The gilded names of the “Magnificent Seven” have long monopolized the gaze of investors, their balance sheets bloated with the manna of artificial intelligence’s ascent. Yet in the shadow of these titans, a cadre of lesser-lauded neocloud leviathans claws toward relevance, their valuations soaring on the frenzied pursuit of AI’s Promethean fire. Among them, Nebius (NBIS +6.83%) stands as both testament and cautionary tale-a creature born of geopolitical rupture, now tethered to the volatile whims of silicon prophets.

Bear witness to its lineage: Nebius emerged from the fractured remains of Yandex, that Russian search monolith expelled from Nasdaq’s temple when the cannons of Ukraine’s siege roared. Conceived as Yandex’s internal GPU-laden hydra, it now rears its head in Amsterdam’s financial courts, reborn as a so-called “neocloud” apostle alongside CoreWeave. Their creed? To furnish the electrum of AI-Nvidia’s sacred GPUs-upon demand, mirroring Amazon’s AWS dominion yet dedicated to the algorithmic sublime. A noble cause, or so the prospectuses claim.

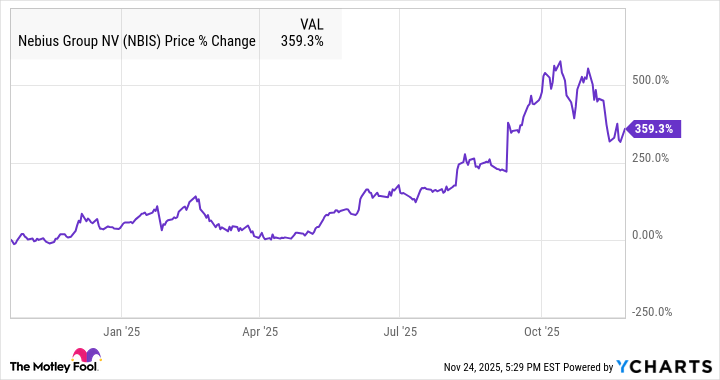

Examine its rebirth: On October 21, 2024, Nasdaq’s gates swung open once more, and Nebius’ shares ascended like a condemned soul granted temporary reprieve. The chart below bears witness to this fever-dream trajectory-a paroxysm of capital euphoria.

The Machinery of Ascension

Let the numbers speak their damning testimony. In Q3, revenue surged 355% to $146.1 million-a figure both magnificent and meaningless. Analysts had dreamed of $155.7 million; the shortfall became a pretext for November’s market inquisition. Adjusted EBITDA? A near-miraculous $5.2 million loss, sustained by the opiate of $99 million in depreciation-a phantom savior masking the rust devouring its silicon bones. Under GAAP’s unflinching lens, a $119.8 million net loss gapes like an open wound.

Yet these numbers are mere hieroglyphs on the tomb of conventional accounting. Nebius and CoreWeave gamble on a future where AI’s insatiable maw never relents-a wager staked on debt’s quicksand. Nebius has conjured $4.1 billion in convertible debt this annum alone, a Sisyphean burden should growth falter. And what of the GPUs themselves? Hedge fund Cassandra Michael Burry whispers of depreciation’s unspoken heresy: that these circuits, worshipped as eternal, may decay faster than accountants dare admit. Through Q3 2025, $223.3 million in depreciation feasted on a $3.31 billion property ledger-a sacrament of obsolescence.

The Oracle’s Dilemma

What then of sustainability? The neoclouds’ creed hinges on AI demand’s perpetual crescendo-a faith tested by market tremors. Partnerships with Microsoft and Meta offer temporary absolution, yet the altar bears risks: debt’s guillotine, depreciation’s relentless tide, and the spectral possibility of an AI winter. For risk-tolerant speculators, Nebius offers a chalice of volatility, its triple-digit growth a siren song amid the broader market’s existential quavering.

Is Nebius a buy? For those who court volatility as both lover and executioner, a sliver of this chimera may adorn a portfolio. But know this: its story is written in disappearing ink, the ledger pages dissolving should the AI epoch prove mortal. The equity researcher’s pen trembles-not from doubt, but from documenting yet another chapter in capitalism’s endless cycle of creation, delusion, and reckoning. 🧩

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Top gainers and losers

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Gay Actors Who Are Notoriously Private About Their Lives

2025-11-28 15:33