At this moment, the S&P 500 is setting new record highs, which could make some people think that investing in index funds following the S&P 500 benchmark might not be ideal. One of the most widely used index funds globally is the Vanguard S&P 500 ETF (VOO), as it mirrors the long-term growth of the S&P 500 with a minimal expense ratio.

It’s clear that the Vanguard S&P 500 ETF may not seem as appealing as it did a year or two back when its price was significantly lower. However, it doesn’t mean investing in it now is a poor decision, especially if you view your investment returns as long-term, i.e., over decades. Here’s the rationale behind this.

The Vanguard S&P 500 ETF might not look as promising compared to its past when its price was lower. But it doesn’t mean it’s a bad idea to invest in it right now, especially if you consider your investment returns over the span of many years. Here’s why I think so.

Investing in the S&P 500 at all-time highs

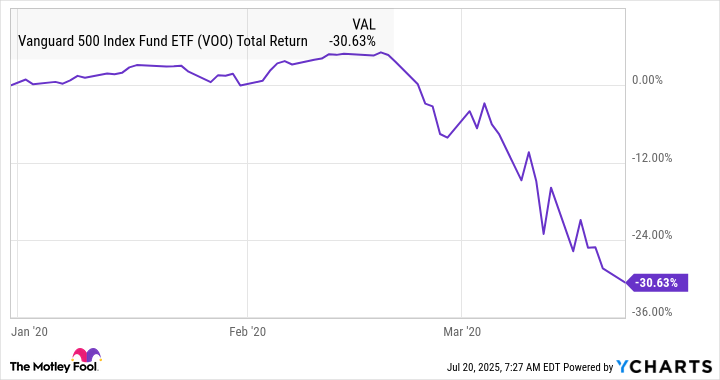

It’s likely that investing in the S&P 500 at its peak just before the COVID-19 pandemic would have been the least favorable time during the past decade, as the chart below demonstrates. In February 2020, the Vanguard S&P 500 ETF reached an all-time high and then dropped by over 30% within a mere month.

So the February high would have been a pretty bad time to buy shares of the index fund, right?

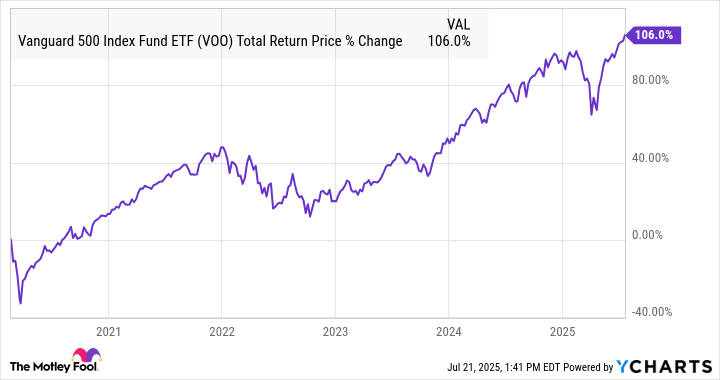

It’s not a requirement, but considering the bigger picture, it’s worth noting that purchasing an investment prior to the COVID-19 crash would still have seen a significant increase of more than double within approximately five and a half years.

Instead of looking back at the best moments when investing over the last twenty years, let’s delve into the most unfavorable scenario: the market peak on October 9, 2007, just before the financial crisis hit the U.S. economy hard, causing the S&P 500 to drop by more than half of its value.

It’s understandable that losing more than half of your investment’s value within a year and a half would be terrifying. However, if you had the patience to endure all the ups and downs, you would now be enjoying a staggering 470% total return over the past almost 18 years.

To clarify, I’m not predicting a market crash or similar events, but it’s possible that the S&P 500 could establish a new record high tomorrow and continue doing so in the coming weeks. However, the main idea is that regardless of what happens in the short term, the long-term returns of the Vanguard S&P 500 index fund are likely to be robust, especially if you invest at a record high.

Averaging could be the way to go

To wrap up, it’s important to note that while investing in the Vanguard S&P 500 ETF might be a good move at the moment, it doesn’t mean you should put all your funds into it immediately. Instead, consider the strategy of dollar-cost averaging, which can be quite beneficial, particularly when the market appears somewhat bubbly.

Essentially, dollar-cost averaging refers to a method where you consistently invest equal amounts of money at regular intervals, rather than investing a lump sum all at once. For instance, instead of putting $5,000 into an ETF right now, you could choose to invest $500 each month for the next 10 months, regardless of the current share price of the ETF.

By investing $500 in the Vanguard S&P 500 ETF today, if the market drops by 20%, your next investment of $500 will purchase 20% more shares due to the dip. Over a period, you’ll automatically buy fewer shares when the ETF is costly and more shares when it’s less expensive, resulting in an advantageous average price over time.

Essentially, even if the S&P 500 reaches a record peak, it doesn’t automatically mean you should avoid investing. By utilizing strategies like dollar-cost averaging and the power of long-term compounding, you could potentially achieve substantial returns in the future.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Banks & Shadows: A 2026 Outlook

- QuantumScape: A Speculative Venture

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- HSR Fate/stay night — best team comps and bond synergies

2025-07-23 14:13