So, here we are, staring at the remnants of a dream that once glittered like a Tesla in a parking lot. Rivian, the electric vehicle startup that made everyone forget about the 2008 crash, is now a cautionary tale wrapped in a leather jacket. You know, the kind of story where you think, “I should’ve bought the stock at $100,” but then realize you were too busy binge-watching Killing Eve to notice the market tanking.

Shares are down 92% from their 2021 peak. If you bought at the peak, you’re probably nursing a hangover by now. The company’s market cap? A measly $16 billion. But here’s the kicker: they’re still building trucks, selling them through their own showrooms, and somehow convincing partners like Volkswagen and Amazon to keep throwing money at them. It’s like watching a friend try to fix their car with duct tape while yelling, “I’ve got this!”

Vertically integrated manufacturing in America

Rivian’s playing the long game, trying to be the American Tesla. They’ve got a factory in Illinois, a bunch of fancy trucks, and a software team that’s probably coding in the dark, hoping it works. But here’s the thing: they’re selling cars that only the wealthy can afford. It’s like trying to sell a luxury yacht to people who still use a flip phone. The reviews are good, sure, but the audience? Tiny.

They’re launching a cheaper SUV in 2026. $45k to $55k? That’s still more than a year’s rent in most cities. But maybe that’s the point. Scale is the holy grail of car manufacturing, and Rivian’s betting everything on it. Or maybe they’re just trying to avoid the fate of every other EV startup that burned through cash and vanished.

Can the company achieve positive cash flow?

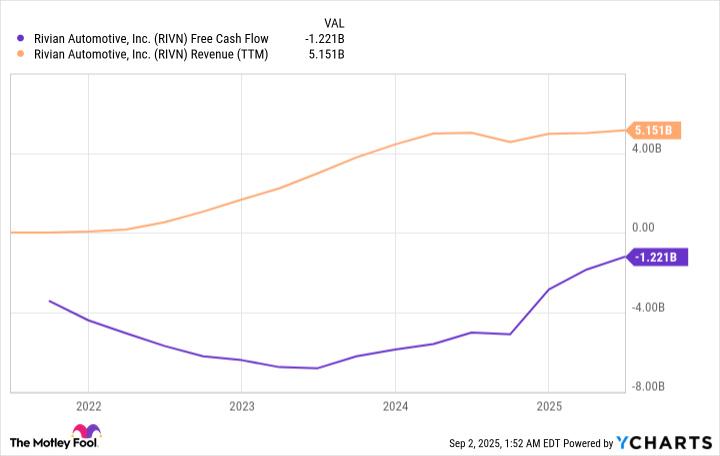

Rivian’s cash burn is like a toddler on a sugar rush. They lost $6 billion in 2023, but now they’re down to $1 billion a year. It’s a slight improvement, but let’s not get carried away. They’ve got $7.5 billion in the bank, which is enough to fund their losses for a while. But if the R2 doesn’t sell, they’ll be back to square one. And if the market crashes? Well, that’s what the stock’s for, right?

Volkswagen and Amazon are throwing their weight behind Rivian, but partnerships are like exes-sometimes they stick around, sometimes they vanish when you need them most. The Georgia factory loan? A political gamble. If the next administration doesn’t like EVs, it’s all for nothing. And let’s be honest, the U.S. government is about as reliable as a used car salesman.

The future for Rivian stock

If Rivian hits $20 billion in revenue, they could be profitable. But that’s a big if. The automotive industry is a graveyard of startups, and Rivian’s just another name on the list. They’ve got the hype, the partners, and the cash. But hype fades, partners leave, and cash runs out. It’s like dating someone who promises you the world but never actually shows up.

Would I invest? Probably not. I’d rather put my money in a savings account and pretend I’m not watching the stock market like it’s a reality TV show. But hey, if you’re feeling lucky, go ahead. Just don’t come crying to me when the stock drops to $1 again. 🚗

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-03 14:42