Over the past few months, I’ve found myself captivated by a new and exciting field of technology called quantum computing, which has recently caught the attention of AI aficionados.

As an onlooker, I find myself intrigued by the potential of quantum applications, even though they’re not fully operational yet at the moment. The research within the industry hints that this technology might be a groundbreaking force. In fact, predictions from management consulting firm McKinsey & Company suggest that quantum computing could potentially generate trillions in economic value over the coming decades. This implies that quantum technology could very well transform the ongoing AI trend into something truly revolutionary in the long run.

A notable firm that’s garnered significant interest in the field of quantum computing goes by the name Quantum Computing Inc. (QUBT). I find the moniker quite fitting, don’t you?

In light of the current share price hovering around $20, is it a suitable moment to invest in Quantum Computing stocks?

What’s with all the hype around Quantum Computing stock?

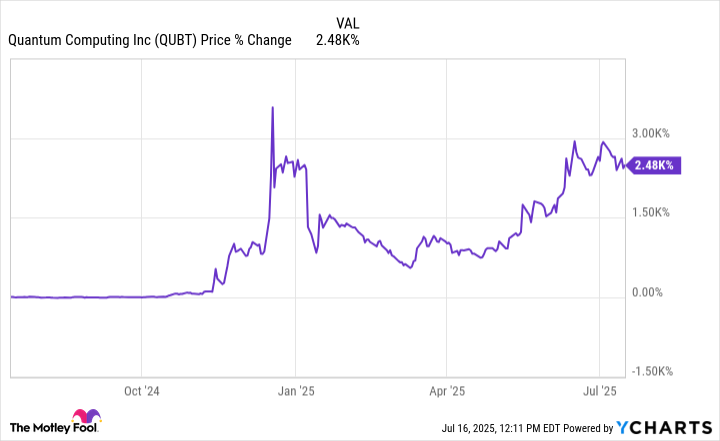

Over the past year, the stocks of Quantum Computing have soared an impressive 2,480%, surpassing both the S&P 500 and Nasdaq Composite in their performance.

Isn’t it obvious that the potential profits from Quantum Computing are enormous? However, it’s important to clarify that its business isn’t necessarily booming at this moment.

Over the past year, Quantum Computing has brought in approximately $385,000 in earnings. I believe that the significant increase in Quantum Computing’s stock value is more related to broader market stories rather than any company-related factors.

On numerous instances, the CEO of Nvidia, Jensen Huang, has expressed positive views towards quantum computing. Given the significant role that Nvidia’s technological foundation plays in the wider artificial intelligence (AI) story, investors might find it reassuring that this forward-thinking leader seems optimistic about the chances associated with quantum computing.

Furthermore, certain economic experts believe a potential reduction in interest rates by the Federal Reserve might be imminent. Lower rates may be seen favorably by investors, with growth-oriented companies like Quantum Computing potentially experiencing significant benefits from this increased investor optimism.

Assessing Quantum Computing’s valuation

According to the given chart, the P/S ratio of Quantum Computing is significantly high, exceeding 5,200. When you consider Quantum Computing from this angle, its nominal revenue values become more prominent. It’s intriguing to ponder how a company with only a few hundred thousand dollars in sales can hold a market capitalization worth billions of dollars.

From my perspective, the market value for Quantum Computing stocks is predominantly based on an optimistic outlook that combines Artificial Intelligence (AI) and quantum application technologies. To emphasize just how overvalued Quantum Computing might be, let’s take a look at the following example:

This way, the sentence maintains its original meaning but uses more casual and conversational language to make it easier for readers to understand.

- Dot-com bubble: During the most euphoric days of internet hype during the late 1990s, companies such as Amazon, Microsoft, and Cisco witnessed peak P/S multiples in the range of 31 to 43.

- COVID-19 bubble: In more recent history, companies such as Zoom Communications and Peloton Interactive witnessed stratospheric valuations as investors bought into the narrative that these companies would capitalize on remote work trends and the at-home economy. Zoom’s P/S peaked at around 124 while Peloton’s high was roughly 20.

Is Quantum Computing stock a buy right now?

As reported in recent financial documents, Quantum Computing has released 14,035,089 shares at $14.25 per share to increase its funds. Given the company’s minimal income and unprofitability, it was inevitable that Quantum Computing would eventually encounter a cash flow problem.

I view this new stock release as an indication that the management team recognizes the overvalued state of the company; thus, they seized the opportunity presented by the elevated market prices.

It seems that even though Quantum Computing stocks are currently priced at $18 per share, the analysis presented earlier suggests they’re overvalued and approaching a speculative bubble territory. Moreover, the recent stock issuance may hint that the management is uncertain about the stock’s current valuation being sustainable.

To me, Quantum Computing is a highly speculative opportunity that is best avoided for now.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-07-20 03:37