Ah, SUI! The cryptocurrency that seems to have the emotional stability of a soap opera character. In the last 24 hours, it has managed to gain some momentum, boasting a market cap of $10.5 billion. But let’s not get too excited; it’s still nursing a 26% hangover from the past 30 days. Technical indicators are throwing mixed signals like a teenager at a school dance. The CMF is at -0.06, which is like saying, “Hey, the selling pressure is easing up, but let’s not throw a party just yet.” 🎉

Meanwhile, the Ichimoku Cloud is suggesting a little consolidation, which sounds suspiciously like a fancy way of saying, “Let’s just sit here and think about our life choices.” The EMA lines are hinting at a potential golden cross, which, if it happens, could lead to a test of resistance at $3.73 and maybe, just maybe, a rise above $4.25. Fingers crossed! 🤞

SUI CMF Is Still Negative, But Showing Potential Recovery

SUI’s CMF is currently at -0.06, which is a notable recovery from -0.35 two days ago. It’s like watching a turtle trying to cross the road—slow but steady. 🐢

The rising CMF indicates that selling pressure is easing, suggesting that buying interest may be gradually returning. But let’s be real, the negative value still reflects that outflows are outweighing inflows, which is like saying the glass is half empty, and the waiter is nowhere to be found.

This lingering negativity suggests that sellers still have a firm grip on the SUI blockchain, but the upward movement hints at a potential shift in momentum if buying pressure continues to grow. It’s like watching a suspenseful movie where you’re not sure if the hero will survive.

The Chaikin Money Flow (CMF) is a volume-based indicator that measures buying and selling pressure by analyzing price and volume data. It’s like the mood ring of the crypto world, ranging from -1 to +1. Positive values indicate buying pressure, while negative values indicate selling pressure. So, with its CMF at -0.06, the market is still leaning bearish, but the recovery from -0.35 suggests that SUI selling pressure is weakening. If CMF can cross above zero, it could signal a bullish reversal. But if it remains negative or turns downward again, well, let’s just say it could be a long winter. ❄️

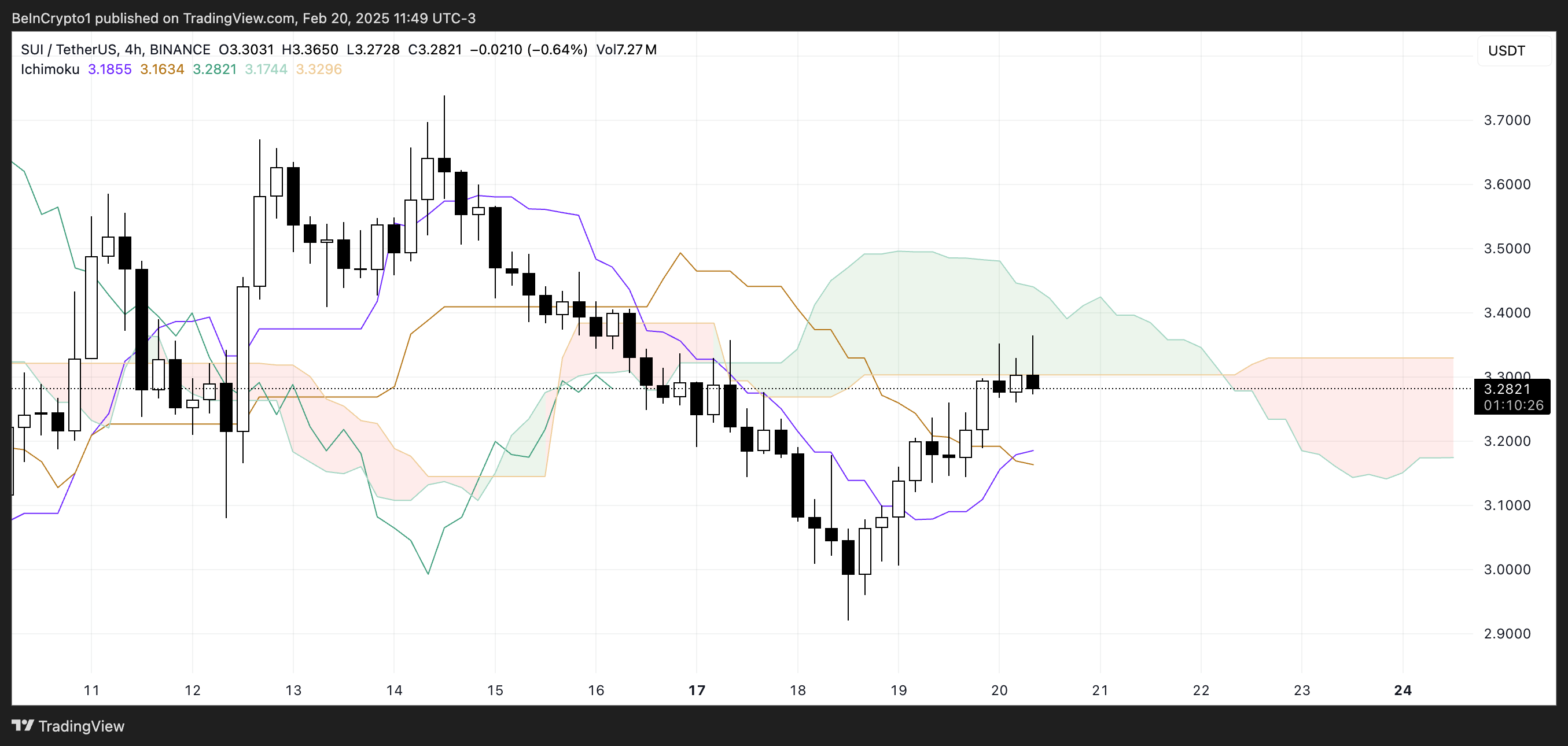

SUI Ichimoku Cloud Shows Cautious Optimism

The Ichimoku Cloud for SUI shows a mixed outlook with signs of potential consolidation. The current cloud’s Leading Span A (green line) is above the Leading Span B (orange line), indicating a bullish sentiment for the near future. But don’t get too comfortable; the price is currently trading within the cloud, suggesting indecision and a lack of clear trend direction. It’s like being stuck in traffic—no one knows when it will end. 🚗💨

The green cloud ahead reflects slight bullish momentum, but its thinness suggests a weak trend that could easily be reversed. It’s like a diet soda—looks promising but ultimately leaves you feeling empty.

The purple Tenkan-sen line is below the orange Kijun-sen line, which typically signals bearish momentum. However, the gap between them is narrowing, suggesting a potential bullish crossover if SUI price continues to rise. This crossover could indicate a shift in momentum toward the bulls. The Chikou Span (green line) is positioned above the price action, reinforcing the current bullish sentiment, but its close proximity to the candles suggests that momentum is not strong.

Overall, the Ichimoku setup shows cautious optimism, with the possibility of a bullish breakout if the price can move above the cloud. But if it fails to do so and breaks below the cloud, bearish pressure could resume. It’s like a game of Jenga—one wrong move and it all comes crashing down.

SUI Could Reclaim $4 Levels Soon

Although SUI price has been up in the last 24 hours

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

2025-02-21 06:17