Investors in financial technology are heavily interested in well-known companies such as Robinhood Markets and Coinbase Global, often the focus of media discussions. However, one lesser-known player in the brokerage sector is gaining traction and could potentially offer significant long-term returns: Interactive Brokers (IBKR). This institutional brokerage platform has transformed into a powerful retail force worldwide, successfully persuading investors to switch to its platform en masse, resulting in substantial revenue and earnings growth.

Is Interactive Brokers more likely to create wealth for millionaires, or has its $100 billion market value become inflated following a 400% increase in share price over the past five years? To unravel this mystery, let’s delve deeper and allow the data to speak for itself.

Institutional trading for the masses

Initially developed by a company specializing in market-making, Interactive Brokers was created as a means to leverage their advanced trading technology for a top-tier brokerage service. Originally serving affluent traders and investment firms, it has since broadened its reach to include individual investors through commission-free stock trading on IBKR Lite accounts.

Using advanced automation technology and access to numerous global stock exchanges and various asset types, it provides a more extensive selection of tradeable assets compared to conventional brokerage firms.

The unique value proposition that sets Interactive Brokers apart from other brokerage platforms is highlighted below, explaining its significant growth from managing only 200,000 accounts in 2015 to currently serving over 3.9 million customers. To illustrate this advantage, consider an investor residing outside the U.S. who wishes to purchase American stocks; Interactive Brokers would be a suitable choice compared to platforms like Robinhood.

On Interactive Brokers, investors worldwide have the opportunity to purchase assets across 200 different countries, ranging from stocks and bonds to options and commodities. For European traders specifically, investing in a U.S. company from the “Magnificent Seven” is made simple due to the extensive technology infrastructure developed over several decades on a global scale.

On Robinhood, foreign investors have been granted access to purchase tokens representing certain U.S. stocks, which are not direct company shares but rather derivative contracts with substantial fees attached. Compared to the extensive selection offered by Interactive Brokers, this demonstrates the wide range of global investment opportunities available through Interactive Brokers for their customers.

It’s not unexpected that an increasing number of individuals are moving towards the company’s brokerage services. This is due to the fact that it offers a more attractive value proposition compared to any other brokerage available.

Ongoing global expansion

The company’s appeal lies in the significant portion of market share yet to be seized in stock, bond, and asset trading. With its 3.9 million customers as of last quarter, it demonstrates a promising potential when compared to 26 million at Robinhood and 45.2 million at Charles Schwab.

In contrast to other brokerages that operate only within the U.S., Interactive Brokers aspires for a global reach, expanding its services to all significant trading markets worldwide. This broad market scope potentially includes hundreds of millions of customers. Even with a modest percentage of the clientele from active traders, it has the potential to amass over 10 million users in the upcoming decade.

Beyond boasting impressive long-term expansion potential, it stands out for having exceptionally high profit margins within its industry. This is largely attributed to its streamlined workforce and advanced automated trading systems. In the recent quarter, it reported an impressive pretax profit margin of 75%, translating to earnings of $1.1 billion from a revenue of $1.4 billion.

By adopting a highly profitable business model, Interactive Brokers stands among global leaders like Visa and Mastercard. While its revenue in the relevant market might not match some of the top-tier stocks, these impressive profit margins could potentially lead to earnings exceeding $10 billion if it continues to attract more clients to its trading platform.

Is Interactive Brokers a millionaire maker?

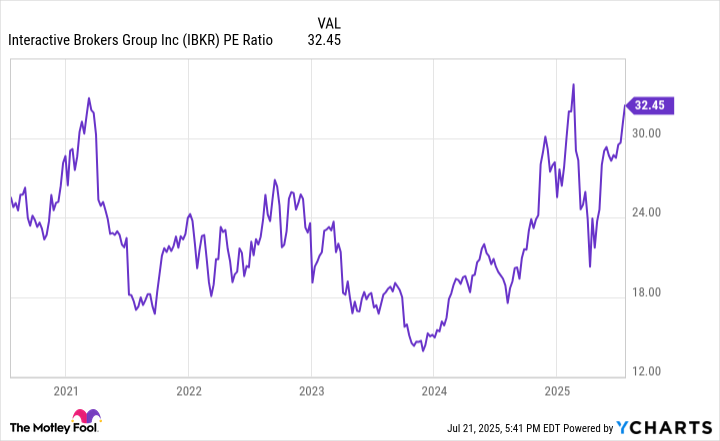

Over the past five years, shareholders of Interactive Brokers have experienced significant gains, with a total return reaching an impressive 412%. This outstanding performance has propelled the company’s market capitalization above $100 billion and raised its price-to-earnings ratio (P/E) to 32.5.

In simpler terms, these prices for this niche stock brokerage might seem high, but I still believe it’s a bargain for long-term investors (those with a time horizon of ten years). This is a company that has the potential to significantly increase its customer base within the next decade, which could lead to increased trading, revenue, and earnings.

I’m quite confident that the company could hit over $10 billion in yearly net income in the coming years, causing its P/E ratio to decrease significantly. Given that shares have already skyrocketed in the past five years and it currently has a market capitalization of $100 billion, immediate gains might not be as substantial.

Given my estimated growth projections for the next decade, investing substantially in Interactive Brokers has the possibility of turning it into a standalone million-dollar investment. Keeping this in mind, Interactive Brokers is a stock worth considering for a diversified portfolio as it could contribute to an individual reaching millionaire status over the coming years.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

2025-07-25 11:39