As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have seen my fair share of bull and bear runs. After carefully analyzing Cardano’s (ADA) recent price surge and the associated data, I find myself cautiously optimistic about its future trajectory.

Based on historical analysis, it appears that Cardano (ADA) could be nearing overvalued levels. This observation follows a remarkable 180% price surge in just the past 30 days.

For some investors, the timing might seem premature, especially with the much-anticipated altcoin season just beginning. However, on-chain indicators suggest that ADA might face a correction before establishing new highs.

Cardano Metrics Flash Bearish Signs

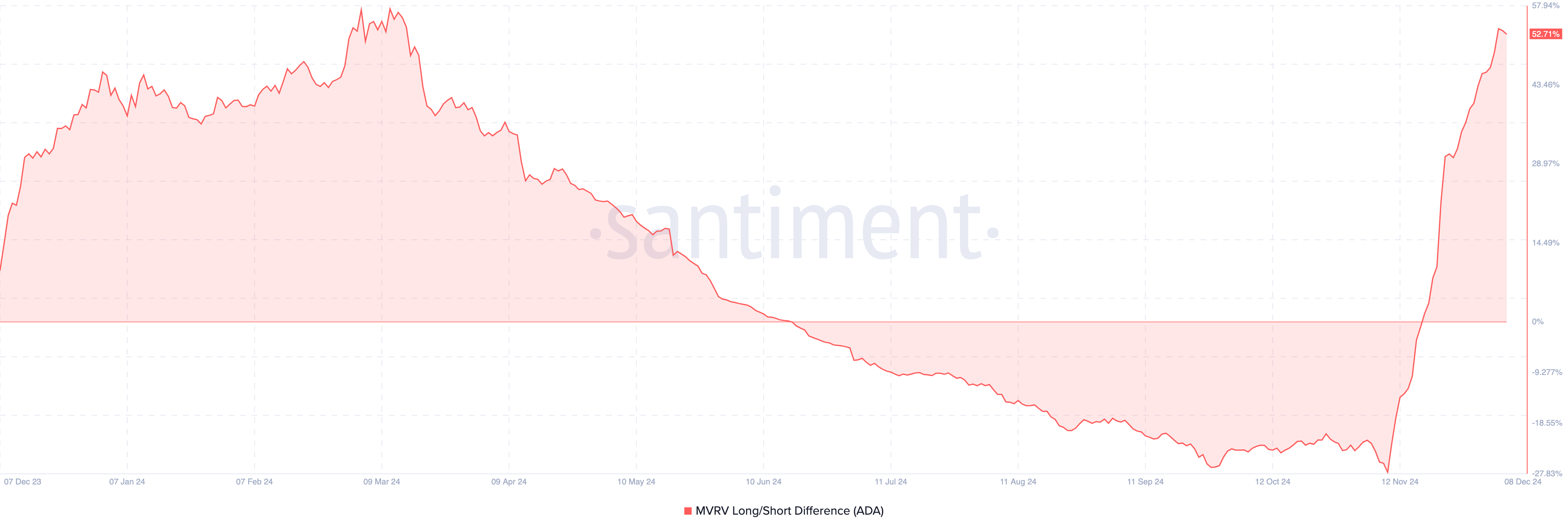

A significant indicator pointing towards potential overvaluation of Cardano could be the Market Value to Realized Value (MVRV) Ratio, specifically focusing on the difference between Long and Short positions. This ratio helps determine whether long-term investors are currently enjoying more unrealized profits compared to short-term traders, at the current market price.

As a crypto investor, when I see an upward trend in the metrics, I can celebrate because it suggests that long-term holders are reaping greater rewards. Conversely, if the numbers start dipping or even slide into negative territory, it’s a sign that short-term traders might be controlling the market at the moment.

By examining this disparity, it’s possible to identify instances where a cryptocurrency might be either undervalued or overvalued. For instance, Cardano’s price reached an overvalued level when the MVRV Long/Short difference peaked at 57.94% back in March, as indicated by historical data.

Based on what we’ve observed, the measurement indicates a value of 52.71%. This could imply that ADA is approaching an overvalued state once more. If this assumption holds true, the price of this altcoin may experience a significant drop as a result.

Additionally, data from IntoTheBlock indicates an increase in the Network Value to Transactions (NVT) ratio. This ratio serves as a tool for evaluating a cryptocurrency’s value compared to the worth being transferred over the network.

When the ratio decreases, it suggests that the number of transactions is increasing more rapidly than the growth of the market capitalization, implying that the token may be underestimated in value. Conversely, an increase in this NVT (Network Value to Transactions) ratio, as seen now with Cardano, means that the market cap has expanded quicker than the worth of transactions being processed. If this trend continues, it could lead to the ADA being labeled overpriced, potentially resulting in a decrease in value.

ADA Price Prediction: Lower Than $1

Looking at the technical aspect, the daily graph reveals that the Bollinger Bands (BB) have widened significantly. This substantial widening suggests a high level of volatility for Cardano (ADA), implying potential large fluctuations in its price over the next few days.

Additionally, the peak of the Bollinger Bands coincided with ADA’s price at $1.30. When the upper band reaches the price, it signals that the asset is overbought. Conversely, when the lower band does this, it suggests that the asset is oversold.

Based on current market conditions, it seems that the price of the Cardano token is overbought. Consequently, there’s a possibility that its value might drop to around $0.92. However, if buying pressure intensifies, the token could surpass $1.40 instead.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

2024-12-08 21:47