In the month of April, I pointed out Nvidia (NVDA) as one of the two technology stocks that appeared undervalued, given its price of approximately $100 per share.

In approximately three months, the stock price reached $173, positioning the chip supplier as the world’s most valued publicly traded company, boasting a market capitalization exceeding $4.2 trillion. Given shares are nearing their peak, we’ll delve into Nvidia’s latest financial reports, insights from management about future prospects, and whether it remains a worthwhile investment opportunity today.

Nvidia’s growth continues to impress, even with geopolitical challenges

Nvidia’s remarkable ascent can be attributed to extraordinary growth, as evidenced by the company’s financial Q1 of 2026, which saw a staggering revenue of $44.1 billion. This figure represents a 69% increase compared to the same period the previous year and a 12% rise from the preceding quarter. The standout contributor was its data center division, generating an impressive $39.1 billion on its own, driven by ongoing demand from cloud services, government entities, and businesses constructing AI infrastructure.

Regarding its financial summary, Nvidia reported a net profit of $18.8 billion for the quarter, marking a 26% increase compared to the same period last year but a 15% decrease from the previous quarter. The decrease was largely attributed to a $4.5 billion cost related to U.S. restrictions on its H20 chips, which were tailored for the Chinese market. In April, the U.S. government enacted new rules that necessitate Nvidia to acquire a license to sell these chips to China, a significant growth market that is now inaccessible due to these regulations. Consequently, Nvidia had to record an inventory loss and costs associated with their H20 line commitments.

In a straightforward manner, CEO Jensen Huang stated during the earnings call that the approximately $50 billion Chinese market is essentially off-limits to American industries. He argued that protecting Chinese chipmakers from U.S. competition serves to bolster their international standing while simultaneously undermining America’s competitive edge.

Lately, Nvidia has expressed that it is working towards getting approval to restart H20 sales in China. They mentioned that American officials have promised to release the necessary licenses, with shipments scheduled to start soon. In this deal, Huang emphasized that Nvidia intends to increase its U.S. investment, focusing on job creation, enhancing domestic AI capabilities, and expanding domestic manufacturing operations.

Currently, Huang and Nvidia seem to be handling geopolitical upheavals with relatively little lasting harm. After the recent announcement, shares increased by 4%, implying that investors are hopeful that the most difficult times might already have passed.

Moving forward, Nvidia initially projected revenues of $45 billion for the second quarter, but faced a potential shortfall of $8 billion due to export restrictions. With these restrictions now lifted, the company’s results could potentially improve, although this improvement might occur towards the end of its fiscal second quarter.

Nvidia’s strong balance sheet gives management flexibility

In the last quarter alone, Nvidia announced an impressive surge of $53.7 billion in cash and liquid assets, marking a significant 71% rise from the $31.4 billion held the previous year. This substantial sum yielded an interest income of approximately $515 million during that period, exceeding the $244 million paid out as dividends by more than double.

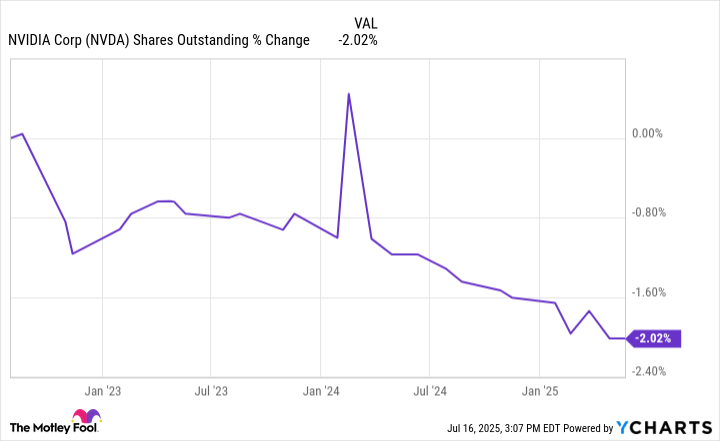

Nvidia’s management prefers to return capital to shareholders primarily through buying back shares rather than offering dividends, with a dividend yield of only 0.02%. In the initial quarter of its fiscal year, the company purchased $14.1 billion worth of stock, an increase from $7.7 billion a year prior. Although this amount is small compared to Nvidia’s massive $4.2 trillion market capitalization, it demonstrates management’s belief in the company’s long-term worth, even after its significant stock growth. Additionally, share repurchases boost the value of existing holdings by reducing the total number of shares outstanding, as Nvidia has reduced its share count by 2% over the past three years.

Is Nvidia still a buy?

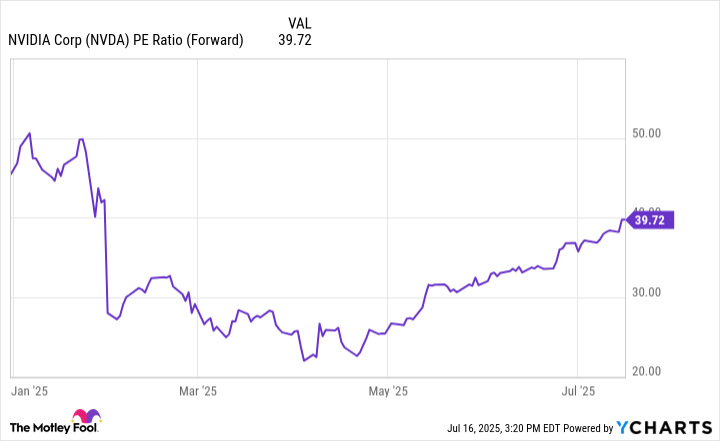

The value of Nvidia’s shares has significantly increased, now priced at around 40 times their predicted future profits, which means it may not offer the same great deal as it did a while ago.

Valuation isn’t the full picture when it comes to Nvidia. This company is uncontested as the leader in AI computing, and its dominance seems to only strengthen with each new product release. To understand the scale of investment companies are making in AI, simply take a look at tech giants like Amazon, Apple, Meta Platforms (Facebook), and Microsoft, who are projected to spend a staggering $320 billion on technology by 2025, an increase from their 2024 budget of $230 billion, which includes data centers.

Huang emphasized that Nvidia is increasingly dominating the field of artificial intelligence computing, referring to this period as another industrial revolution in the making. The firm consistently pushes technological limits, with their latest move being the release of the Blackwell NVL72 AI supercomputer – a machine designed for advanced reasoning, currently under mass production.

As an ardent follower of technological advancements, it’s clear that Nvidia is leading the charge in this tech revolution. Lately, its stock has been on a significant upward trend, which might make some potential investors hesitant to jump in right away. For those with a long-term perspective, a measured strategy like dollar-cost averaging could be a wise choice for gradually building a stake in one of the key players shaping the future of technology.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-21 14:37