For a while now, Nvidia (NVDA) has been the go-to stock for artificial intelligence (AI), but due to its recent surge in value, some investors are wary about whether it’s still worth investing more given the current price. While I acknowledge the reservations, I believe there is a strong case that Nvidia doesn’t appear overpriced when considering a timeframe beyond just one year.

Should you be prepared to hold onto Nvidia shares for a period of three to five years, I believe it could be an opportune moment to invest. On the other hand, if your timeframe is limited to just one year, the stock might seem relatively expensive.

Data center expansion will continue to be a massive source of growth

Nvidia dominates the global market in graphics processing units (GPUs), thanks to top-notch hardware and software that lets users tailor GPUs for diverse tasks. Experts suggest that over 90% of data centers worldwide rely on Nvidia’s GPUs, demonstrating how popular their products have become.

GPUs aren’t solely utilized for AI tasks; they are employed whenever a demanding computational job is required. These tasks range from drug discovery, cryptocurrency mining, engineering simulations, all the way back to their initial purpose, graphical rendering in gaming. The reason GPUs perform well in these roles lies in their capacity to process numerous calculations simultaneously. Furthermore, when connected in clusters, the power of GPUs can be significantly boosted almost instantly.

2025 has seen AI hyperscalers announce unprecedented capital investments, predominantly for building new data centers. This trend is set to continue and even escalate in 2026, with data center construction projects spanning several years ahead. As a tech enthusiast, I’m excited about this because it aligns with Nvidia’s projection made at their 2025 GTC conference – they expect the global spending on data centers to surge from $400 billion in 2024 to an astounding $1 trillion by 2028. This upward trend in data center investments is a promising sign for Nvidia’s stock, as their GPUs are highly sought-after components in these modern tech hubs, making me optimistic about its growth over the long term.

If this situation arises, there’s ample opportunity for Nvidia’s stock to escalate, given its significant stake in the market. In its fiscal year 2025 (covering most of 2024), the company reported a staggering $115 billion in data center revenue. This implies that Nvidia accounts for almost 30% of overall data center expenditure. If it manages to preserve this market share, it could potentially rake in an astounding $300 billion from data centers alone, assuming the forecast holds true.

I’m thrilled to note that today’s figures offer a substantial advantage, which means the stock price seems more appealing than it might have first appeared!

Nvidia’s stock appears expensive, but so do many others in the market

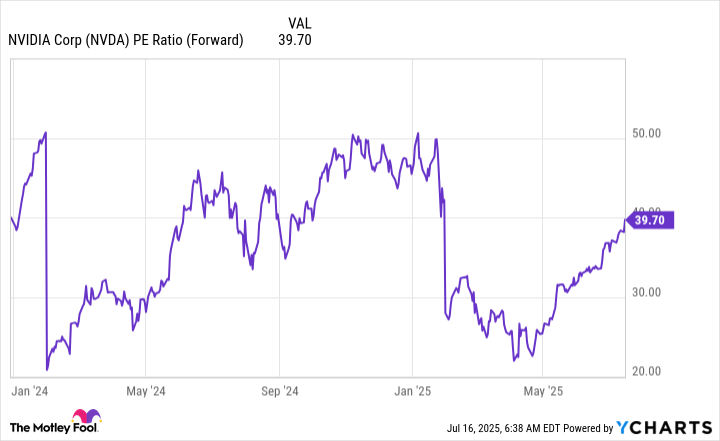

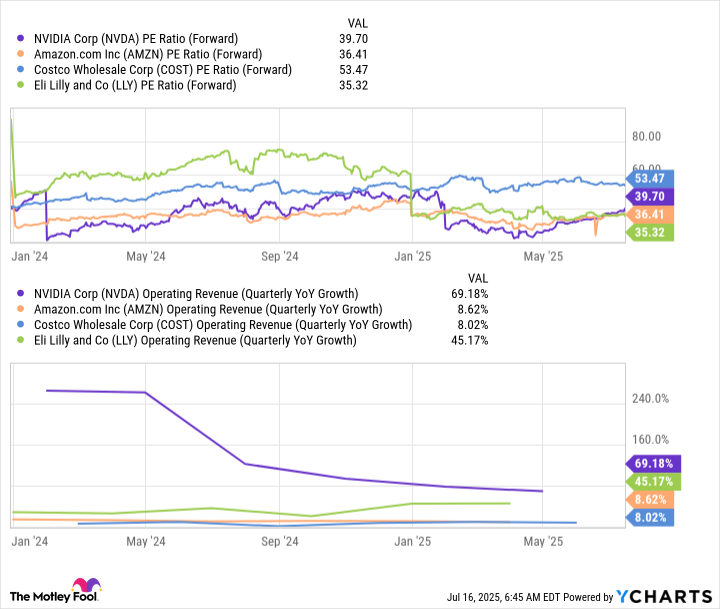

Currently, Nvidia’s stock trades at about 40 times forward earnings.

Historically speaking, Nvidia has been one of the rare firms that have managed to expand rapidly and maintain profitability, with a notable exception being its relatively high cost compared to other businesses. For their Q2 earnings, Nvidia anticipates a growth rate of 50% in revenue, which significantly outpaces the majority of companies within the market.

To add to this, if you label Nvidia as costly, then it’s important to note that many other stocks might require similar caution from investors. For instance, Amazon (NASDAQ: AMZN) with its 36 times forward earnings, Eli Lilly (NYSE: LLY) boasting 35 times forward earnings, and Costco Wholesale (NASDAQ: COST) at 53 times forward earnings are equally expensive. However, these stocks lack the growth rate and potential upside that Nvidia offers.

From my perspective, it appears that the overall market is quite pricey at the moment. However, given the swift growth trajectory of Nvidia and its promising long-term outlook, I believe it remains a secure choice for investors to acquire shares now, provided they are prepared to hold onto them for three to five years. Keeping this timeframe in mind, Nvidia continues to be an attractive investment option.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-20 14:12