There’s a huge surge in interest for artificial intelligence (AI), with newcomers like Anthropic and OpenAI, who only recently started making profits, now being valued at over $100 billion. The U.S. is planning to invest hundreds of billions of dollars into AI data centers. However, one AI-related stock has been underperforming this trend. The stock symbol for enterprise software provider C3.ai, which literally uses ‘AI’ in its name and ticker, has dropped by 21% this year and is currently 85% below its all-time highs.

Observing here, it’s clear that the company’s revenue is soaring at an impressive rate, even hinting at potential record-breaking figures in the current financial year. However, whether buying C3.ai stock right now is advisable is a question I can’t answer directly. It’s crucial to do thorough research and consider factors like market trends, financial health, and future projections before making investment decisions.

Enterprise and government AI deployments

C3.ai encourages businesses and public sector entities to employ its collection of artificial intelligence (AI) software solutions for simplifying big data analysis and streamlining management tasks. These offerings include C3.ai Applications, their AI Platform, AI ex Machina, and AI CRM, all of which have been successfully marketed to clients. Indeed, they seem to appreciate the potential of AI in numerous applications.

Through partnerships with major cloud service providers, C3.ai offers software applications that aid organizations in managing their data, ensuring operational security, and providing AI and machine learning insights. While these terms might sound like jargon, customers appear to appreciate the value delivered by the company’s services. As stated on its website, C3.ai has deployed over 4.8 million AI models for clients and executes approximately 1.7 billion predictions daily – a significant amount of data analysis indeed.

I’m noticing that management is actively strengthening its collaboration with cloud and consulting partners, specifically Microsoft Azure. They’ve formed a strategic alliance with C3.ai and are jointly sealing deals with major corporations. Furthermore, consulting giants like McKinsey are actively deploying C3.ai tools among their clientele. These partnerships are expected to expand our sales reach significantly, leveraging the extensive client networks these organizations already maintain.

Additionally, significant agreements have been finalized with American government institutions like the United States Air Force. This prestigious organization granted C3.ai a contract ceiling of $450 million, enabling them to implement their analytical solutions across various Air Force fleets.

Slower growth and unprofitablity

In simpler terms, while C3.ai’s management frequently boasts about their AI product-related agreements, partnerships, and implementations, a closer examination of their financial statements may leave potential investors somewhat unimpressed.

During the last financial year (ending in April), our revenue surged by 25%, amounting to $389 million. On its own, this appears to be an impressive growth rate. However, it’s essential to note that we are currently experiencing a significant increase in AI spending, which should result in remarkable revenue growth for companies specializing in AI software. For instance, Palantir Technologies, one of C3.ai’s competitors, increased its U.S. commercial revenue by 71% year over year in the last quarter and operates on a much larger scale than C3.ai.

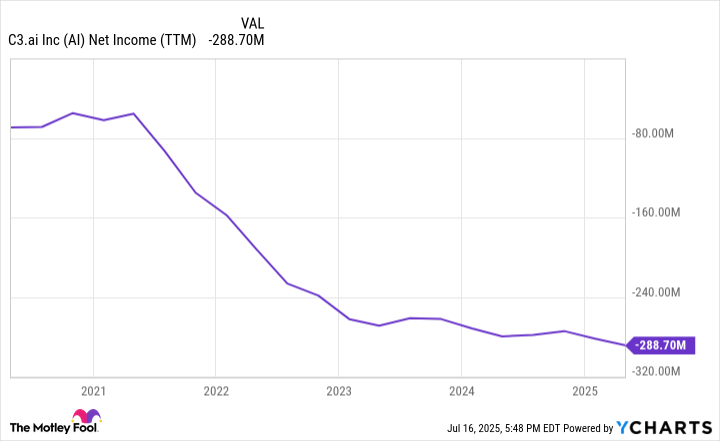

In summary, while Palantir manages to be profitable, C3.ai does not. In the previous year, C3.ai earned $389 million in revenue and $236 million in gross profit. However, these revenues were achieved at a significant cost – $240 million on sales and marketing expenses and $226 million on product development. Consequently, it failed to produce any positive cash flow or net income. In fact, during the last fiscal year, C3.ai reported a net loss of $289 million – a figure that has grown worse each year since its initial public offering.

Should you buy C3.ai stock?

The leadership at C3.ai often shares compelling narratives, featuring significant contracts, AI implementations, and major collaborative agreements.

At the close of each day, what truly counts is if the corporation can flip its fortunes and achieve profitability. Unfortunately, it’s drowning further in debt, which could ultimately trigger a decline in its share price. Despite anticipating a remarkable revenue of $447.5 million for this fiscal year, these figures might only exacerbate losses as the company struggles to expand its software applications and analytics division.

In a market cap of $3.6 billion, C3.ai appears inexpensive compared to other AI companies with valuations in the tens of billions, but its small revenue stream and lack of profitability suggest it may struggle even during an AI boom. If it can’t thrive in such favorable conditions, when would it ever turn a profit? At this moment, investing in C3.ai stock is not advisable. There are far superior AI stocks to consider for your portfolio right now.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-20 14:17