Ah, the celestial dance of Cosmos (ATOM) unfolds! This fleetingly wonderful asset has sauntered to the tune of a 14% rise in the last 24 hours, waving its bullish banner high as technical indicators hint at more delightful escapades ahead. The Relative Strength Index (RSI)—that fickle friend—has catapulted from the depths of despair to nearly overbought territory, showcasing a fervent surge of buying pressure reminiscent of a passionate lover’s embrace.

On the mystical Ichimoku Cloud chart, ATOM has triumphantly breached the cloud, as bullish crossovers gracefully waltz into view, heralding what could be a noteworthy trend reversal. As the price flirts with a rather pivotal resistance zone, traders keenly observe whether our dear ATOM can sustain this breakout and flirt with the $6 mark come April. Will it flirt back? 🤔

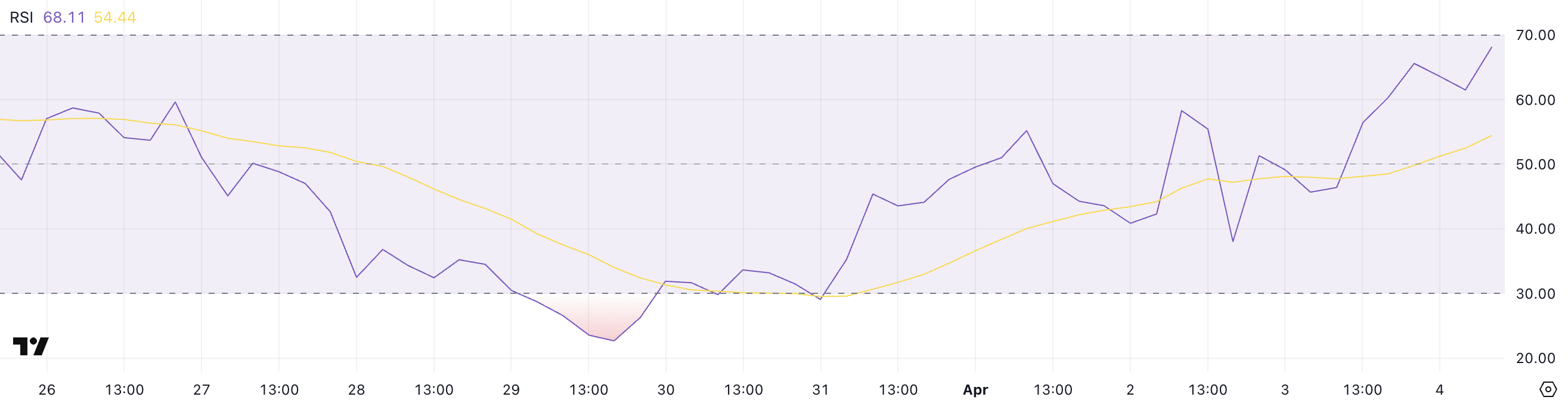

Cosmos RSI: Getting Awfully Cozy with Overbought Levels

Oh, how the tides have turned! Cosmos, in just a few short days, dances from a pitiful 29 to a respectable 68.11 on the RSI scale. This rapid ascension is akin to watching a caterpillar transform into a butterfly—if only it weren’t precariously close to the edge of falling off the perch of ‘overbought.’

Every chart aficionado knows the RSI is no ordinary indicator; it measures the pulse of price movements, oscillating between the extremes of zero and one hundred. A reading below 30—who would have thought—indicates our sweet Cosmos was utterly neglected and destined for a rebound, while above 70? Well, that’s just asking for trouble!

At present, ATOM’s RSI is primed near that troublesome threshold of 70, suggesting this recent price explosion might reach an exhausting climax—at least for now. Will it bounce jubilantly into overbought territory, or shrink back to more sensible inclinations? Only time will tell, though traders might start plucking profits like ripe cherries from a tree. 🍒

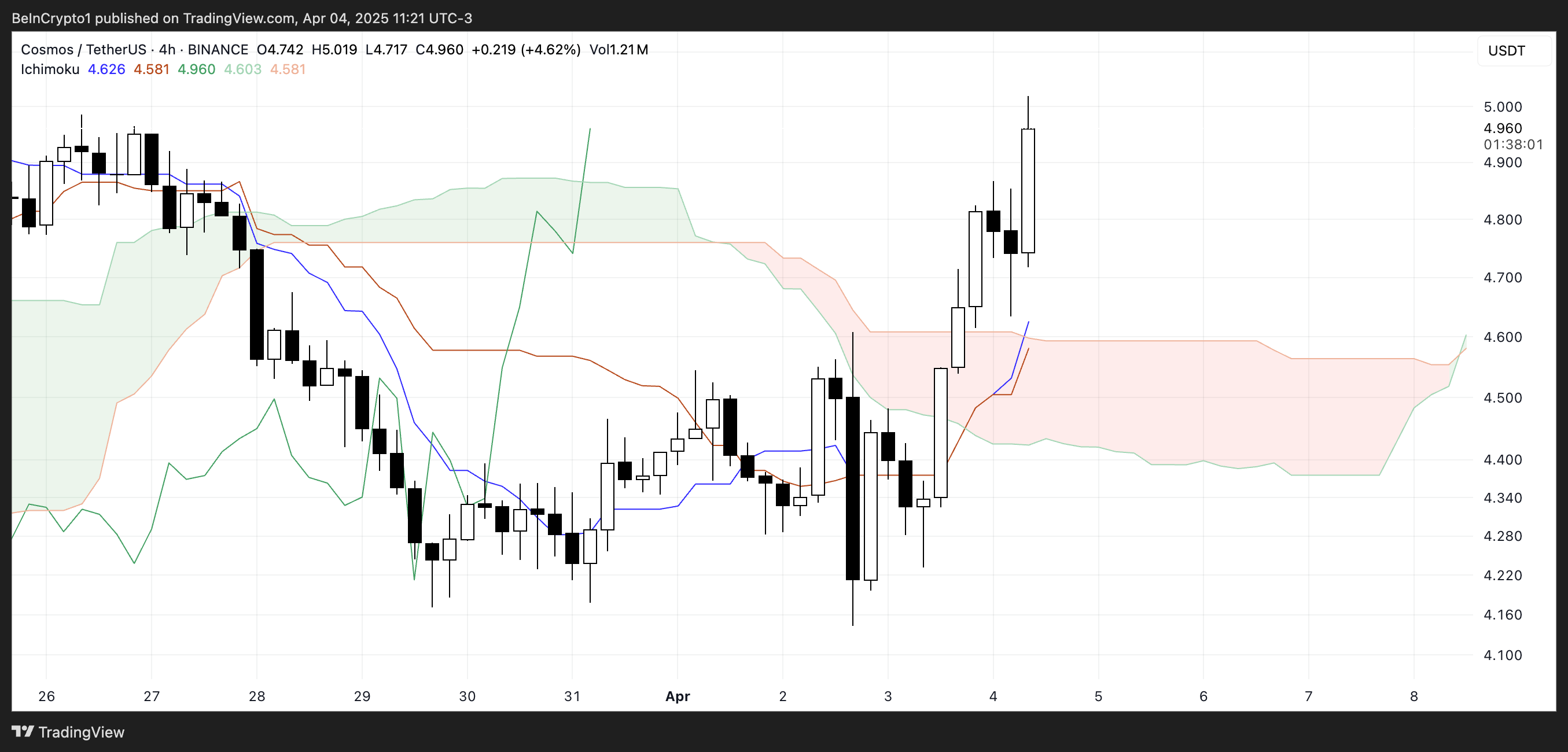

ATOM’s Ichimoku Cloud: A Symphony of Bullish Setup

In the arena of Ichimoku symbolism, Cosmos struts boldly; the price has valiantly breached the enveloping cloud, a sure sign of a potential trend shift. The blue conversion line (Tenkan-sen) has shot up like a hopeful student’s GPA, surpassing the red baseline (Kijun-sen)—a classic sign of bullish determination.

Such harmonization of lines speaks of accruing momentum, whispering sweet nothings of continued uplift if it chooses to stick around.

Moreover, the Leading Span A (the green cloud) has begun to lift its chin, while Leading Span B (the less enthusiastic red boundary) flattens, perhaps in resignation. This metamorphosis translates into a thinning cloud ahead, hinting that the bears may soon be made to retreat. With the price gallantly above the cloud and the lagging span (Chikou) away from recent turmoil, the sentiment sways favorably bullish.

Could Cosmos Race to $6 Come April?

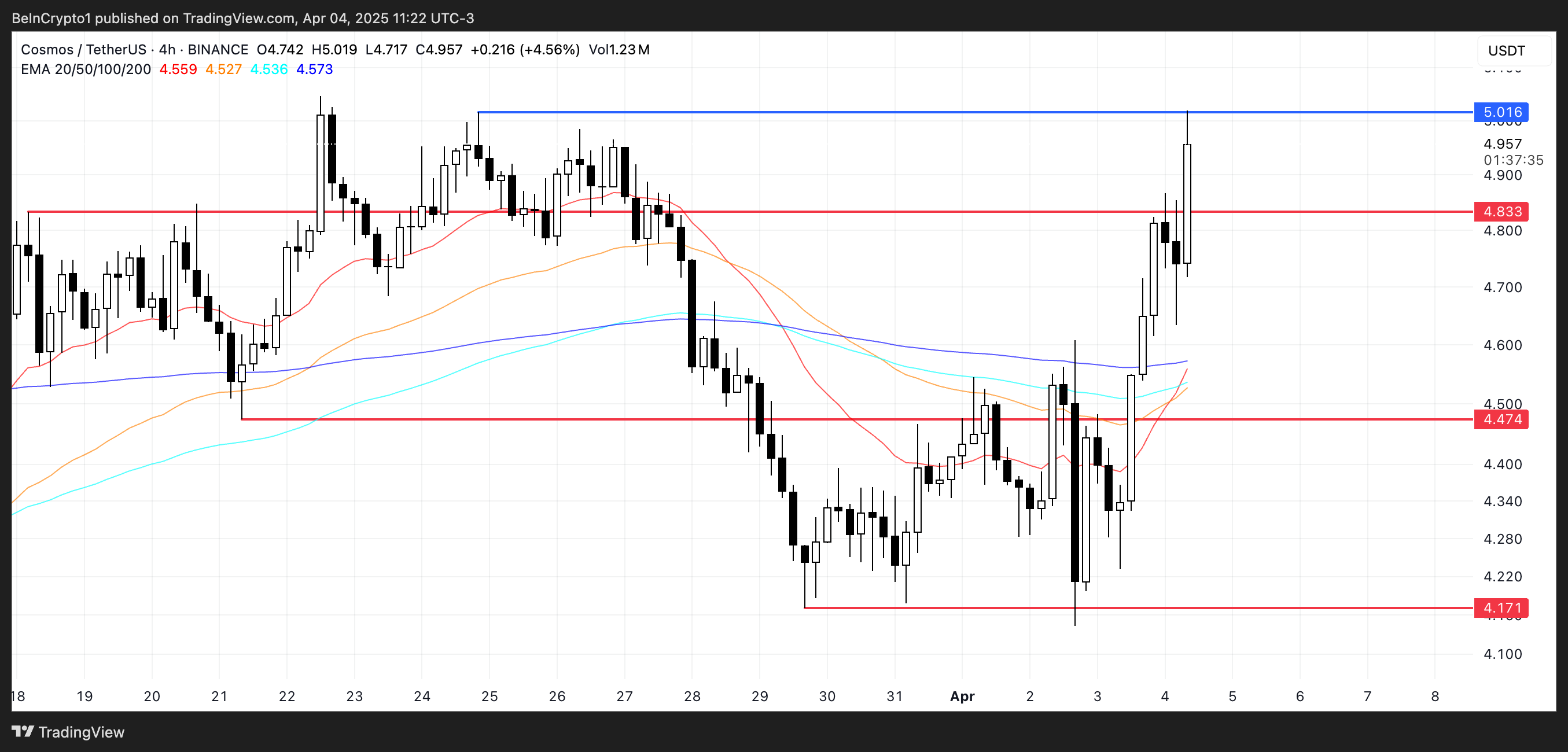

Currently, Cosmos struts closer to a notable resistance level at $5, and should it vault over this threshold, we might witness glorious gains towards $5.5 and—dare I say it?—$6, like a contestant on a high-stakes cooking show. 🥳

The gleaming EMA lines are getting cozy, hinting at a golden cross—where the sprightly short-term EMA dances above its languid longer-term counterpart. Should this romance be confirmed, it could attract a flurry of onlookers eager to join the upscale party, particularly if the volumes play along.

Yet, beware! Should ATOM falter and be rebuffed at resistance, the tides might turn, ushering our dear friend back towards key support levels. The first pit stop to observe would be around $4.83. Should the descent continue, further levels—$4.47 and $4.17—could become the subject of our collective concern.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2025-04-05 00:47