Almost two weeks have passed since Bitcoin reached that lofty peak, like a spoiled child on Christmas morning. Meanwhile, the crypto world hangs in suspense, as if waiting for the punchline of a very long joke.

According to Alphractal, that venerable oracle of crypto wisdom, some trends are brewing that suggest altcoins might just swoop in to steal the spotlight—and our wallets.

Bitcoin’s dominance has hit 64%, a number that could be mistaken for a resistance level or perhaps the weight of Uncle Ivan’s Sunday stories. Historically, whenever Bitcoin dominance dips from this height, altcoins embark on a rally so wild it would make a circus animal jealous—sometimes even 50 times wild! 🐒

Altcoin Dominance Near Critical Support — Brace Yourselves!

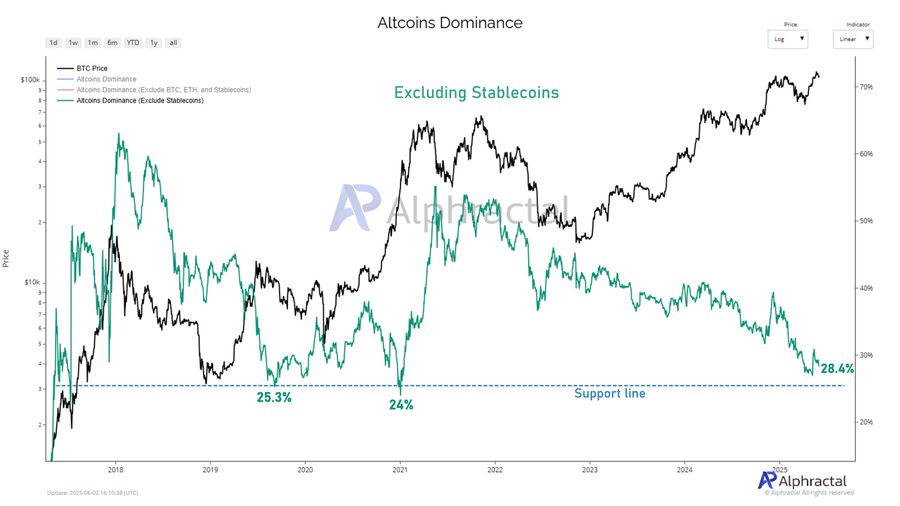

Data shows that altcoin dominance (excluding the ever-present stablecoins like USDT and USDC) has fallen to 28.4%. That’s close enough to support levels the market has reverently paid attention to before, possibly predicting what the market whispers about during long Russian winters: *”Now is the time… maybe.”*

Typically, when altcoin dominance hovers around 24% to 25.3%, the market sighs in relief, because it signals that altcoins are getting ready for a comeback—probably with more sass than usual. These levels have historically appeared when Bitcoin and stablecoins are hogging the stage, leaving altcoins to brood in the wings. 🍿

But lo and behold, as soon as altcoins reach this stage, they bounce back faster than Uncle Ivan avoiding his cousin’s questions about marriage.

With this support level approaching again, one might say the altcoins are sharpening their claws for another theatrical rise—perhaps more dramatic than a village tale.

Excluding Ethereum—Because Why Not?

Now, here’s a chart that skips not only stablecoins but also the noble Ethereum—because why include the main star? It shows that altcoin dominance (sans ETH and stablecoins) is at 18.92%. Close enough to the venerable 18%, which has served as a steadfast guardian for years, much like Aunt Masha’s patience during family visits.

Historically, when this level is touched, Bitcoin’s dominance would often take a nosedive, and altcoins would graciously, or perhaps begrudgingly, get a moment in the sun. Despite thousands of new coins blossoming like springtime dandelions, this level remains a formidable fortress.

Bitcoin at 64%—Is the Next Circus in Town?

Bitcoin, that stubborn beast, just reached 64%, a level known for causing tears and tantrums among traders. Crypto analyst CryptoElites shared a chart that shows this resistance has been a tough nut to crack—like trying to explain quantum physics to a drunk uncle.

In 2019 and 2021, Bitcoin peaked and then, like a dramatic Russian novel, fell sharply. And what happened next? Altcoins exploded—some with gains of 50x or even more. 🎢

The current scene suggests that history might repeat itself, and a glorious altcoin season—full of fireworks and questionable investment choices—is just around the corner.

Meanwhile, the altcoin index languishes at 22, reminding us that the road to riches is long and filled with unexpected detours, much like a village road after a snowfall.

Sponsor

Ah, rewriting in the style of Chekhov, are we? One imagines a world-weary sigh escaping each //api-prod.nex-ad.com/ad/event/viptOH6Y). Just as Chekhov’s characters yearn for connection, ManyChat helps businesses effortlessly connect with customers on platforms like Facebook, Instagram, and WhatsApp, automating responses and nurturing leads with a sigh of digital efficiency. It’s almost poetic, this dance of technology mirroring the human condition, offering a free trial to unlock new dimensions of business growth, a small solace in the vast, indifferent universe of cryptocurrency and fleeting altcoin rallies.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-06-03 10:55