In the grand tapestry of cryptocurrency, the Pi Network (PI) has emerged, not merely as a token, but as a spectacle of human folly and ambition. Launched with the fervor of a thousand suns, it has claimed the title of the largest airdrop in the annals of crypto history, eclipsing even the illustrious Uniswap. Yet, as the dust settles, the price action resembles a tempestuous sea, with waves of volatility crashing upon the shores of expectation. Despite the cacophony of excitement, the ADX, that fickle mistress of market momentum, has plummeted from a robust 60.2 to a mere 15, whispering tales of indecision and waning enthusiasm.

Ah, the RSI, that harbinger of market sentiment, has also taken a nosedive from the dizzying heights of over 90 to a more sobering 45.2. This shift from rampant buying to a more tempered approach suggests that the once fervent buyers are now donning the garb of caution. Should the selling pressure persist, the specter of testing support at $0.71 looms ominously. Conversely, a flicker of hope may ignite a rally towards resistance at $1.02, with dreams of ascending to $1.26 dancing in the minds of the hopeful. 😅

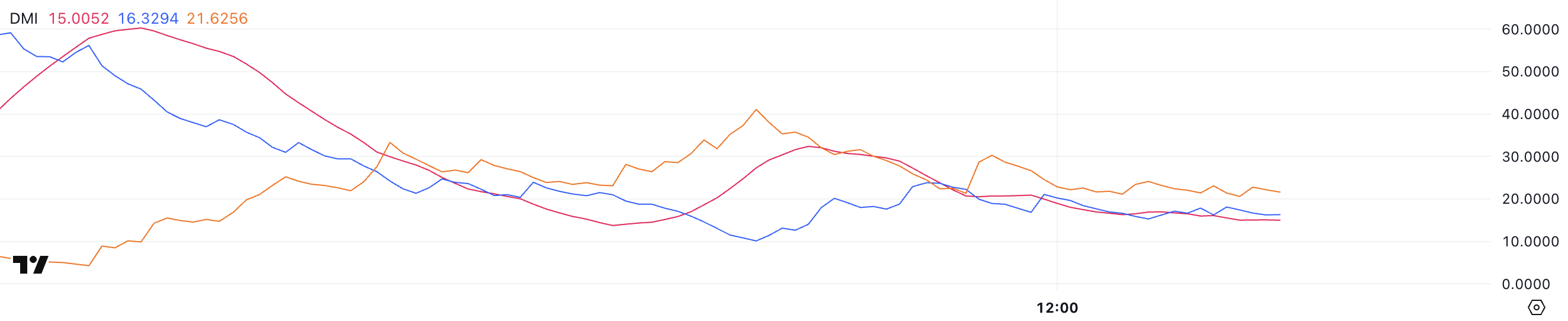

Pi Network DMI: A Tale of Uncertainty

Behold the DMI chart of Pi Network, where the ADX languishes at 15, a stark contrast to its earlier glory of 60.2, mere hours post-launch. This rapid descent is akin to a once-mighty river reduced to a trickle, signaling a loss of momentum and a retreat from the initial euphoria. The market, it seems, is caught in a web of indecision, lacking the clarity of direction that traders so desperately seek.

With an ADX of 15, we find ourselves in the realm of weak trends, where volatility has diminished, and the price of Pi may meander aimlessly until a new trend emerges. 🥱

The Average Directional Index (ADX) serves as a compass, guiding traders through the murky waters of market sentiment. An ADX below 20 suggests a lack of direction, while numbers between 20 and 40 hint at a trend in the making. Above 40? Well, that’s where the real action lies.

As we delve deeper, the +DI and -DI lines reveal the shifting tides of buying and selling pressure. Currently, Pi Network’s +DI stands at a meager 16.3, a far cry from its earlier heights, while the -DI has surged to 21.6, indicating that sellers are now firmly at the helm. This reversal of fortunes suggests that the bullish tide has receded, leaving sellers to bask in the glow of control. With the ADX languishing and prices in decline, the future remains shrouded in uncertainty, as traders brace for either a breakdown or a miraculous reversal. 🤔

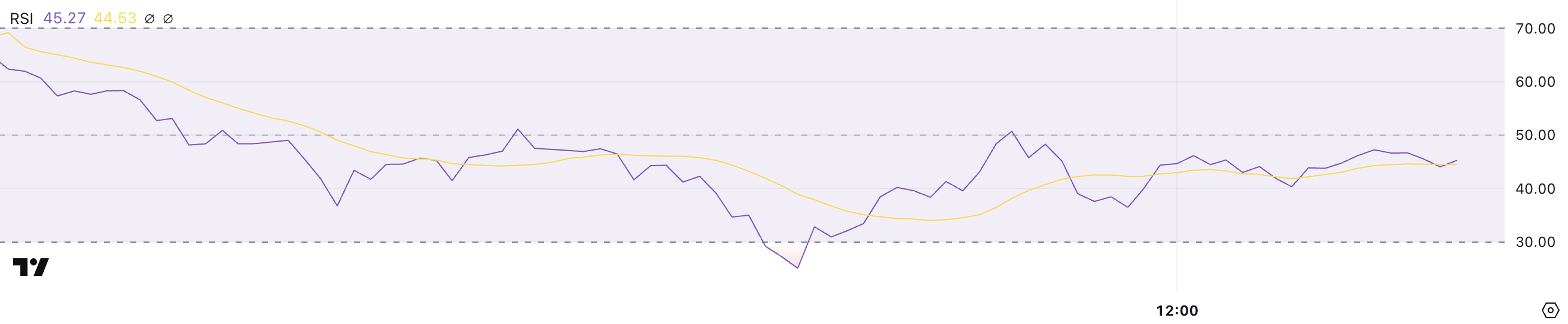

PI RSI: A Dramatic Fall from Grace

In a tale of dramatic irony, the RSI of Pi Network now rests at 45.2, a stark contrast to its earlier peak of over 90. This initial surge, driven by fervent buying and market exuberance, has given way to a sobering reality. The swift decline to 25.1, a few hours prior, reflects a market sentiment that has turned on a dime, as selling pressure takes the reins.

The recovery to 45.2 suggests that the extreme selling has abated, yet the RSI’s position below 50 indicates that bearish sentiment still holds sway. The Relative Strength Index, that fickle friend, oscillates between 0 and 100, offering insights into the market’s pulse. An RSI above 70 signals overbought conditions, while below 30 hints at oversold territory. With Pi’s RSI hovering at 45.2, we find ourselves in a neutral to slightly bearish landscape, as traders await a clearer path forward. 😬

This precarious position suggests that while selling pressure has eased, the appetite for buying remains tepid. Should the RSI ascend above 50, it may herald a bullish reversal, igniting hopes of a

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DEXE/USD

- ALEO/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Discover the Exciting World of ‘To Be Hero X’ – Episode 1 Release Date and Watching Guide!

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- ‘I’m So Brat Now’: Halle Berry Reveals If She Would Consider Reprising Her Catwoman Character Again

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Who Is Sentry? Exploring Character Amid Speculation Over Lewis Pullman’s Role In Thunderbolts

2025-02-21 04:05