Quantum computing shares have surged from being nearly unheard-of on Wall Street to incredibly popular within just a few short months. In late December, Alphabet announced that its Willow quantum chip had reached an important milestone in quantum computing, solving intricate problems in mere minutes which would require traditional supercomputers 10 septillion years. This announcement ignited a flurry of interest in quantum computing stocks, a trend that had already been gathering steam following the elections.

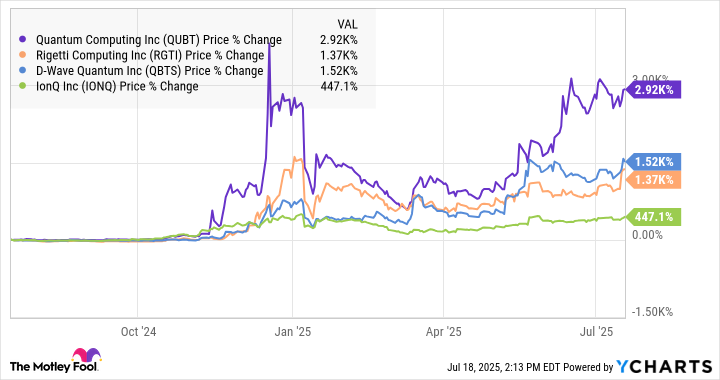

Among the award recipients was Quantum Computing Incorporated (QUBT), often referred to as QCI. Since Alphabet’s announcement, its shares have experienced a significant increase. As the ensuing graph demonstrates, Quantum Computing and comparable companies such as Rigetti Computing, IonQ, and D-Wave Quantum have all witnessed remarkable growth over the past year, moving in tandem with the trend.

In terms of originality, Quantum Computing stock might not take the cake for the most creative name in its field, but it’s undeniably the top performer among the four quantum computing stocks during the past year. Some speculators see it as a potential successor to Nvidia, a stock that has skyrocketed approximately 100 times over the last ten years, currently boasting a market cap of an impressive $4 trillion.

Are they right? Let’s see if Quantum Computing’s super surge can continue.

Where Quantum Computing stands today

One reason Quantum Computing outperformed the other three stocks is that it’s the smallest company, which means it gained from the same market trend but had a smaller starting point to grow from. Despite its small size, it still has the lowest market capitalization among them, currently valued at around $3 billion. At this stage, its revenue is minimal, with only $39,000 reported in the first quarter, and it also recorded an operating loss of $8.3 million during that period.

As a quantum computing enthusiast, I’m thrilled to be part of a company that’s blazing a unique trail. Unlike many other companies delving into quantum computing, we’re dedicating our efforts to the exciting realm of photonic quantum computing. While IonQ, Rigetti, and Alphabet are exploring supercomputing technologies, we’re pushing boundaries in a different direction.

In the first quarter, we made a significant stride forward by completing construction on our Quantum Photonic Chip Foundry right here in Arizona. This milestone positions us to meet the surging demand for thin film lithium niobate (TFLN) photonic chips, setting us up for exciting times ahead!

Management anticipates an increase in revenue next year as production at the foundry commences. However, Quantum Computing remains a high-risk investment due to its nature, but it currently has sufficient funds to sustain operations for several years. By the end of the first quarter, the company boasted $166.4 million in cash and no outstanding debt.

Can QCI become the next Nvidia?

Comparing a startup like Quantum Computing (QCI), which currently generates less than $1 million in annual revenue, to tech giants such as Nvidia might seem far-fetched, given their stock’s current behavior. After all, QCI barely generates any income, and there’s no solid evidence that its business model works or if there will be enough consistent demand for its product. However, many groundbreaking technologies start in this manner, and it took Nvidia years to reach its current level of success.

Back in 1999, Nvidia debuted their groundbreaking Graphics Processing Unit (GPU), an innovation that has continuously been refined, broadened, and developed since then. Despite its early beginnings, Nvidia was significantly larger than QCI is today. In the fiscal year ending January 30, 2000, Nvidia boasted a staggering $374.5 million in revenue.

The ability of Quantum Computing Inc. (QCI) to maintain its performance for investors hinges on whether quantum computing indeed represents the next major technological advancement. Despite the recent spike in QCI’s stock price, it remains uncertain as the full potential has yet to be realized.

Monitor closely the performance of QCI’s upcoming photonic chips in the coming year as they increase production. If the market reaction mirrors that of AI chips, QCI might make a significant stride towards becoming the next Nvidia by navigating its production processes smoothly.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Brent Oil Forecast

2025-07-23 15:25