A year ago, I found myself in uncharted territory with CrowdStrike (CRWD). An unfortunate software glitch from our end triggered the largest IT outage ever recorded, disrupting everything from airline flights to surgeries. The fallout was monumental; initial estimates suggested it would cost U.S. Fortune 500 companies over $5 billion. Over the past year, this incident has undeniably impacted our earnings. In an effort to make amends, we introduced “Customer Commitment Packages” as a gesture of goodwill.

Despite facing this challenge, CrowdStrike has remarkably continued to thrive, with its revenue increasing by double digits, and maintaining robust customer relationships. This growth has propelled the stock to rise more than 50% since the IT outage on July 19 of last year. So, is CrowdStrike a worthwhile investment today, one year after the major IT disruption? Let’s delve into it.

CrowdStrike’s AI-driven platform

Initially, let’s discuss the essence of CrowdStrike’s operations. This company specializes in providing a cloud-based cybersecurity system powered by artificial intelligence (AI). The platform, named Falcon, collects data from various aspects of a specific business to enhance and improve its capabilities. By learning from this data, it helps businesses thwart cyberattacks and other security issues they might encounter.

Falcon is comprised of several components, such as threat hunting, intelligence gathering, and automated malware analysis, among others. These modules can be customized according to a customer’s unique requirements, allowing them to tailor CrowdStrike’s services to perfectly fit their security needs.

For increased adaptability, CrowdStrike’s “Falcon Flex” enables clients to select specific services from their comprehensive offering on demand. This empowers customers to adjust the size of their security system by increasing or decreasing it at any given moment.

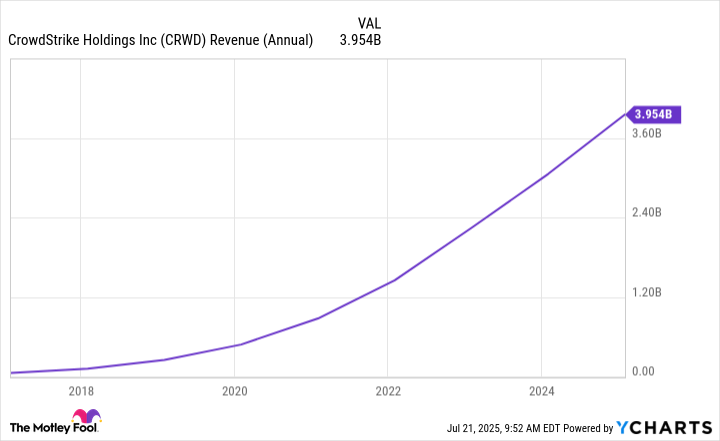

Last year’s widespread outage underscores the widespread appeal of CrowdStrike’s services, as it disrupted businesses globally. Furthermore, the company’s increasing revenue over the last few years demonstrates this popularity.

Let’s examine CrowdStrike’s journey following the outage. Here are two key points to keep in mind:

1) The incident was due to a software update glitch, not a cybersecurity breach, which means CrowdStrike’s competence in this field remains unquestioned.

2) CrowdStrike responded swiftly by providing a solution within an hour of the issue arising. Although some systems required several weeks to recover, their rapid crisis management underscores their efficiency, a trait that could reassure customers about their continued partnership with the company.

In their initial earnings report post-crisis, CrowdStrike announced that many customers chose to stay with them, and they also secured new contracts. However, certain customer retention packages have been a drag on earnings in subsequent quarters. These packages included benefits like discounts, extra modules, and flexible payment options. The company has now phased out this program by the end of Q4 (January 31), but anticipates that it will affect revenue until the end of this fiscal year.

Double-digit growth in recurring revenue

In the recent quarter, CrowdStrike has seen significant growth as their annual recurring revenue jumped by 22% to surpass $4.4 billion. Approximately $194 million of this growth was achieved within the quarter itself. Moreover, the company recorded a historic cash flow from operations amounting to $384 million. To top it off, CrowdStrike declared an authorization for share repurchase, enabling them to buy back up to $1 billion worth of shares; such a move indicates optimism about the company’s future prospects.

Reflecting on our current scenario, I find myself pondering: Given the entire spectrum of events, should CrowdStrike be considered a worthwhile investment a year following the major IT disruption? Despite the noticeable surge in CrowdStrike shares recently, reaching unprecedented heights, it’s crucial to remember that the company anticipates encountering challenges due to the outage for the remainder of this fiscal year. However, when it comes to investing, we should always focus on a company’s long-term potential. From this perspective, the company’s future appears promising. CrowdStrike has demonstrated resilience even in adversity and continues to expand. The consistent revenue patterns we observe at present indicate a bright outlook for the future.

As an ardent investor, I can’t help but see the potential in this stock today, a year post-crisis. It’s not just a buy; it’s a solid investment to secure for the long haul as we embark on a fresh era of growth.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Opendoor’s Stock Takes a Nose Dive (Again)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-07-22 11:32