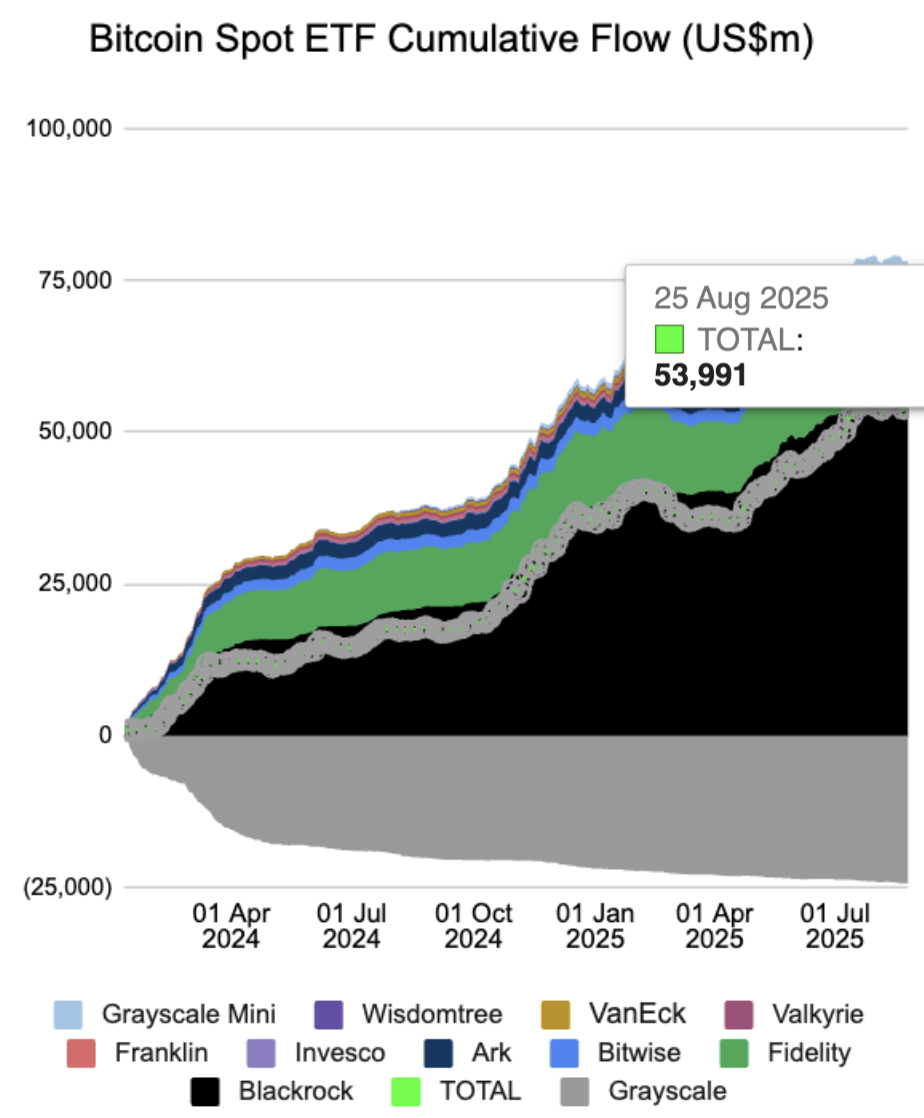

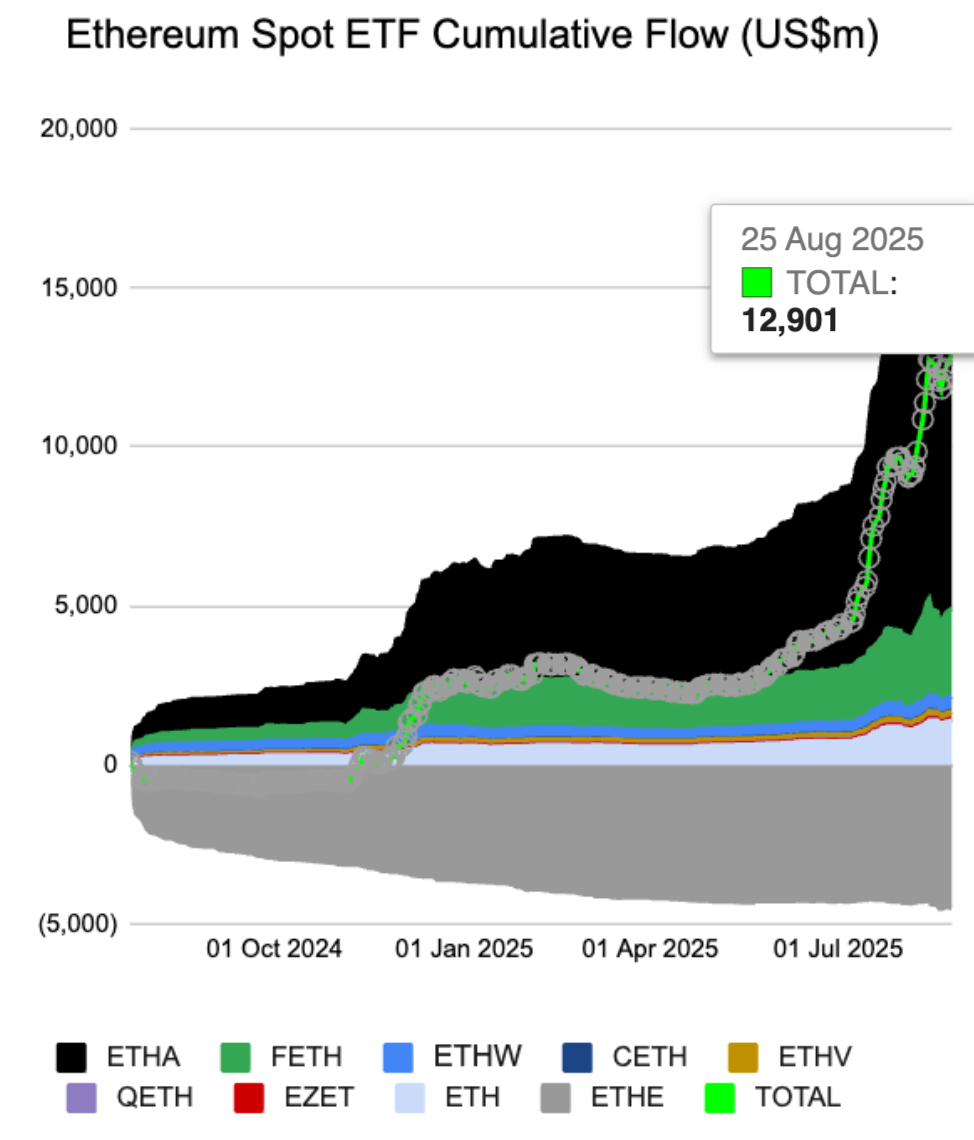

Let’s take a stroll down memory lane. When Bitcoin ETFs first hit the market, they were like a floodgate of capital pouring into the market. With Bitcoin ETFs alone pulling in a whopping $53.99 billion, and Ethereum ETFs attracting over $12.90 billion, no wonder the prices soared. 📈

Bitcoin’s price got a massive boost, thanks to rising flows and institutional demand. Ethereum took a little longer to join the party, but in August 2025, it finally hit a new all-time high. Take a look at those gains! 😎

If history repeats itself, Canary’s ETF could see a similar flow of capital-meaning more demand for tokens in the index. It’s like a crypto tidal wave waiting to crash in. 🌊

But hey, with Ethereum, Cardano, Solana, and Avalanche on the list, don’t be surprised if some of the U.S.-based underdogs like Chainlink (LINK) and Stellar (XLM) also make a move. Who’s ready for the next big crypto showdown? 🥊

Altcoin Season Catalysts

If this ETF takes off, it could spark an “altcoin season.” This is the magical time when altcoins outperform Bitcoin for 90 days straight-when 75% of the top 50 cryptos in market cap just leave Bitcoin in the dust. 🏁

For an altcoin season to ignite, there are a few key ingredients: Bitcoin dominance must plateau or dip, altcoin market capitalization must rise, and of course, institutions need to be buying like crazy. 🏢

The total altcoin market cap right now is a massive $1.58 trillion (as of August 26). Could it reach the highs of 2021, when it topped $1.71 trillion? Only time will tell! ⏳

Ethereum and Binance Coin (BNB) already hit their all-time highs. If the demand keeps up, other cryptos might just follow suit. 🚀

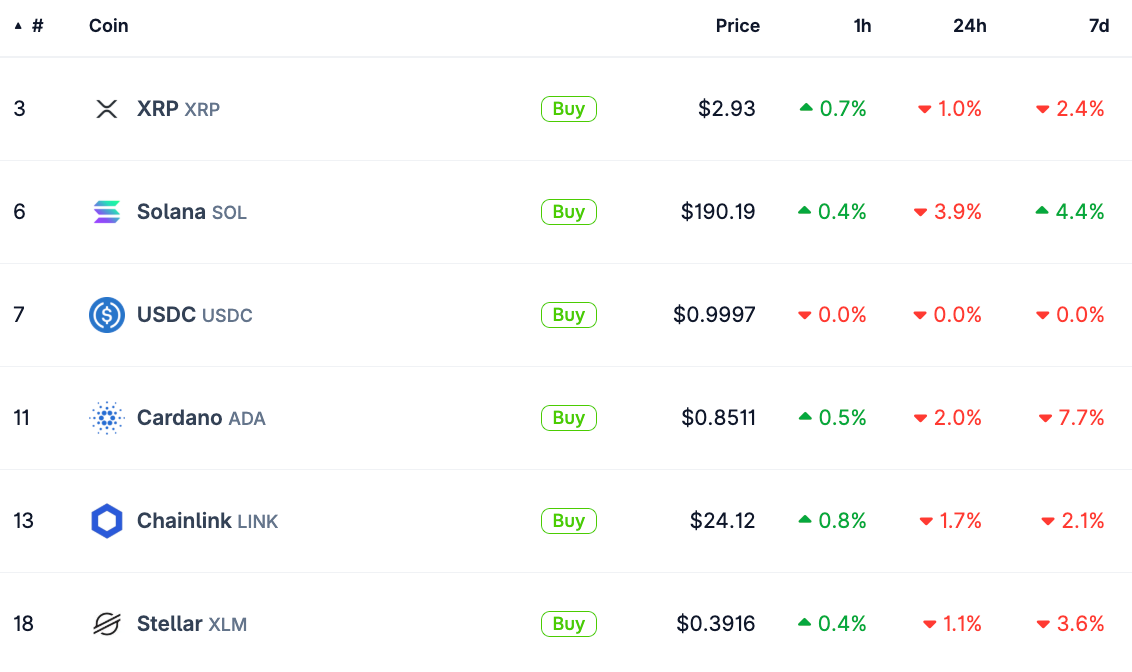

Top 5 Altcoins Likely to Gain

If Canary’s ETF gets the SEC’s approval, these five altcoins stand to gain big: XRP, ADA, LINK, XLM, and SOL. A win for these guys is a win for American-made altcoins across the board. 📈

Currently, the market cap for U.S.-made cryptos is hovering above $518.99 billion, with a 24-hour trade volume exceeding $53.12 billion. That’s a lot of zeros! 💥

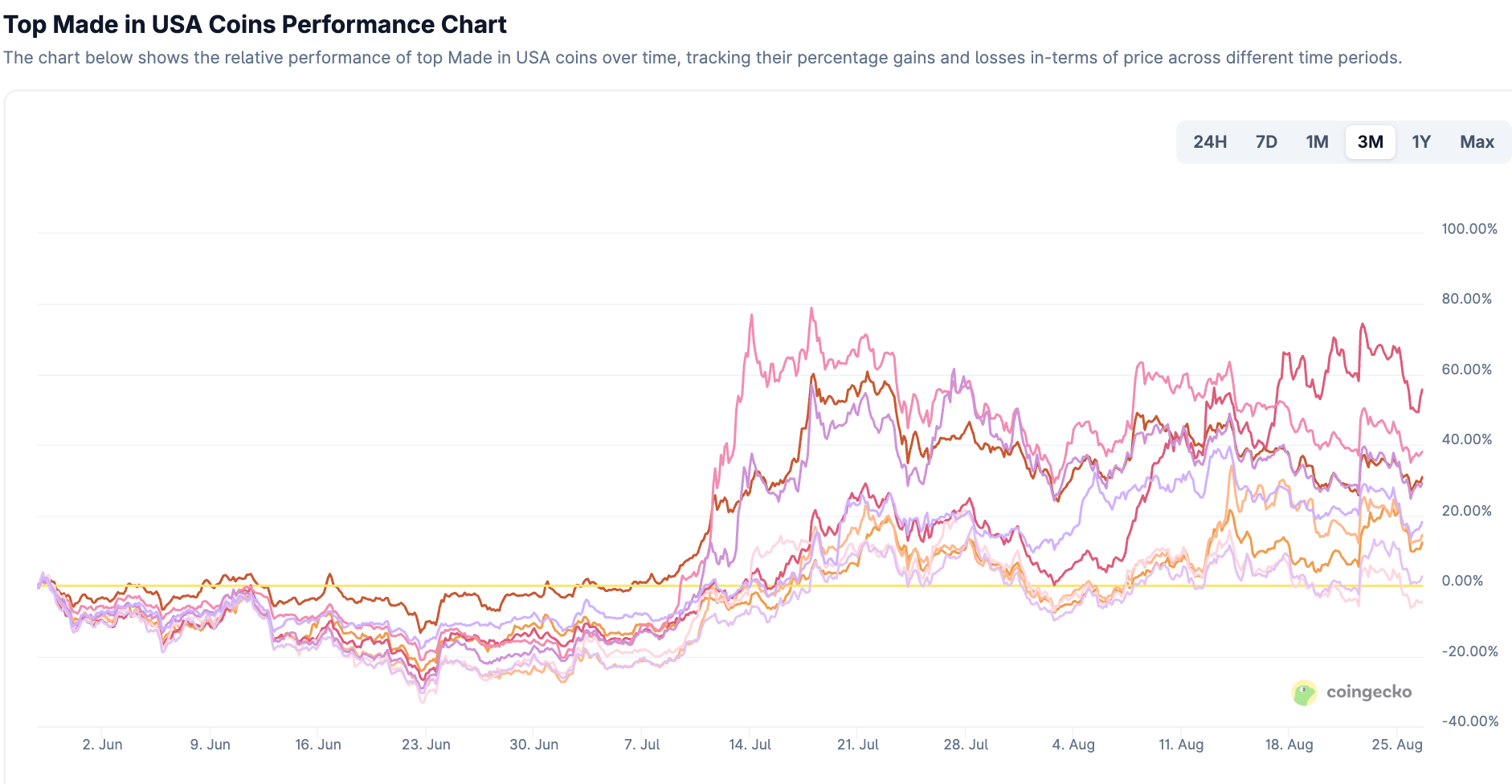

The price action for these top coins over the past three months shows us a picture of potential gains. It’s like a crypto treasure map waiting to be explored. 🗺️

Why Investors Could Be Wary of Canary Capital’s ETF

Alright, let’s play the cautionary tale here. Canary’s ETF isn’t for the faint of heart. The filing clearly states that this investment is high-risk. That’s code for: you could lose everything. 💸

What’s worse? It’s not covered by the Commodity Exchange Act, which means there’s no safety net if things go south. This ETF isn’t regulated by the CFTC, and if you invest, you won’t have the protections that futures market investors enjoy. So, buyer beware! ⚠️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-26 23:02