Almost everyone relies on the S&P 500 as a benchmark for tracking the U.S. stock market’s performance due to its comprehensive reflection of the American economy. However, just because it’s widely used doesn’t necessarily mean it’s the wisest choice for investing in stocks.

Depending on your unique investment strategy and objectives, you might find that the Invesco S&P 500 Growth Allocation at Risk (GARP) ETF (ticker symbol: SPGP, currently at 1.00%) could be a more suitable choice for you. Here’s why this fund may appeal to some investors:

1. Focus on growth and value: The GARP ETF targets companies that exhibit both strong growth potential and undervalued characteristics, offering a balanced approach to investing.

2. Diversification: By investing in a diversified portfolio of U.S. equities, the fund helps reduce the risk associated with putting all your eggs in one basket.

3. Low expense ratio: The SPGP ETF has a competitive expense ratio, making it an attractive option for investors seeking to minimize fees and maximize returns.

4. Solid track record: With a proven performance history, the Invesco S&P 500 GARP ETF could be a reliable choice for those looking to build long-term wealth.

What exactly does the S&P 500 track?

The S&P 500 comprises approximately 500 significant company stocks chosen by a panel. These stocks typically play crucial roles within their respective industries, making them large corporations. The combined list of around 500 stocks is intended to offer a comprehensive reflection of the U.S. economy as a whole.

Although building an index does allow for monitoring the U.S. stock market’s performance, its primary objective holds a subtler intention. This becomes evident when considering the S&P 500 as a tool for investors pursuing a more refined investment strategy. In essence, this index serves as a succinct compilation of significant and economically influential companies.

The foundation for various investment strategies can be established by this method, as demonstrated by the SPDR Portfolio S&P 500 High Dividend ETF that selects high-yield stocks from the 500 stocks within the index. Other ETFs also generate value and growth portfolios using the same index, but the Invesco S&P 500 GARP ETF stands out as particularly intriguing.

What does the Invesco S&P 500 GARP ETF do?

This Invesco ETF, specifically the S&P 500 Growth at a Reasonable Price (GARP), initially focuses on the stocks within the S&P 500 index. It then assesses factors like sales growth per share, earnings growth per share, price-to-earnings ratios, financial debt, and return on equity to identify undervalued stocks that are supported by expanding businesses. Approximately 75 stocks make it into the index followed by this GARP ETF.

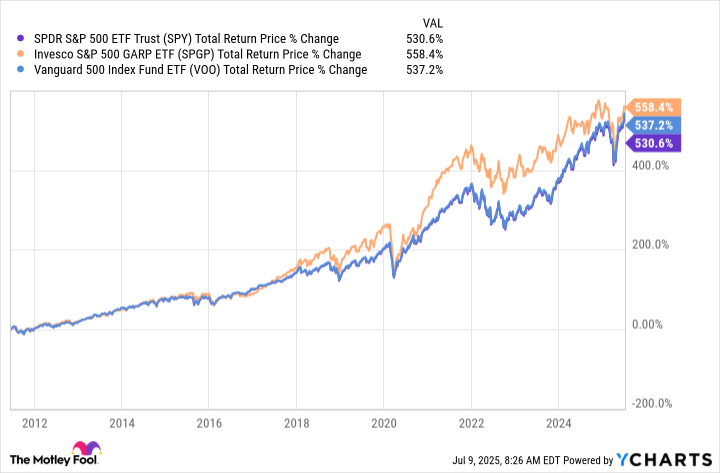

The final product is a portfolio that surpasses the performance of two widely used S&P 500 index ETFs: the SPDR S&P 500 ETF and the Vanguard S&P 500 ETF. It’s important to note that the difference in performance isn’t substantial, but over time, even small variations can accumulate. Essentially, investing in the Invesco S&P 500 GARP ETF focuses on selecting the most promising stocks within the index.

A different investment option, such as the Invesco S&P 500 GARP ETF, might not suit every investor. For instance, this ETF provides a relatively low dividend yield of about 1.5%, which is slightly higher than the S&P 500 index’s approximately 1.3%. However, it falls significantly short when compared to the SPDR Portfolio S&P 500 High Dividend ETF’s generous 4.5% payout.

If you’re focused on earning income, it might be best to avoid the Invesco S&P 500 GARP ETF. However, if your preference leans towards investing in a group of significant, economically influential companies that are currently undervalued and have strong growth potential, then the Invesco S&P 500 GARP ETF could be an ideal match for you.

The problem with the Invesco S&P 500 GARP ETF

Speaking candidly, there’s one minor issue with the Invesco S&P 500 GARP ETF: its expense ratio of 0.36% is relatively high when compared to other exchange-traded funds. However, given its strong performance, it appears that this ETF has more than justified its higher price tag.

Today, with the market reaching record highs, I find myself contemplating a shift in investment strategy. Instead of opting for a broad S&P 500 index fund, I’m leaning towards the Invesco S&P 500 GARP ETF. This particular ETF seems to offer a blend of value and growth stocks, creating an appealing alternative to traditional indices.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- Nvidia vs AMD: The AI Dividend Duel of 2026

- Where to Change Hair Color in Where Winds Meet

2025-07-18 01:03