Nvidia (NVDA) stands out as a dominant force in the realm of artificial intelligence (AI), with its graphics processing units (GPUs) playing a pivotal role in AI model training and processing since day one. Over time, Nvidia has consistently introduced cutting-edge products to preserve its lead. Yet, it’s essential to note that traditional computing is not the only method for AI training; quantum computing, an emerging approach, could potentially capture more attention in the future.

Although Nvidia hasn’t definitively entered the quantum computing field, they are bolstering their presence through diverse initiatives that could potentially pave the way for them to bridge the chasm between conventional and quantum computing. Given Nvidia’s active participation in this sector, does it make a wise choice to invest in quantum computing stocks at this moment? One might consider it so, considering the potential relevance of quantum computing is probably still a few years off.

Nvidia is acting as a support company in quantum computing

Nvidia doesn’t construct quantum computers itself, instead, it allows specialized quantum computing companies and other tech giants to handle that. However, Nvidia is concentrating on a hybrid method that merges traditional and quantum computing. This hybrid focus involves supplying the hardware and software for the conventional side to facilitate interaction with quantum processing units (QPUs) that are being developed by others.

One significant advancement is the introduction of CUDA-Q, a quantum computing adaptation of Nvidia’s software. The success of Nvidia’s GPUs in AI applications was largely due to its CUDA software. If CUDA-Q becomes the preferred platform for quantum computing, it will solidify Nvidia’s position within the industry.

This method is shrewd because Nvidia isn’t heavily investing financial resources into the quantum computing competition like some other corporations are. Instead, they’re focusing on creating tools that will aid the leading company in making quantum computing accessible to everyday markets.

Investing in quantum computing companies without any additional income streams before relevant years have passed could be risky, given that most experts predict widespread access to quantum computers won’t occur until around 2030. A prudent approach might be to choose a large tech company involved in the quantum computing race or invest in a versatile player like Nvidia, who stands to gain from the emergence of quantum computing regardless of the final winner.

Given the circumstances, it seems that investing in Nvidia could prove beneficial in the field of quantum computing. It might be an excellent choice to consider among top quantum computing stocks. However, whether buying Nvidia is wise at present in the current market remains uncertain.

Nvidia’s stock appears to be expensive, but it has strong growth ahead

Over the past several months, the market has experienced significant growth, and Nvidia’s share price has grown along with it. This year, the stock has climbed approximately 30%, leading to an increase in Nvidia’s overall value or market capitalization.

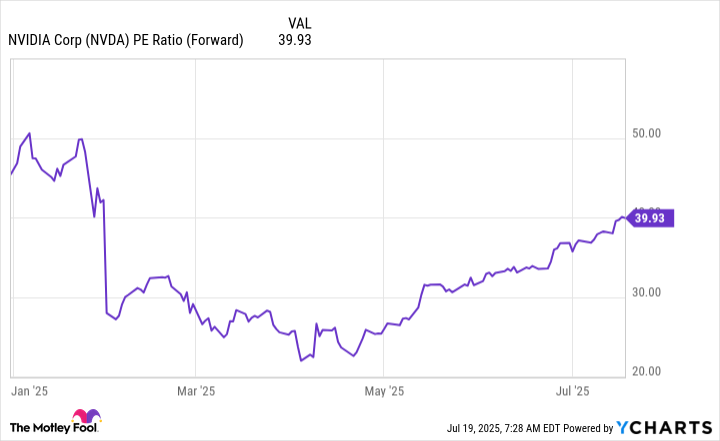

From my perspective, although its valuation stands at 40 times its forward earnings, it doesn’t seem excessively pricey compared to other leading tech companies. However, what sets Nvidia apart from its peers is its astonishing growth rate. Predictions suggest that the company’s revenue will surge by a staggering 50% in Q2.

Furthermore, it’s possible that 2026 could witness a surge in data center demand, given that AI hyperscalers have declared significant investments for the year 2025, a trend likely to continue into 2026 as these data centers are constructed and equipped with Nvidia GPUs.

Based on my analysis, it’s my conviction that Nvidia continues to be a promising investment choice, offering substantial growth prospects stemming primarily from its AI expansion, while quantum computing might fuel additional growth approximately by 2030.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2025-07-20 04:51