In the distant, foggy future, when we look back on the marvels of human ingenuity, we might fondly remember the era of flying taxis. It’s hard not to imagine us-dressed in inexplicably futuristic clothing, probably with holographic umbrellas-gliding effortlessly over traffic, sipping lattes, while the city sprawls below us like an expensive model train set. Archer Aviation, with its electrifyingly optimistic Midnight aircraft, seems poised to be part of this dream, launching its first commercial air taxis in the UAE, followed, presumably, by New York City. But before you throw your hard-earned money at it, let’s pause for a moment. Is this the future? Or is it just another over-hyped ride to disappointment?

Archer’s Progress: Bold Steps, But Still a Whole Lot of Hope

There’s a buzz-no, a hum-surrounding Archer’s Midnight aircraft. It promises to ease traffic congestion in the urban jungle, which, if we’re being honest, could use some help. Archer’s partnership with United Airlines only sweetens the deal, suggesting that these flying taxis might not be the stuff of vaporware. And let’s not forget the Olympics in Los Angeles, where these aircraft will take center stage in 2028. Imagine it: the world watching, as futuristic taxis zip overhead, while we-perhaps caught in the very traffic the taxis are supposed to solve-wave cynically.

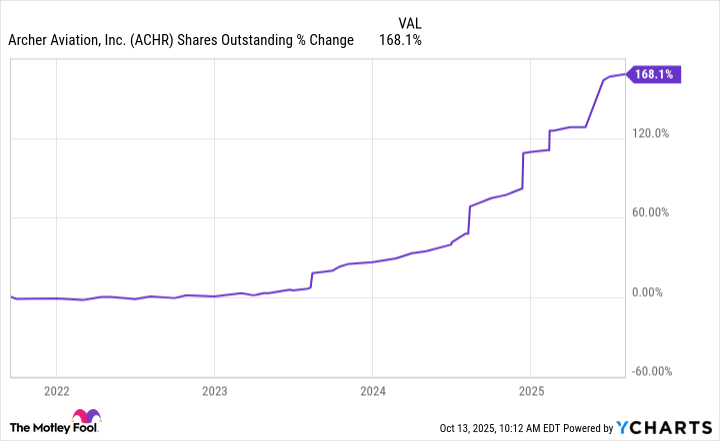

Still, the company is in its infancy. Its aircraft might look sleek in renderings, but until they’re being cranked out at scale, and until there’s actual revenue coming in, we’re left with little more than a promise wrapped in a slick marketing campaign. Sure, it’s exciting, but will it be financially sustainable? Will there be enough demand to justify the skyrocketing production costs? We don’t know. What we do know is that without cash flow, and enough to fund operations, we’re looking at a future where more shares might need to be offered-more dilution, more risk.

The Valuation: Is Archer Living in the Stratosphere?

Now, let’s talk numbers. Archer is valued at around $8 billion. Yes, billion. And here’s the kicker: the entire eVTOL market, according to Grand View Research, was valued at just over $2 billion last year. So, if we’re playing this game of “valuations,” Archer is roughly four times the size of the market it operates in. If you were to explain that to your accountant, they’d probably throw their calculator at you and suggest a nice walk outside. Paying a premium for something that doesn’t yet exist at scale seems like a gamble. And not the fun kind of gamble, either. The kind where you wonder why you’re holding the dice and whether they’re loaded.

If you’re betting on ideal conditions-the assumption that everything will go well, that Archer will scale, and the market will explode-you’re basically hoping the stars align. I mean, it’s entirely possible, but it’s equally likely that something could go wrong. Maybe the battery technology doesn’t scale, maybe regulators get cold feet, or maybe we just can’t stop complaining about the noise. A high valuation based on rosy projections leaves little room for safety, which, for investors, is a bit like hoping your seatbelt will hold up in a crash test. It might, but there’s no guarantee.

So, Should You Buy Archer Stock? Slow Down, Partner

Archer Aviation is a fascinating story-if you’re into electric vertical takeoff and landing aircraft (and honestly, who isn’t?). The Midnight aircraft looks like something out of a sci-fi movie, and with partnerships with companies like United Airlines, there’s a certain allure to the stock. But let’s not get carried away. The company has a lot to prove. A wait-and-see approach seems like the safest bet. There’s no rush to buy in, especially given the inflated valuation and the long road ahead. Sure, you might miss out on some early gains, but you’ll also avoid the risk of investing in something that might crash before it ever gets off the ground.

Investing is like relationships: it’s better to wait for the right moment rather than rush into something that feels right in the moment. After all, isn’t that what we all wish we’d done in our twenties? 😊

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-10-16 13:54