Recently, the conversation surrounding autonomous driving has shifted away from Tesla and Waymo, as on July 17th, it was announced that the ride-sharing company Uber Technologies (UBER) is collaborating with electric vehicle manufacturer Lucid Group (LCID). This partnership aims to realize Uber’s dreams of developing their own fleet of robotaxis.

After the announcement of the deal, Lucid’s shares surged almost 40%. Now, let’s delve into the details of this partnership between Lucid and Uber, and consider if it might be a suitable opportunity for investors to invest in Lucid.

How are Uber and Lucid working together?

As an avid investor, I’d like to shed some light on the intricacies of Uber’s partnership with Lucid before delving into details. You see, understanding Uber’s business model is crucial, much like grasping how Airbnb operates without owning or constructing properties. Unlike traditional automobile companies that manufacture and sell vehicles, Uber isn’t in the car-making business. Instead, it leverages a unique approach: drivers who own (or lease) their cars offer ride-hailing and delivery services via an app, directly connecting them with users.

As giants like Waymo and Tesla pour billions into refining autonomous vehicle tech, Uber is making moves in the robotaxi sector by forging strategic alliances with auto manufacturers and robotics experts.

From now on, Lucid will align with notable companies such as Waymo, WeRide, Avride (belonging to Nebius Group), and Serve Robotics within Uber’s autonomous driving network.

According to the agreement, Uber is planning to contribute $300 million towards Lucid Motor Company’s production of around 20,000 (or more) vehicles over the next six years. These vehicles will be outfitted with self-driving technology provided by Nuro, a partner of Uber.

Is Lucid stock a buy now?

The table given provides an analysis of Lucid’s manufacturing and distribution data, profits after deducting costs (gross profit), and their trends from the past year.

| Category | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 |

|---|---|---|---|---|---|

| Production | 1,728 | 2,110 | 1,805 | 3,386 | 2,212 |

| Deliveries | 1,967 | 2,394 | 2,781 | 3,099 | 3,109 |

| Gross Margin | (134%) | (134%) | (106%) | (89%) | (97%) |

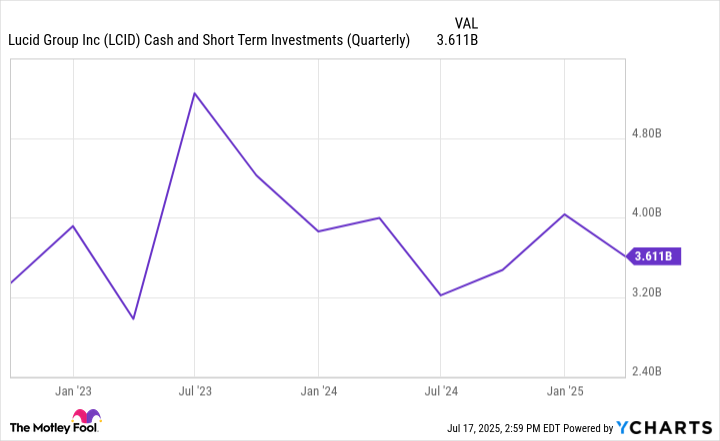

Observing the diagrams here, certain recurring aspects are hard to ignore. Initially, I notice that Lucid’s manufacturing and delivery numbers have shown inconsistencies across multiple recent quarters. Additionally, much like other emerging electric vehicle manufacturers, such as Rivian, Lucid seems to be swiftly depleting its financial resources.

While I can’t help but feel a bit ambivalent about Uber investing $300 million into Lucid, considering the trends shown in the graph, it seems that Lucid may be relying on this injection of funds to meet its existing orders from Uber.

Lucid’s current financial situation, with less profitable operations, could pose challenges in the long term when compared to established, technologically advanced companies like Waymo and Tesla. Additionally, planning to produce only 20,000 cars over six years doesn’t convey a strong sense of urgency, particularly when competition from competitors such as Waymo and Tesla is intensifying.

In my opinion, this agreement carries a significant amount of execution risk for Lucid, and it appears Uber is aggressively pushing for partnerships in the self-driving car industry, aiming to challenge Tesla more head-on. However, Tesla has shown minimal inclination towards collaborative efforts so far.

As a fervent admirer, the allure of joining Uber’s world is undeniable, but at this point, it seems more like a captivating public relations boost for Lucid. Don’t get me wrong, if successful, this partnership could revolutionize Lucid in the future; however, their strategic plan remains hazy and speculative at present. Consequently, I believe that the Uber collaboration, in itself, is not enough to motivate a purchase of Lucid stock at the moment.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

2025-07-20 08:22