So, here we are, folks! Onyxcoin (XCN) has taken a bit of a tumble, down 16% over the past week. But wait! Before you start crying into your crypto portfolio, it’s still up a whopping 52% over the last 30 days. Talk about a rollercoaster ride! 🎢 The XCN Relative Strength Index (RSI) is currently lounging at 40.1, which means we’re experiencing a mild bearish momentum. It’s like a gentle breeze rather than a hurricane, so no need to panic just yet.

Meanwhile, the Average Directional Index (ADX) has decided to take a vacation, dropping to 15.1. This suggests that the downtrend is losing its grip, like a toddler letting go of a balloon. 🎈 Despite the ongoing bearish trend, the Exponential Moving Average (EMA) lines are hinting that XCN might just muster the courage to challenge some key resistance levels. If the stars align, we could see a surge of up to 30% before March. Fingers crossed! 🤞

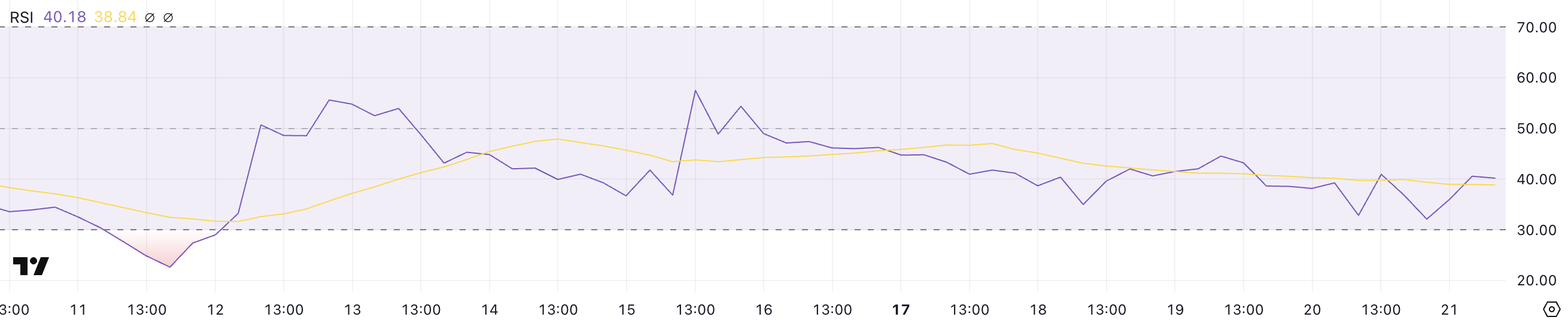

XCN RSI Has Been Neutral Since February 12

XCN’s RSI is currently at 40.1 and has been hanging out below 50 for the past five days, without dropping to the dreaded oversold level of 30. It’s like that friend who always shows up to the party but never quite gets on the dance floor. 💃

This indicates that XCN is experiencing mild bearish momentum, but it’s not a total disaster. The fact that it hasn’t touched the 30 levels suggests that selling pressure is more like a gentle nudge rather than a shove, potentially signaling a consolidation phase or a weakening of the bearish trend.

Now, the RSI is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100. Typically, an RSI above 70 is like a red flag, indicating that an asset may be due for a correction or pullback. On the flip side, an RSI below 30 is like a “buy me” sign, suggesting the asset could be undervalued. With XCN’s RSI at 40.1, it’s in a cautious zone where bearish sentiment exists but isn’t particularly strong. It’s like waiting for the kettle to boil—will it or won’t it?

If buying interest picks up, XCN could waltz its way towards the 50 mark, signaling a potential reversal to bullish momentum. Conversely, if it continues to weaken, a drop below 30 would indicate increased selling pressure and a possible continuation of the downtrend. Yikes! 😱

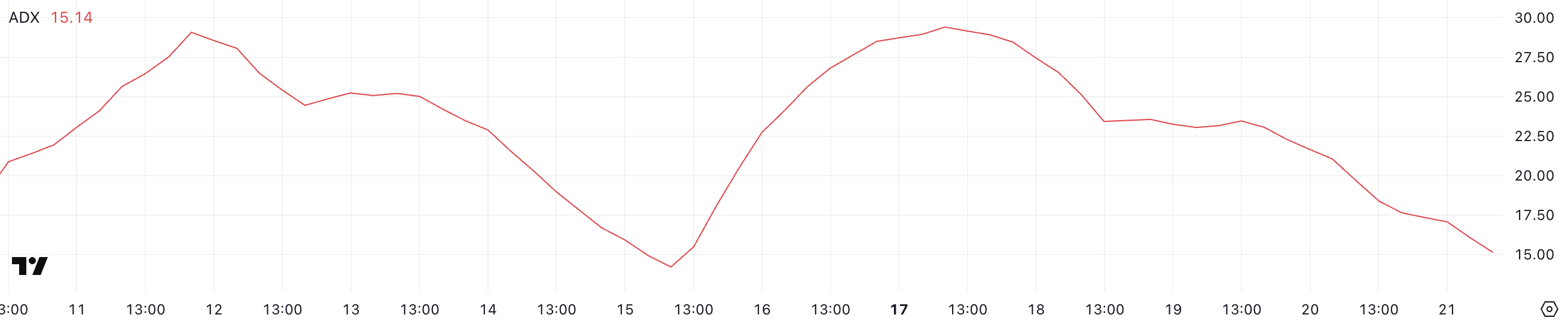

Onyxcoin ADX Shows the Downtrend Is Easing

Onyxcoin, built on Arbitrum, currently has an Average Directional Index (ADX) of 15.1 after reaching a peak of 29.4 just four days ago. It’s like watching a soap opera—just when you think the drama is at its peak, it starts to fizzle out. 📺

The drop below 20 suggests that the downtrend, which has been present over the last few days, is losing momentum. While Onyxcoin’s price is still in a downtrend, the declining ADX indicates that the strength of this bearish movement is diminishing, potentially leading to a period of consolidation or a slowdown in selling pressure. It’s like the market is taking a breather.

ADX is an indicator used to measure the strength of a trend, regardless of its direction. It ranges from 0 to 100, with values below 20 indicating a weak or non-existent trend and values above 25 suggesting a strong trend, either bullish or bearish. When ADX is rising, it signals strengthening momentum, whereas a declining ADX suggests weakening trend strength. Onyxcoin’s ADX at 15.1 suggests that the current downtrend is losing power, and the market is entering a phase of low momentum. It’s like a car running out of gas—slow and steady!

This could lead to a period of price consolidation or even a potential reversal if buying interest returns. However, as long as the ADX remains below 20, any price movements are likely to be weak and lack significant directional

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-22 06:18